Litecoin Price Outlook: LTC long-term trend under pressure

- Litecoin price set to close the week below the 10-week simple moving average (SMA) for the first time since October 2020.

- Bearish momentum divergence at the February high was a caution flag for traders.

- LTC popularity on Google fading despite trading near the rally highs.

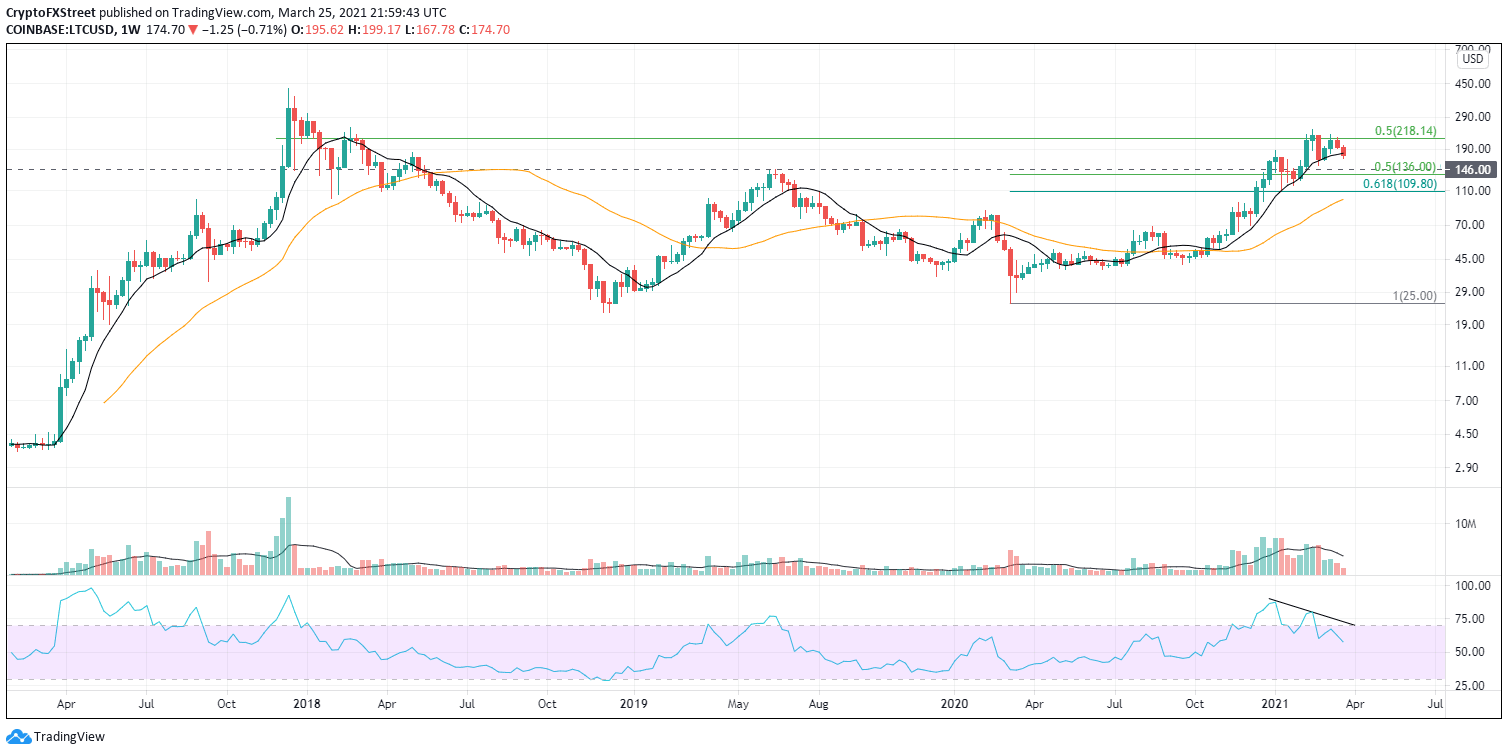

Litecoin (LTC) price has been in a furious tug-of-war with the 0.50 retracement level of the 2017-2018 bear market throughout February and March. It was a warning that LTC needed to notably correct, both in time and price, to release the price compression generated during the explosive rally from the October 2020 low.

Litecoin price is not flashing massive buy signals

A quick check of the Google search trends shows that LTC is less than half as popular than its peak in February and lower than at the January and February price lows. Its popularity with traders and general investors has taken a dramatic turn in just a month, not unlike other cryptocurrencies.

Like other altcoins, LTC has been respecting the 10-week SMA on pullbacks during 2021, but the longer-term trend dynamics will change if the current weakness holds until tomorrow. It will become a story of recapturing the moving average versus holding the moving average.

In case LTC weakness accelerates, traders should be targeting a test of the June 2019 high at $146.00 followed by a test of the 0.50 retracement level at $136.00. The two levels coincide with heavy price gyrations in early January.

LTC/USD weekly chart

First and foremost, LTC needs to decisively recapture the 10-week SMA before new price highs can be considered, but only if the Relative Strength Index (RSI) first falls below 40.

It should not be overlooked that daily volume is not swelling above-average, potentially raising hopes the correction will be short-lived.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.