Is it a “buy the dip” opportunity for gaming tokens ApeCoin, Axie Infinity, SAND and FLOKI?

- ApeCoin, Axie Infinity, SAND and FLOKI rank among gaming tokens that have dominated blockchain activity by 50% in January 2023.

- A report from DappRadar revealed that during the first month of 2023, blockchain gaming witnessed a massive spike in popularity.

- APE, AXS, SAND and FLOKI prices have declined since February 21, offering traders an opportunity to buy the dip.

Blockchain gaming made up half of all activity from decentralized applications in January 2023. A new report by DappRadar revealed that the beginning of 2023 is bullish for gaming tokens like Axie Infinity (AXS), ApeCoin (APE), The Sandbox (SAND) and FLOKI.

Also read: Why the crypto China narrative is not bullish for Bitcoin and Ethereum prices

Crypto gaming tokens Axie Infinity, ApeCoin, SAND and FLOKI present “buy the dip” opportunity

Blockchain gaming has gained mainstream popularity since the beginning of 2023. DeFi intelligence platform DappRadar published a report on February 21, 2023, outlining the spike in on-chain gaming activity.

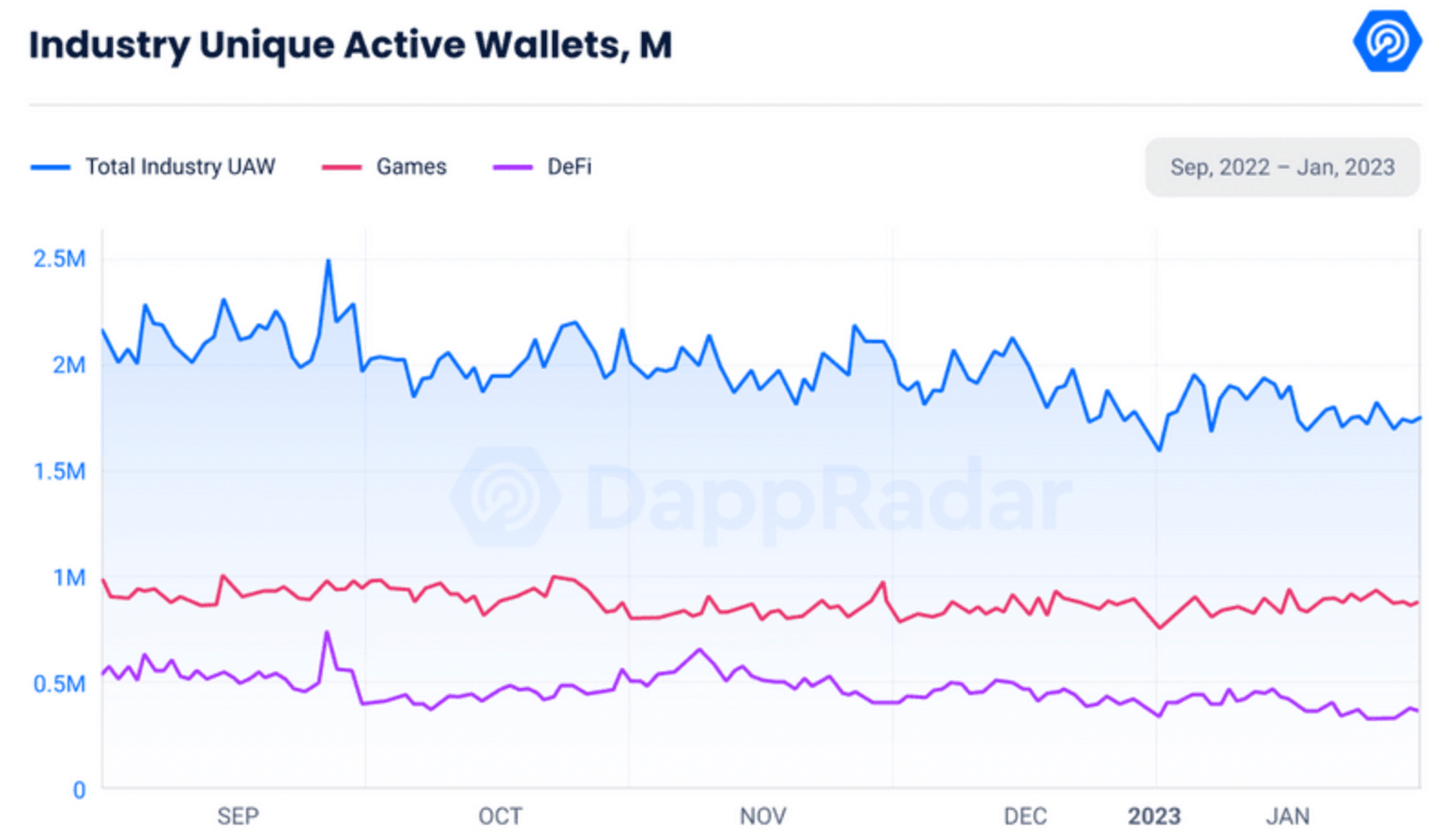

Daily Users on blockchain games have climbed to 858,621, making up 48% of January’s Dapp activity.

Industry Unique Active Wallets

The market capitalization of top gaming tokens has climbed 122% on average with GALA leading with a $384 million market cap. The trade volume of gaming tokens like AXS climbed 71%.

What’s driving the surge in AXS, APE, SAND and FLOKI?

Axie Infinity price climbed from $6.04 to $10.43, since the beginning of January 2023. The surge in AXS’ popularity was driven by the introduction of a new concept called “Eras.” Season two of the game introduced players to the “Final Era,” and AXS holders turned bullish in response to the update.

Season 2 of @AxieInfinity introduced a new concept called "Eras".

— VicTree (@Smartalecc5) February 10, 2023

Now that we've entered the "Final Era" let's see how the marketplace reacted to these balance changes.

Spoiler Alert: There are more balanced sales at prices!

AXS price yielded 72% gains since the start of the year and the push in blockchain gaming has acted as a catalyst for the token. AXS nosedived from its local peak of $13.66 on January 23, since then the gaming token started a short-term downtrend. With the gaming narrative gathering steam, AXS has presented traders with a “buy-the-dip” opportunity.

Metaverse gaming tokens ApeCoin and SAND offered holders nearly 5% gains over the past week. APE and SAND have room for climbing higher after the recent correction in the blockchain gaming tokens’ prices.

Other bullish catalysts are ApeCoin’s surge in popularity due to the hype surrounding the Yuga Labs ecosystem and new partnerships for Sandbox in Saudi Arabia. In conclusion, the surge of the top gaming tokens is a very positive sign for the industry. The hype surrounding blockchain games and metaverse projects has grown in 2023, offering traders an opportunity to buy the dip.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.