Litecoin bulls target $170 mark as open interest reaches four-year high of $887 million

- Litecoin price extends its gains on Wednesday, rallying over 7% so far this week.

- LTC’s open interest hints for rally continuation as it reaches a new almost four-year high of $887 million.

- Senior ETF analyst at Bloomberg reports a 90% chance of Litecoin’s ETF approval.

Litecoin (LTC) price extends its gains and recovers above the $135.00 level on Wednesday, rallying over 7% so far this week. LTC’s open interest hints at a continuation of the rally as it reaches the highest level since May 12, 2021, of $887 million. Senior ETF analyst at Bloomberg reports a 90% chance of approval for Litecoin Exchange Traded Funds (ETFs), further supporting LTC’s bullish outlook.

Litecoin bulls aim for $170 mark

Litecoin price retested and found support around its 200-week Exponential Moving Average (EMA) at $87.45 during the first week of February and closed above its weekly support level at $96.30. Moreover, it retested and bounced from a descending trendline drawn by connecting weekly highs since the end of March 2022. During the second week of the month, LTC rallied by more than 17%. As of this week, it continues its rally by over 7.0%, trading around $135.52 at the time of writing on Wednesday.

If LTC continues its recovery, it could extend its rally to retest its December 5 high of $147.06. A successful close above this level would extend additional gains to retest the $170 mark.

The Relative Strength Index (RSI) on the weekly chart reads 65, above its neutral level of 50, and points upward below overbought conditions, indicating strong bullish momentum.

LTC/USDT weekly chart

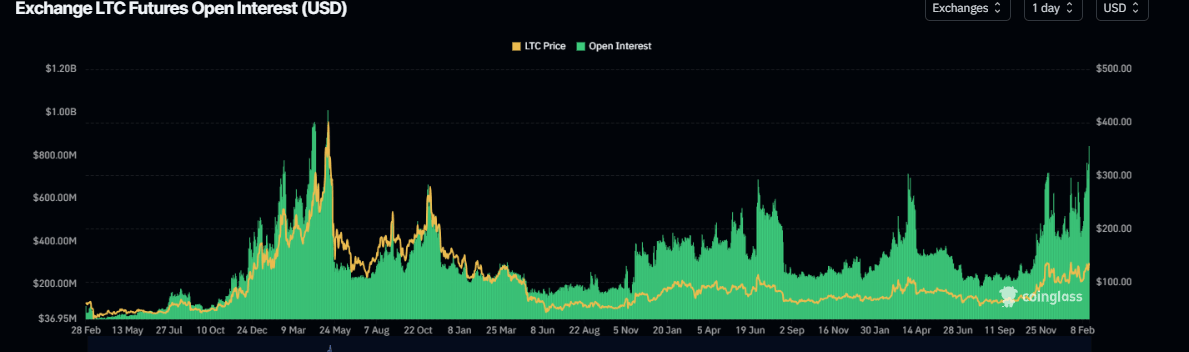

Litecoin's Open Interest (OI) further supports the bullish outlook. Coinglass’s data shows that the futures’ OI in LTC at exchanges rose from $420.52 on February 5 to $887.90 million on Wednesday, a new yearly high and highest level since May 12, 2021. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the LTC price.

LTC Open Interest chart. Source: Coinglass

Eric Balchunas, Senior ETF analyst at Bloomberg, posted on the X platform that the odds of approval of Litecoin ETF in 2025 are leading and stand at 90%, then Dogecoin (DOGE), followed by Solana (SOL) and Ripple (XRP).

Approval of ETF is a positive sign for Litecoin in the long term, as an ETF can make it easier for traditional investors to gain exposure to LTC without needing to purchase and store the cryptocurrency directly. Moreover, approving an ETF could lend more legitimacy to LTC and increase liquidity.

Our official alt coin ETF approval odds are out. Litecoin leads w 90% chance, then Doge, followed by Solana and XRP. We are only doing for 33 Act $IBIT-esque filings. But def poss to see futures or Cayman-subsidiary type 40 Act stuff get through as well. https://t.co/JSaNnifjbu

— Eric Balchunas (@EricBalchunas) February 10, 2025

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.