LUNA prepares for a 20% move as lawsuits against Do Kwon and associates Pile

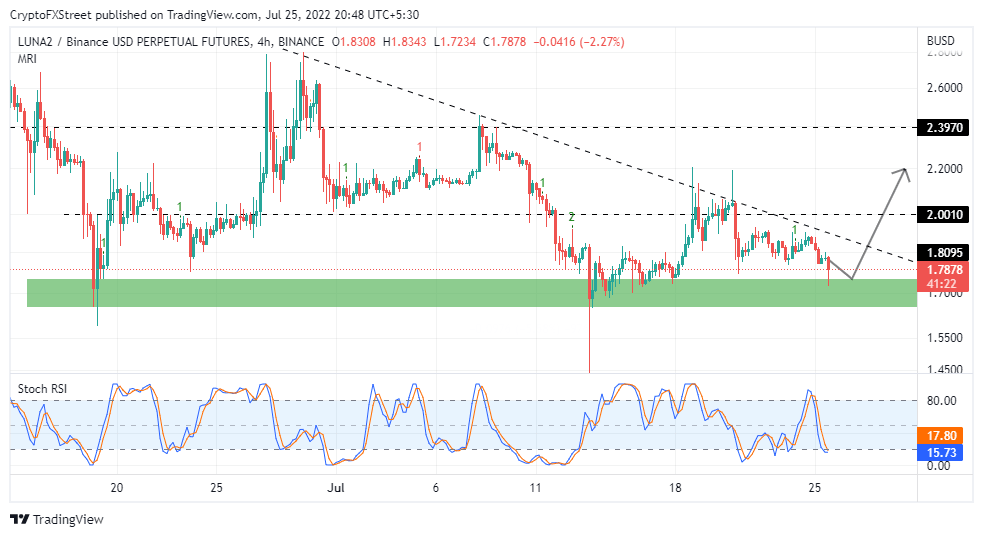

- LUNA will likely drop to $1.75 to seek fresh liquidity before jumping 20% to $2.20.

- Bragar Eagel & Squire PC files a class action lawsuit against Do Kwon and his affiliates for violating the Exchange Act.

- Due to near oversold conditions, LUNA might bounce back past the descending trendline in the four-hour timeframe.

LUNA price regained momentum toward the end of last week and exchanged hands at $2.20, bolstered by increased liquidity, according to FXStreet’s analyst, Akash Girimath. However, the embattled token failed to stretch the bullish leg further, leading to an immediate correction.

At the time of writing, LUNA price teeters at $1.77 after closing the day under $1.80. Another dip is expected to take precedence during the American session on Monday, but a reflex rebound may follow in preparation for another upswing to $2.20.

Legal pressure is mounting on Do Kwon and TerraForm Labs

A series of class action lawsuits have been filed against Do Kwon, the founder of TerraForm Labs, with the latest coming from Bragar Eagel & Squire PC. According to the filing, Kwon, Nicholas Platias, the firm’s head of research and other affiliated companies, violated the Exchange Act, the Racketeer Influenced and Corrupt Organizations Act (RICO) as well as the Securities Act.

A total of three class action lawsuits have been filed against TerraForm Labs, Do Kwon and Nicholas Platias in the United States. Some of the affiliates mentioned in the case by Bragar Eagel & Squire PC include Jump Trading, Republic Capital, DFinance Capital, Three Arrows Capital (3AC), Jump Crypto and Tribe Capital.

This class action lawsuit represents several groups of people, including all investors, companies and individuals who bought LUNA tokens in the period running from May 20, 2021, and May 25, 2022. The scope covers tokens like TerraUSD (UST), KRT, WHALE, Terra (LUNA), and aUST, among others.

LUNA price seeks refuge ahead of an impending jump to $2.20

The Stochastic RSI has dropped below 30, implying that sellers have the upper hand. However, this could also mean their influence might gradually weaken in the coming sessions or a few days. Robust support is expected to come into play in the region between $1.65 and $1.75, shown in green.

Traders should look for an incoming bullish divergence with the RSI rising above the moving average. Another critical signal would emanate as the index moves into the neutral zone toward the mean line as it indicates growing buying pressure.

LUNA/USD Four-hour chart

LUNA price may run into resistance at the descending trend line on the other side of the fence. Note that prices have been kept below this line for nearly a month. If it remains unbroken, investors should brace for more losses with $1.65 and $1.45 in the picture. On the positive side of things, piercing the line could propel LUNA price to higher levels at $2.40 and $2.60, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren