Identifying an opportunity to time SafeMoon’s breakout

- SafeMoon price is recovering quickly after crashing 85%.

- Despite the 104% upswing, SAFEMOON could rally another 30% to $0.00096.

- A daily candlestick close below the $0.00035 support level will invalidate the bullish thesis.

SafeMoon price seems to be making a comeback after crashing for nearly five months. This downswing formed a base around a significant support level and has bounced back exponentially. For now, investors can expect SAFEMOON to continue this ascent until it tags a critical resistance barrier.

SafeMoon price makes headway

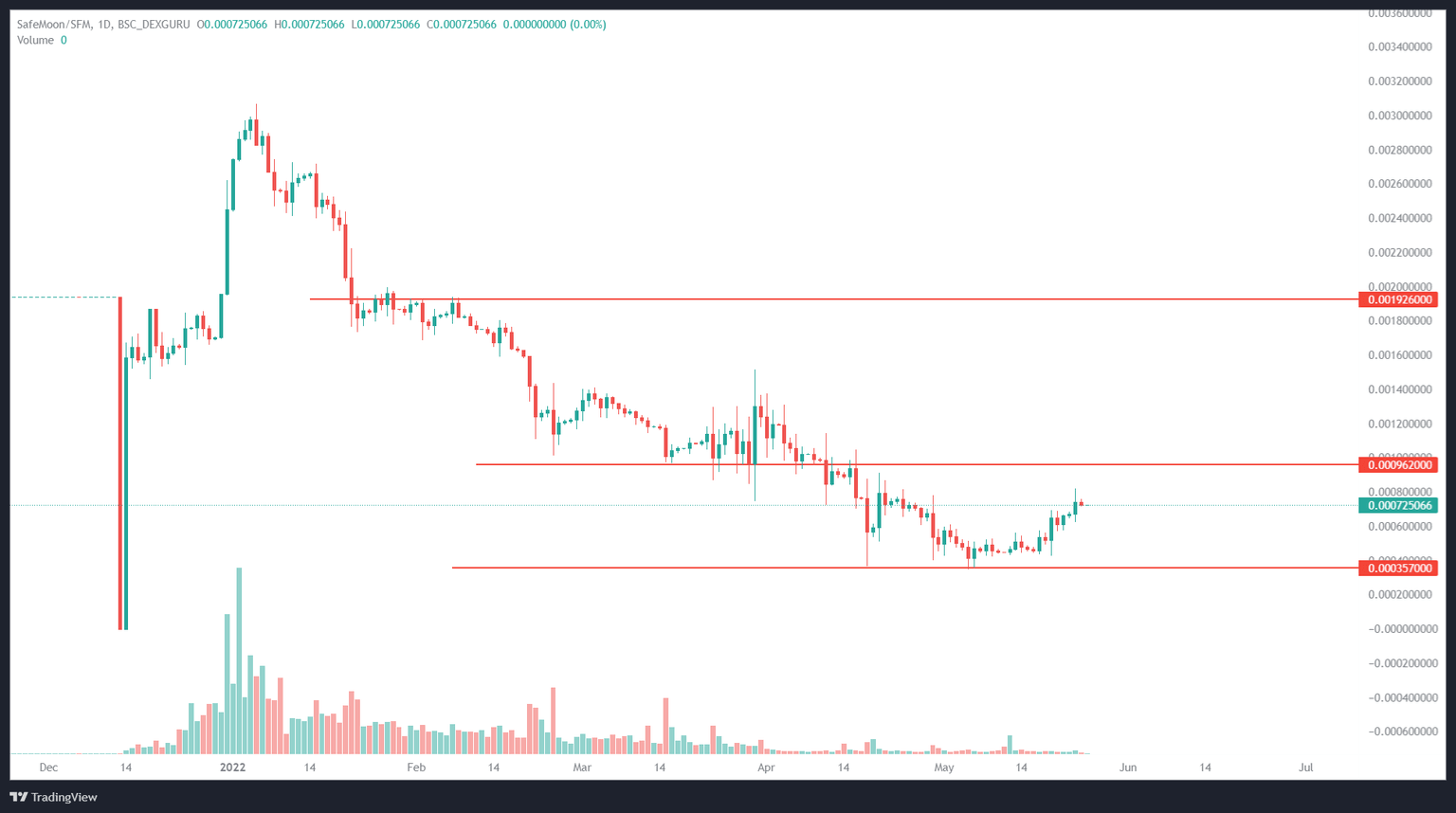

SafeMoon price set a swing high at $0.003000 on January 5 and crashed a whopping 85% to form a bottom at $0.000357. This downswing snowballed after May 5 as the LUNA ecosystem came tumbling down.

As a result, SAFEMOON sliced through the $0.000960 support level and crashed 65% to tag the new barrier at $0.000357. Although the five-month downtrend was a familiar sight to holders, the stabilization around the $0.000357 afforded them a small ray of hope. This consolidation hinted that Safemoon price was planning to recover.

Rightfully so, SafeMoon price rallied 131% from $0.000354 to $0.000820 in less than twenty days. Currently, SAFEMOON is hovering around $0.000820 and shows signs that this rally is likely to extend higher.

Investors can expect the altcoin to rally another 30% before retesting the $0.000960 hurdle. This critical barrier is where SAFEMOON will likely form a local top, allowing bulls to rest and buyers to book profits

SAFEMOON/USDT 1-day chart

While the crypto space is expecting a relief rally, a sudden uptick in selling pressure could sidestep the bullish outlook.

In such a case, daily candlestick close below the $0.00035 support level will invalidate the bullish thesis by producing a lower low.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.