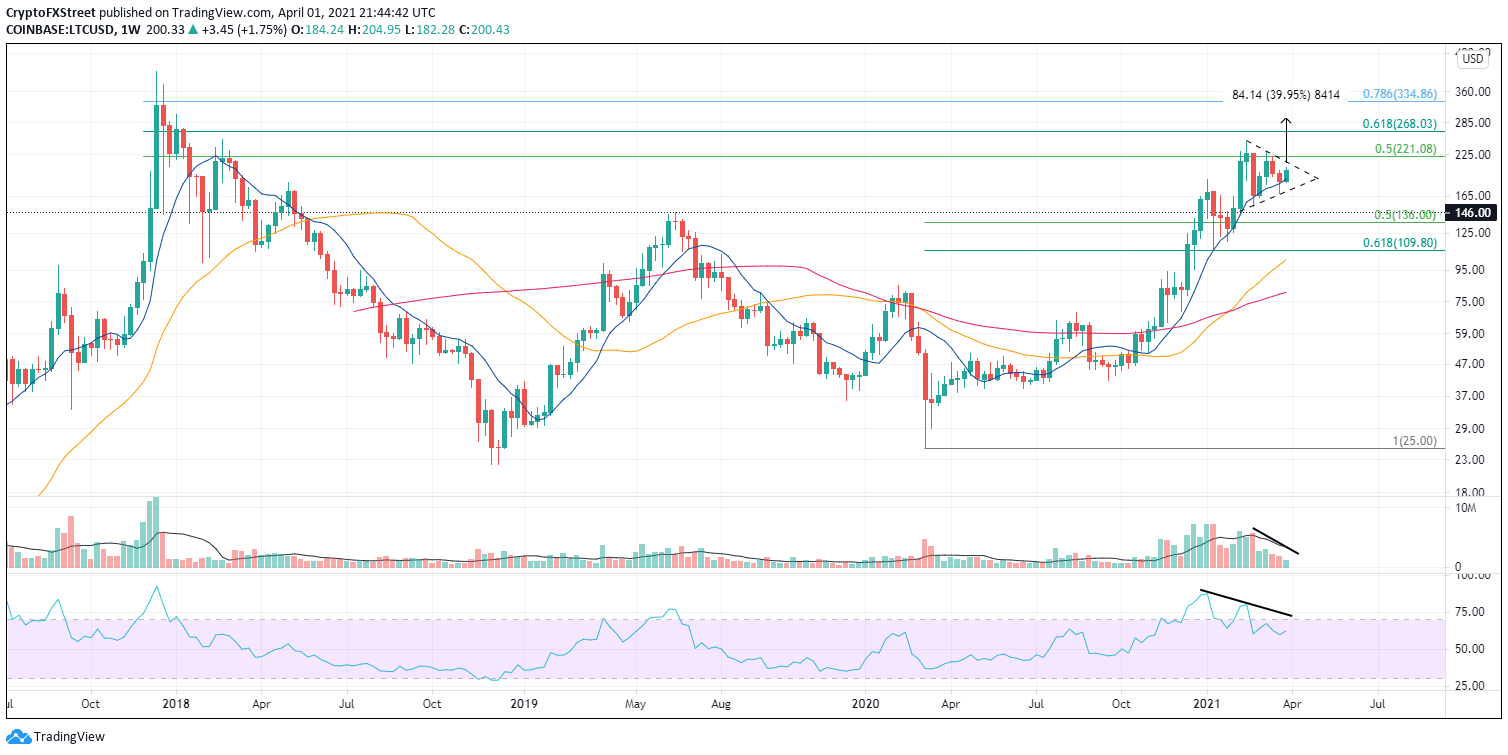

Litecoin Price Projection: LTC could rally 40% from continuation pattern

- Litecoin price building a symmetrical triangle pattern.

- Volume trending downwards over the last five weeks.

- 10-week simple moving average (SMA) remains vital short-term support.

Litecoin price climbed almost 900% in less than a year and is now consolidating the substantial advance in the form of a symmetrical triangle as buyers and sellers’ uncertainty has led to gradually declining volatility. A breakout from the continuation pattern is often a precursor to a longer trend.

Litecoin price is no longer overbought

During the symmetrical triangle formation, volume declines almost 90% of the time, and breakouts tend to be to the upside. With LTC flashing many of the characteristics of a model symmetrical triangle and the weekly Relative Strength Index (RSI) no longer overbought, it raises the probability that the token is getting closer to an upward resolution of the pattern.

Immediate resistance following a breakout would be the 0.50 retracement of the 2017-2018 bear market at $221.08. In fact, LTC has struggled with the price level in four of the past seven weeks. Close above this retracement level is the February high at $247.00, followed by the 0.618 Fibonacci retracement level at $268.03.

The pattern’s measured move target is $295.00, while the most optimistic projection is the 0.786 retracement level at $334.86. A test of the all-time high at $420.00 should follow another consolidation process.

LTC/USD weekly chart

First and foremost, LTC needs to hold the lower trendline at $169.60 on any weakness. If selling pressures heighten, then the June 2019 high at $146.00 is the next support level. Since there is some price congestion in that area at the beginning of this year, it should provide steady support.

A failure to bottom out at $146.00 puts the Fibonacci retracement levels of the 2020-2021 rally on alert. The 0.50 retracement level is at $136.00, and the 0.618 Fibonacci retracement level is at $109.80.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.