Is this the pullback Ethereum Classic price has been waiting for ahead of the Merge?

- Ethereum Classic quickly erases gains to $33.84 as turbulence hits the crypto market.

- ETC’s bearish correction would be a blessing in disguise if a fresh FOMO wave influenced new buy entries.

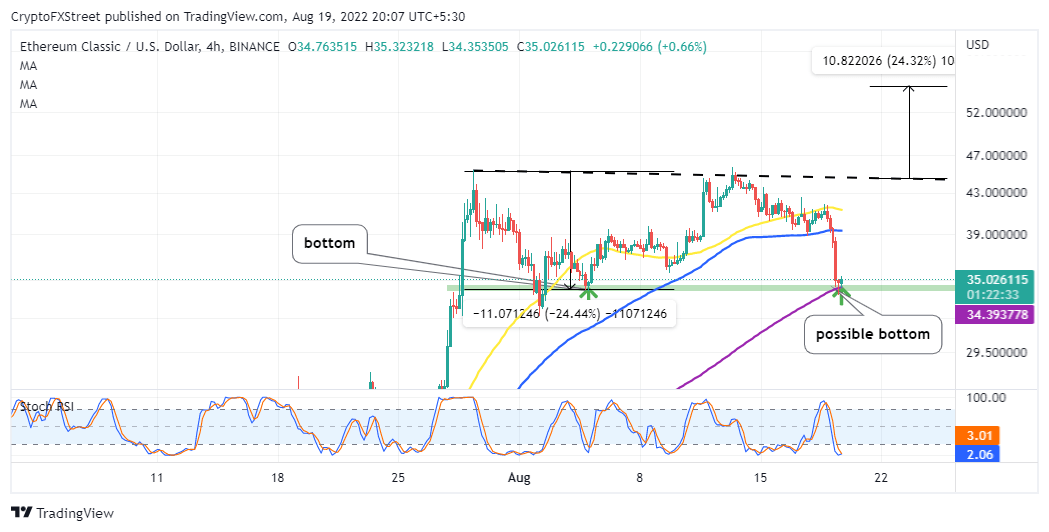

- Ethereum Classic price eyes a 48.88% move following the formation of a double-bottom pattern.

Ethereum Classic price is retesting support at $33.84 after the cryptocurrency market generally flipped bearish on Friday. Before the losses, ETC had more than tripled in value to trade at a five-month high of $45.77.

Over the last five weeks, Ethereum Classic price responded positively to the hype surrounding the upcoming Ethereum (ETH) Merge. As the largest smart contracts platform awaits rebirth on the all-new proof-of-stake (PoS) consensus, Ethereum Classic price is making strides toward new yearly highs.

Will FOMO keep propelling Ethereum Classic price higher?

Ethereum Classic price is receiving much attention from investors (speculators) and miners. The latter group is preparing for the Merge – set to render their equipment useless within the Ethereum (ETH) ecosystem. On the other hand, the Ethereum Classic proof-of-work (PoW) blockchain is being flaunted as the best go-to platform for miners wishing to continue their activities.

However, the move remains uncertain amid calls for a hard fork on Ethereum – to allow its PoW protocol to exit after the transition. Several cryptocurrency exchanges have expressed support for the PoW Ethereum if developers and users warm up to the idea.

For now, Ethereum Classic price is more concerned about reversing the uptrend north from support at $33.88. The 200-day Simple Moving Average (SMA) reinforces this buyer congestion area, elevating ETC to $34.86 at the time of writing.

ETC/USD four-hour chart

From a technical vantage point, Ethereum Classic price is poised to make a successful return beyond the crucial resistance at $40.00. This move will advance 44.88% from the current support at $33.88 if a double-bottom pattern formed on the same four-hour chart confirms.

Traders should watch ETC’s approach to the neckline to gauge whether they should settle for early profits or firmly hold till $55.30. The oversold position of the Stochastic RSI implies that a bullish reversal is around the corner.

Nevertheless, investors should wait for Ethereum Classic price to close the day above the 200-day SMA before going all-in for the imminent uptrend. Trading below the moving average, ETC could explore downstream levels around $24.00 and $14.00.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren