Litecoin price eyes 21% ascent as LTC leveraged token undergoes reverse token split

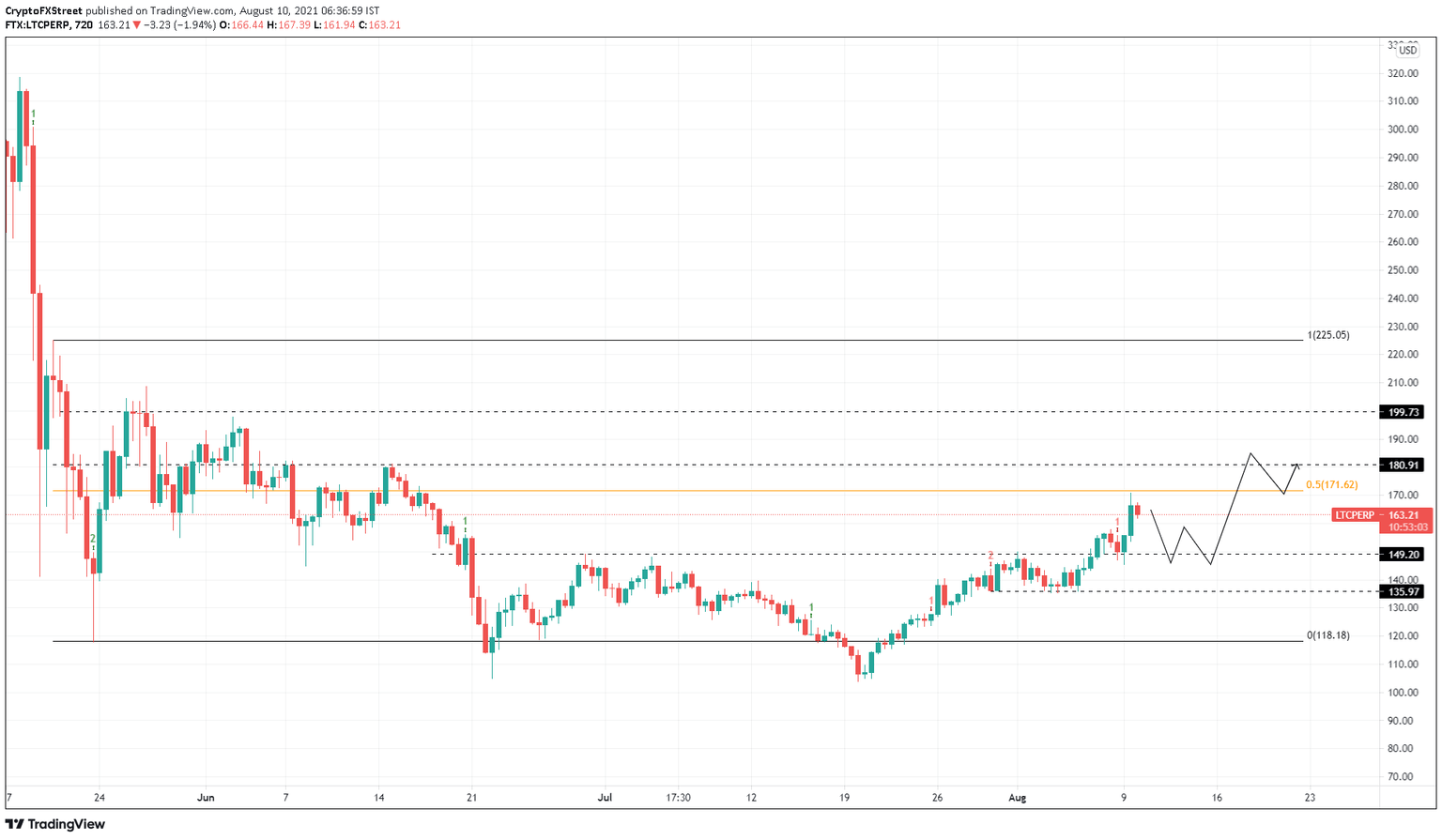

- Litecoin price is hovering just under the 50% Fibonacci retracement level at $171.62.

- Binance announced a reverse token split of LTC leveraged tokens.

- A breakdown of the $135.97 support level will invalidate the bullish thesis.

Litecoin price is currently experiencing a decreased bullish momentum, which could result in a sideways movement or a pullback. While this retracement is necessary, it will provide buyers an opportunity to book profits and come back stronger.

Binance announces reverse token split

On August 9, Binance revealed plans to perform a reverse token split for Litecoin and Uniswap leveraged tokens. This split will consolidate 100,000 of either LTC or UNI tokens to 1.

According to the announcement,

A reverse token split is a process that consolidates the existing number of issued tokens into a smaller number of proportionally more valuable tokens.

A user holding 1,000,000 LTCUP or LTCDOWN will see only ten tokens after the split occurs.

This process allows users “a better trading experience,” according to Binance. The trading for these tokens will be paused for a total of 24 hours starting August 17 at 03:00 UTC. Since leveraged tokens are risky, the exchange advised its users to redeem their tokens before the split to avoid price changes.

Litecoin price looks to set up higher high

Litecoin price sliced below the range low at $118.18 on July 19 as the market underwent a sell-off. This move resulted in LTC setting up a swing low at $103.82. The altcoin has rallied roughly 64% since then to tag the trading range’s mid-point at $171.62.

While this uptrend was impressive, the bulls seem to have lost their momentum, leading to a retracement. The support level at $149.20 is the most likely candidate for harboring the incoming selling pressure.

Interestingly, this barrier was recently flipped into a support level after acting as a resistance barrier preventing multiple attempts to breach it. Therefore, investors can expect this demand floor to hold its ground.

Assuming the buyers make a comeback, LTC will likely take a jab at the mid-point at $171.62. Breaching this barrier will allow Litecoin price to tag the $180.91 resistance level. This move would constitute a 21% upswing from $149.20.

LTC/USDT 12-hour chart

Investors need to note that the bullish thesis assumes that the buyers make a comeback at $149.20. Therefore, an inability of the buyers to follow through or an increased selling pressure that overwhelms the bullish momentum could jeopardize the outlook explained above.

A breakdown of $135.97 to create a swing low will invalidate the bullish scenario and potentially trigger a sell-off to the range low at $118.18.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.