Institutional investors shift focus to Ethereum futures as demand for Bitcoin weakens

- Big investors are turning their attention to Ethereum, according to JPMorgan analysts.

- Bitcoin futures have witnessed weak demand as BTC futures have traded below spot prices.

- Ethereum futures premium rose 1%, which shows a strong divergence in demand from the leading cryptocurrency.

Institutional investors have been increasingly pivoting from Bitcoin to Ethereum since August as demand diverges to the second-largest cryptocurrency by market capitalization. JPMorgan analysts stated that the leading digital asset suffered a setback as BTC futures traded below the actual price of the crypto asset.

Ethereum gains traction as Bitcoin demand subsides

Big investors are steadily looking at other cryptocurrencies, shifting their gaze from Bitcoin to Ethereum, since August. The expectations for the leading digital asset have softened, as BTC futures on the Chicago Mercantile Exchange have traded below the actual price of the bellwether crypto asset.

According to JPMorgan, the trend seems to suggest that institutional investors are shying away from the Bitcoin futures trade, which indicates a setback for the leading cryptocurrency and a reflection of weak demand.

Under typical healthy demand, futures tend to trade at a premium to actual Bitcoin due to high storage costs for BTC. Yields available for passive cryptocurrency investing also incentivize futures prices to go up, according to JPMorgan's research.

Bitcoin futures allow investors to place bets and trade contracts that are linked with the future price of the bellwether digital asset.

The current weakness in futures is bearish for Bitcoin, as investors increasingly flock to Ethereum. The 21-day average for ETH futures premium rose to 1% over spot Ether prices, according to CME data. JPMorgan highlighted that this event showed a strong divergence in demand.

Bitcoin price faces difficulty in discovering higher foothold

Bitcoin price has been struggling to tag higher levels as BTC continues to record lower lows. Despite the buyers stepping in after the recent dip to $39,611, the leading cryptocurrency has been faced with a top signal, potentially awaiting another drop.

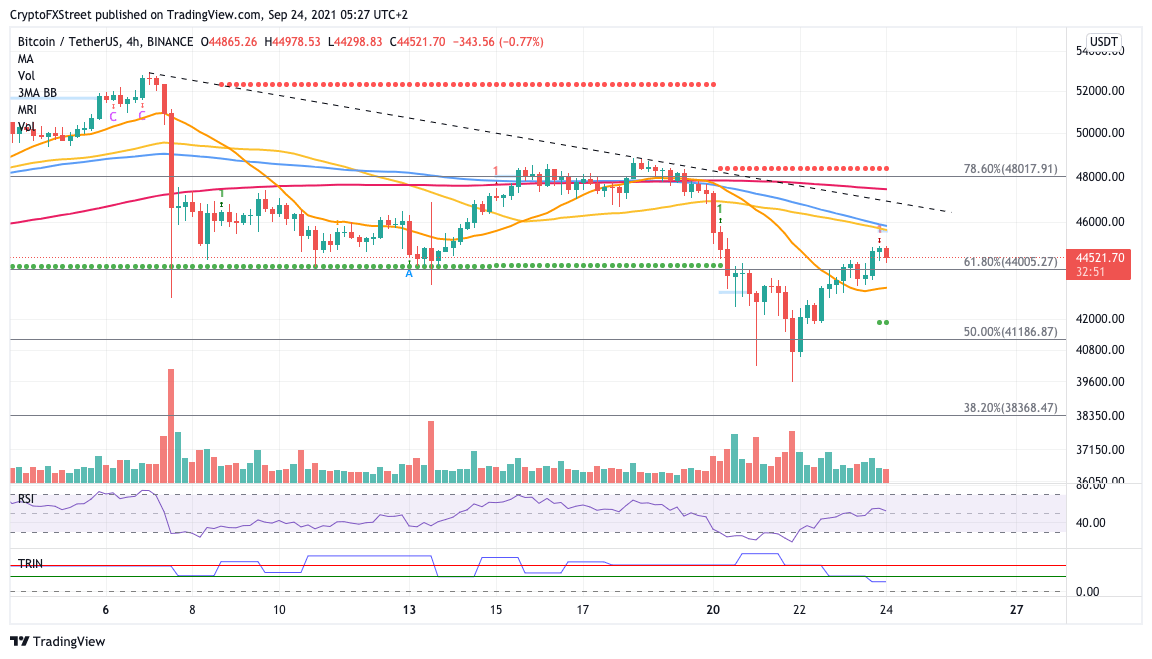

Bitcoin price has been locked in a downtrend governed by the descending diagonal trend line on the 4-hour chart. The Momentum Reversal Indicator (MRI) has printed a top signal, suggesting that BTC could be vulnerable to another plunge.

BTC/USDT 4-hour chart

The first line of resistance for Bitcoin price is at the 61.8% Fibonacci retracement level at $44,006. BTC will discover further support at the 20 four-hour Simple Moving Average (SMA) at $43,225. An additional foothold may emerge at $41,906, where the support line given by the MRI appears.

Should an increase in buying pressure incentivize Bitcoin price to climb higher, the next resistance level is at $45,815, where the 50 four-hour and 100 four-hour SMAs coincide. The descending diagonal trend line will act as the following hurdle for BTC at $46,947.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.