Maker Price Forecast: MKR generates highest daily revenue of $10 million

- Maker price is extending its gains on Wednesday after rallying more than 20% so far this week.

- Artemis data shows that MKR generated $10 million in revenue on February 10, the new yearly high in daily revenue.

- Coinglass’ OI-weighted funding rate data is positive, suggesting potential upward momentum in MKR’s price.

Maker (MKR) price extends its gains by 6%, trading around $1,189 on Wednesday after rallying more than 20% so far this week. On-chain data support a bullish move ahead as MKR generated a new yearly high in daily revenue, and funding rate data is positive.

Maker bulls aiming for double-digit gains

Maker price broke and closed above the descending trendline on February 12 and rallied 9.28%, closing above $1,023 up to Tuesday. At the time of writing on Wednesday, it extended by 6%, trading around $1,189.

If the MKR continues its upward trend, it could extend the rally by 42% from the current levels to retest the daily resistance of $1,700.

The Relative Strength Index (RSI) on the daily chart reads 59, above its neutral level of 50, indicating bullish momentum. Moreover, the Moving Average Convergence Divergence (MACD) indicator on the daily chart showed a bullish crossover last week, giving buy signals and indicating an upward trend ahead.

MKR/USDT daily chart

Artemis data shows that Maker generated $10 million in revenue on February 10, the new yearly high in daily revenue, further bolstering the bullish outlook.

Maker Revenue chart. Source: Artemis

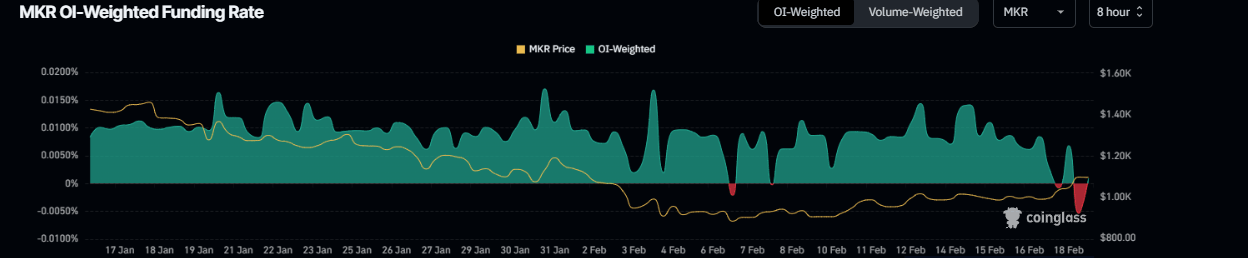

According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the price of MKR will slide further is fewer than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their open interest rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

In the case of MKR, this metric stands at 0.0009%, reflecting a positive rate and indicating that longs are paying shorts. This scenario often signifies bullish sentiment in the market, suggesting a potential upward trend on MKR’s price.

MKR OI-Weighted Funding Rate chart. Source: Coinglass

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.