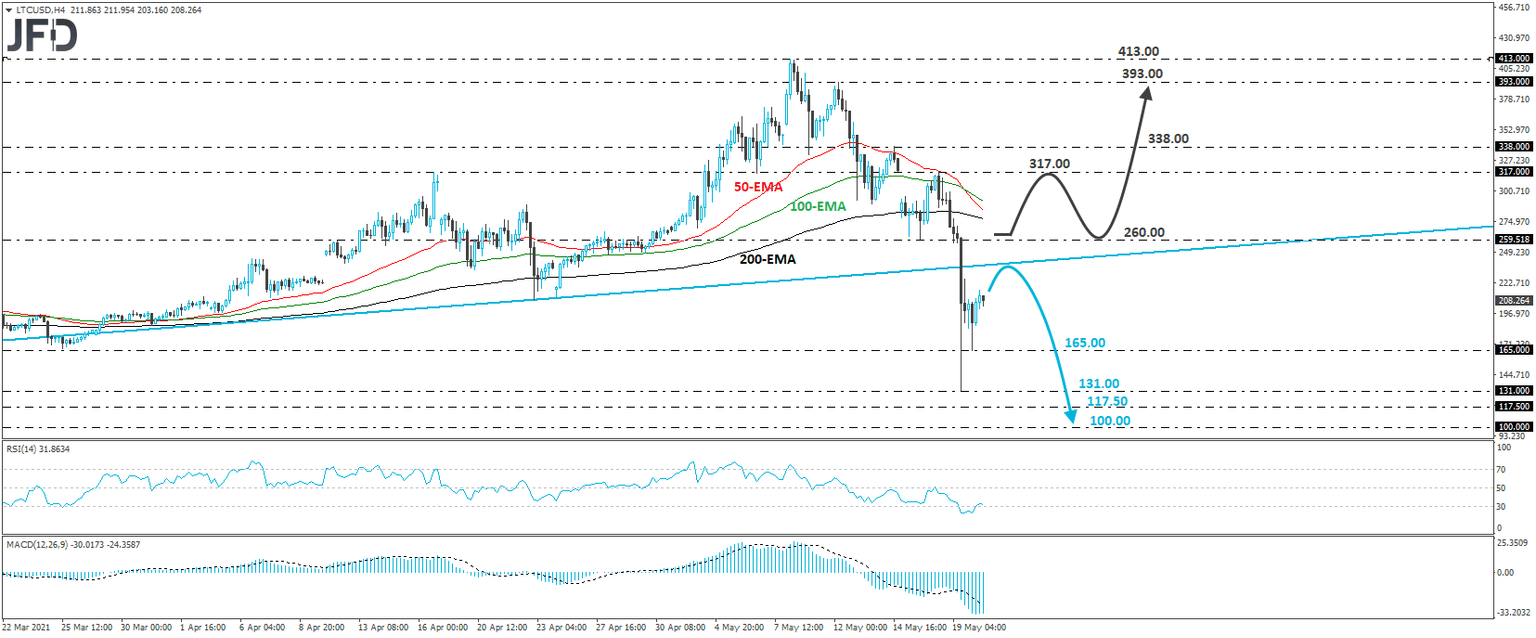

Litecoin breaks below an upside support line

LTC/USD tumbled yesterday after China decided to ban financial institutions and payment companies from providing services related to cryptocurrency transactions. This one of multiple hits the crypto world has received, one of which was a week ago, when Elon Musk tweeted that Tesla would stop accepting Bitcoin as payment for its cars. Yesterday’s tumble took Litecoin below the upside support line drawn from the low of December 11th, which suggests that more declines may be in the works.

After hitting support at 131.00, Litecoin rebounded, but still stayed below the aforementioned upside line. Even if the recovery continues for a while more, the bears may decide to charge again from near that line and bring the price down for a test at today’s current low of 165.00. A break lower could aim for yesterday’s low of 131.00, where another break may take the crypto into territories last tested in February. The next support zone could be at 117.50, marked by the low of January 27th, or the psychological round figure of 100.00.

Shifting attention to our short-term oscillators, we see that the RSI rebounded from its below-30 territory and just crossed above 30, while the MACD, although below both its zero and trigger lines, shows signs of bottoming as well. Both indicators detect slowing downside speed and support the notion for some further recovery before the next leg south.

Now, in order to start examining whether the bulls have gained back control, we would like to see a rebound back above 260.00, a resistance marked by the inside swing low of Monday. This would also take the crypto above the pre-mentioned upside line and may encourage advances towards the 317.00 zone, marked by Tuesday’s high, or towards the high of last Friday, at 338.00. If neither obstacle is able to stop the buyers, then we may see extensions towards the 393.00 zone, marked by the high of May 12th, or the all-time peak, at 413.00, hit on May 10th.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD