Is GAL and 1INCH token unlock a sell-the-news event?

- 1INCH and GAL token unlocks are scheduled for March 24 and 30 respectively.

- The two crypto tokens have yielded gains for holders over the past two weeks, token unlock could therefore be a sell-the-news event.

- 1INCH token unlock accounts for 0.004% of the total supply and GAL unlock will add 0.096% to circulation.

1inch (1INCH) and Galxe (GAL) have token unlocks scheduled for March 2023. Typically, token unlocks increase the circulating supply of an asset, negatively influencing the price. In the case of 1INCH and GAL, the two tokens have yielded gains for holders over the past week, making it likely that unlock turns into a “sell-the-news” event.

Also read: Analysts turn to Ethereum rivals hunting for next altcoin with 2x gains

1INCH and GAL token unlock details

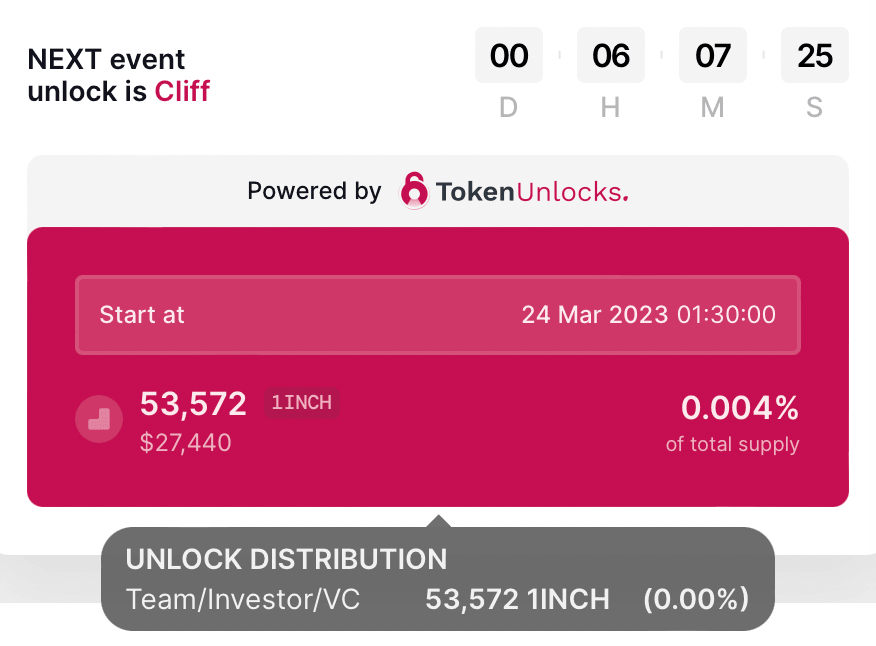

According to data from Token Unlocks, 1INCH unlock is scheduled for 24 March. A total of 53,572 1INCH tokens worth $27,440, nearly 0.004% of the supply.

1INCH token unlock

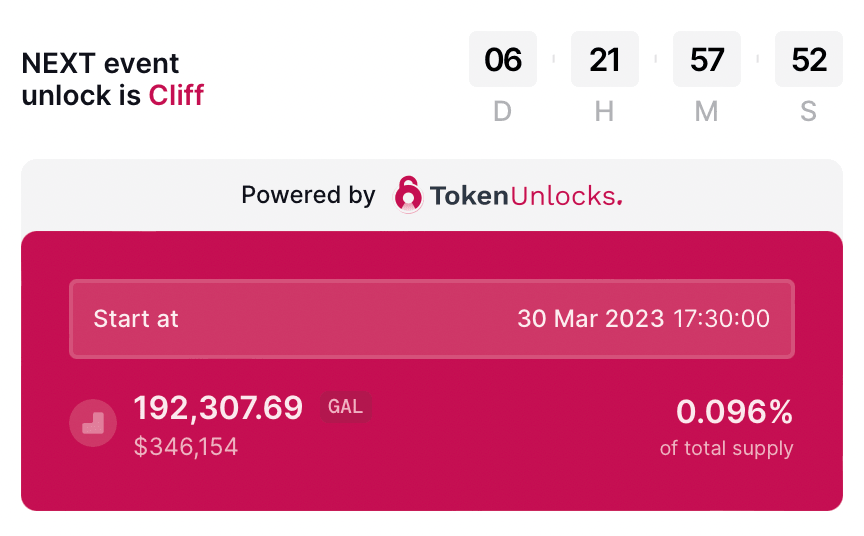

A week from the 1INCH token unlock, the GAL token unlock is scheduled to occur, where 192,307 tokens worth $346,154 will be unlocked. The GAL token unlock on March 30 will introduce 0.096% of the supply in circulation.

GAL token unlock

1INCH holders gained 8.2% over the past two weeks and GAL yielded 20.3% gains. Since the two altcoins have offered nearly double-digit gains since March 9, it is likely that the token unlock event turns out to be a “sell-the-news” for holders. 1INCH and GAL holders can expect a correction in their prices with the upcoming token unlock.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.