Internet Computer soars after launch of decentralized wallet OISY's new version

- Internet Computer rises sharply, posting a fourth consecutive day of gains and testing resistance at $6.00.

- The launch of OISY's decentralized wallet version 1.5 expands support to new chains, including Solana, Polygon, BNB Chain and Base.

- Bulls target a breakout toward $7.60 for ICP, which would represent a 34% increase from current levels.

Internet Computer (ICP) edges higher, trading at around $5.95 on Monday as the cryptocurrency market looks forward to the second round of trade talks between the United States (US) and China.

ICP's remarkable gains of over 7% on the day and 11% over the past 24 hours reflect solid sentiment surrounding the token following the launch of the protocol's decentralized wallet OISY's version 1.5.

Internet Computer OISY wallet extends support to new chains

Dfinity, the organization that oversees the operation of Internet Computer, has launched the latest version, 1.5, of the protocol's decentralized wallet, OISY. According to the information shared on the social media platform X, the new version stands out for introducing support for new chains, a privacy mode, an address book, and a network filtering feature.

In addition to the earlier support for major chains such as Bitcoin (BTC), Ethereum (ETH) and Internet Computer (ICP), OISY wallet users can tap into Solana (SOL), Polygon (POL), BNB Chain and Base. The support has been made possible without the need for bridges or extra steps courtesy of a new user interface (UI).

OISY wallet's network filter has received a full overhaul, allowing users to search for tokens by chain, hide protocols that are not in use, and view balances across the entire ecosystem.

"The entire interface's been tightened up," the OISY wallet team said via an X post. "Tokens are now clustered by usage, send flow previews USD values live, token titles and icons are cleaner, mobile nav is sharper, and we've supported better pricing".

With regulations taking shape worldwide, anonymity is once again taking center stage. Dfinity has introduced a privacy mode, restoring control to the user.

A simple tap now allows users to obscure key figures such as wallet balances, token values and activity logs. Other key features included in the new version range from an address book that makes repeat transactions easier and safer to a sprinkles feature used to track tokens for on-chain rewards without going through unnecessary steps.

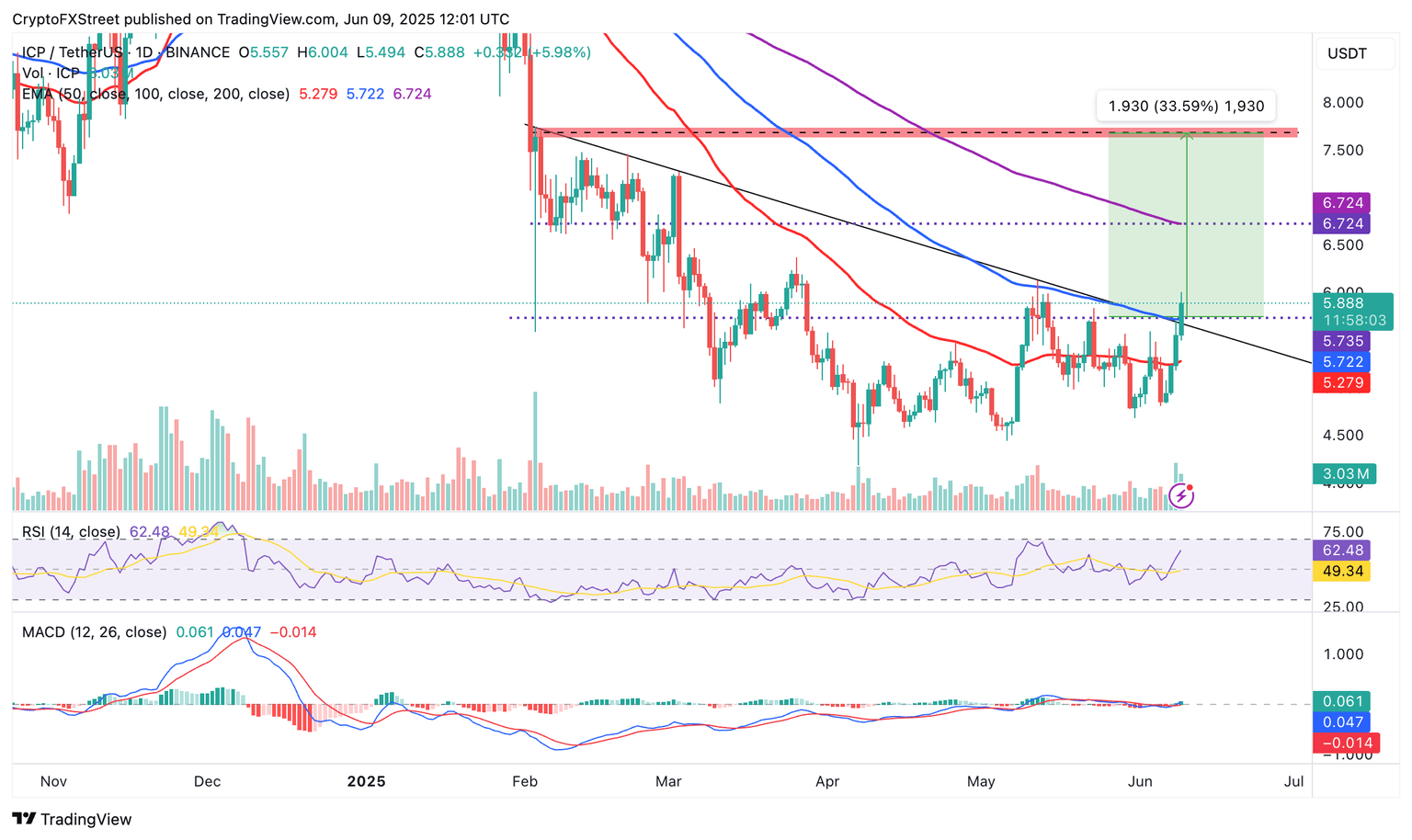

Technical outlook: Internet Computer builds momentum, signaling a 34% move of $7.60

ICP's price hovers at around $5.88 at the time of writing, slightly below the critical resistance at $6.00. The artificial intelligence (AI) token also sits on top of two key moving averages, including the 50-day Exponential Moving Average (EMA) and the 100-day EMA, which hold at $5.72 and $5.28, respectively, suggesting that the technical structure has a firm bullish bias.

A buy signal from the Moving Average Convergence Divergence (MACD) indicator, validated on Sunday, confirms the bullish outlook, encouraging traders to seek exposure to ICP.

Based on the upward trending Relative Strength Index (RSI) at 63, the path of least resistance is upward. Moreover, traders would look for a break above the $6.00 resistance and a subsequent daily close on top of the same level to ascertain ICP's bullish potential (ICP).

Such a move could expand the scope to higher levels, such as the 200-day EMA at around $6.72 and the seller congestion zone at approximately $7.60, representing a 34% increase from the current level.

ICP/USD daily chart

On the other hand, traders should be cautious as sharp corrections often follow such prominent price increases.

Key catalysts of a potential correction include profit-taking activities, overbought conditions as the RSI rises, and changing market dynamics, particularly due to uncertainty in the current macroeconomic climate. Therefore, the key areas of interest to traders looking forward to buying the dip include the 100-day EMA at $5.72 and the 50-day EMA at $5.28.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren