Litecoin Price Analysis: LTC is at risk of a massive sell-off if it fails to clear $130

- Litecoin retreated from the recent high after a strong rally.

- The price may extend the decline if it fails to clear $130.

Litecoin (LTC) topped at $139.3 on December 27, and the bulls hit the pause button. At the time of writing, the token is changing hands at $128, down 4% on a day-to-day basis. Despite the retreat, it is still 25% higher on a weekly basis. Litecoin is highly correlated with Bitcoin. So the see-off of the pioneer digital currency from the all-time high at $28,250 dragged LTC down.

Currently, Litecoin is the 5th-largest digital asset with a current market capitalization of $8.5 billion and an average daily trading volume of $9.9 billion. The coin may soon outpace XRP as the token is losing ground rapidly amid legal issues with the SEC.

Litecoin is ready for a correction

As FXStreet previously reported, LTC experienced a strong bullish momentum that took the price from $70 to nearly $140. The price doubled in less than a month without any meaningful retreats.

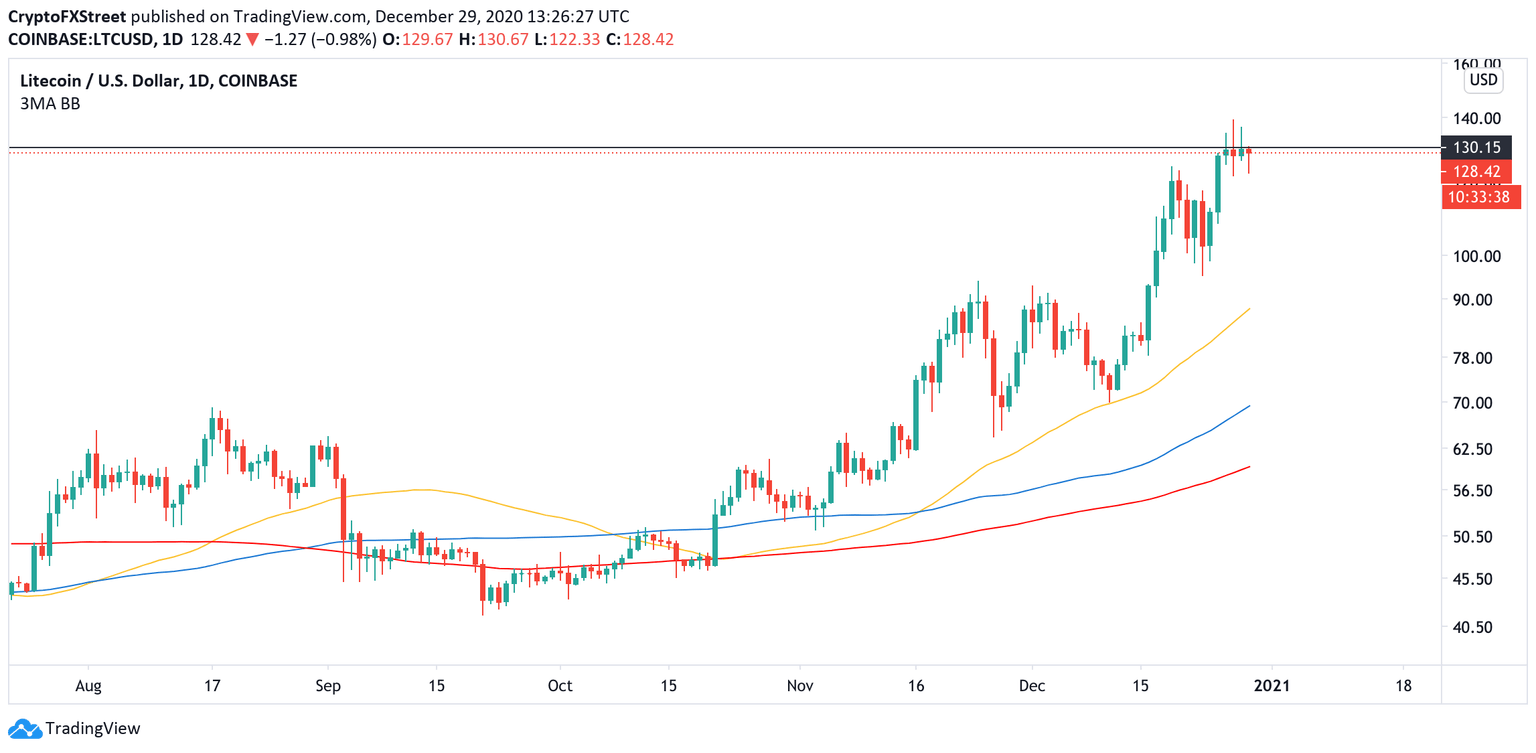

The LTC has made several attempts to clear $130, but the upside momentum faded away each time the price moved above this area. This is visible on a daily chart. A sustainable move above this area is needed for the upside to gain traction with the next focus on $140 and $146, which is the highest level since June 2019.

LTC, daily chart

On the other hand, a failure to clear this barrier will result in a sell-off towards $100. This support is critical for Litecoin's bull trend. If it gives way, the immediate positive scenario will be invalidated with the next stop at $90-$87. This area served as resistance in November and December. Now it is also reinforced by the daily EMA50.

LTC, In/Out of the Money Around Price (IOMAP)

Meanwhile, In/Out of the Money Around Price (IOMAP) data confirms a strong resistance on approach to $130 as over 51,000 addresses purchased million LTC from $130 to $134. If this area is cleared, the buying pressure will increase. The price may quickly reach the next target of $146.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637448455060653682.png&w=1536&q=95)