How low can the Bitcoin price go?

Bitcoin’s BTC $61,207.03 “Uptober” is off to a rocky start. In the first three days of the month, the BTC price dropped from $66,000 to under $60,000.

Moreover, despite Bitcoin’s price three-week general uptrend, it is currently forming a bearish engulfing on the weekly chart, which may indicate a lead to a longer consolidation period before any recovery.

BTC/USDT weekly chart. Source: TradingView

Let’s examine how low the price of Bitcoin could go if the current correction continues for the next few days or weeks.

A “golden zone” recovery

On Sept. 27, Bitcoin closed a daily candle above its previous local top, forming a bullish higher-high (HH) pattern for the first time in 5-months. This was a major shift in market structure, and it is often ideal for uptrend charts to form a higher low (HL) before the next leg up.

Bitcoin is currently experiencing a bounce from a demand zone between $60,500 and $57,400, which also coincides with the Fibonacci 0.50-0.618 retracement lines. The gap between 0.5 and 0.618 is often described as the golden zone, where high-time frame traders build potential swing positions.

Bitcoin 4-hour chart. Source: TradingView

Bitcoin is currently just above the 0.5-0.618 gap after testing the psychological level at $60,000. But as illustrated in the chart, BTC faces resistance from the 200-EMA indicator. Therefore, there is a high possibility that the price will fall below $60,000 over the next few days.

Dentoshi, an independent analyst, also mentions that losing the 4hr EMA-200 indicates that BTC might chop again and highlights a potential sweep at $57,400, which is the lower range of the golden zone.

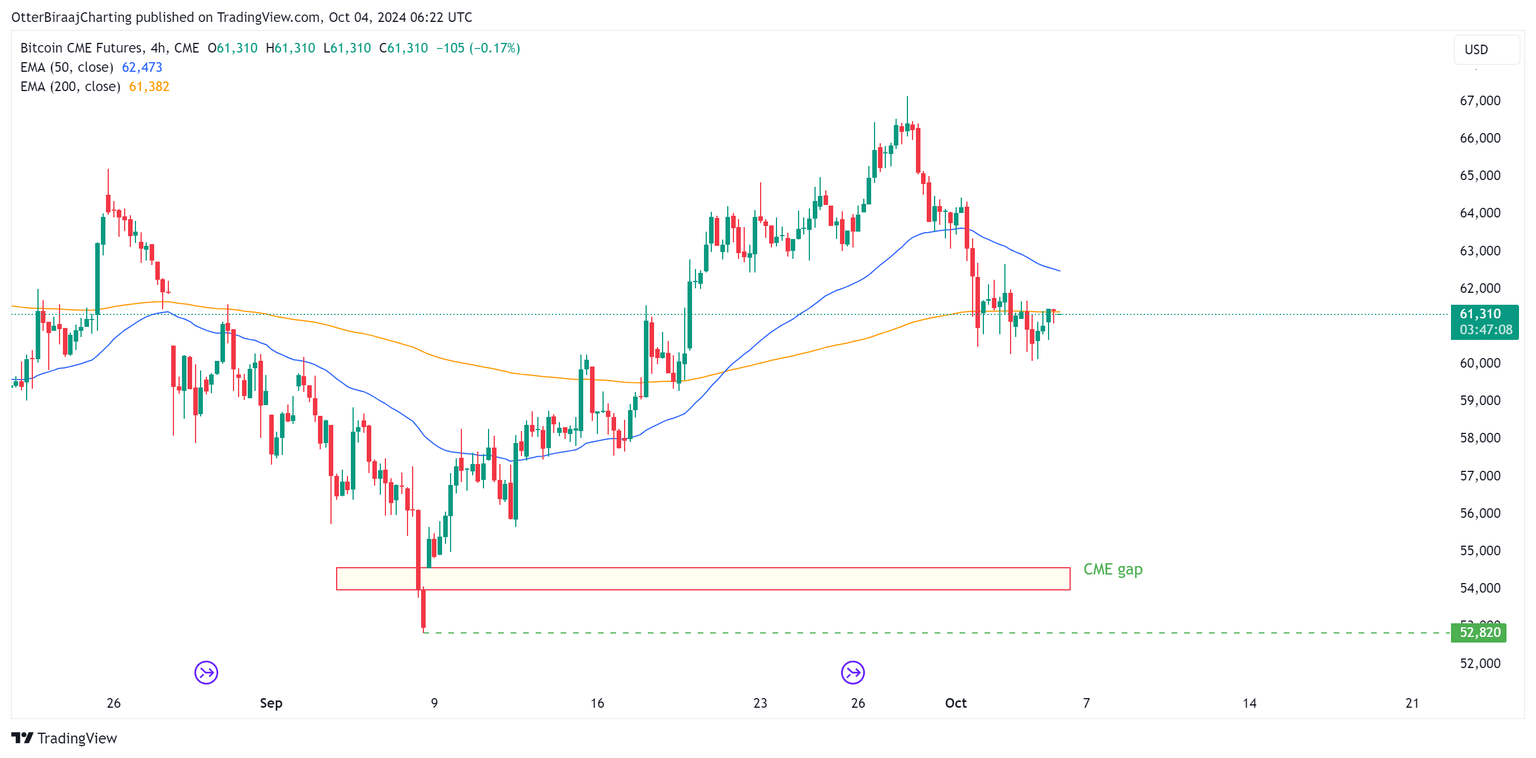

Bitcoin CME gap at $54,000

Bitcoin’s recent price rally began on Sept. 8, after which BTC price gained 18% to $66,140. Previously, a CME gap was formed over the Sept. 6-7 weekend, which did not get filled on the way up.

Bitcoin CME gap chart. Source: TradingView

As reported by Cointelegraph, over the past quarter, Bitcoin future CME gaps tend to get “filled,” and this particular gap remains unfilled.

Therefore, retesting the $54,000 Bitcoin CME gap should be the last pivotal range that BTC can drop down to without disrupting its higher high (HH) and higher low trend (HL).

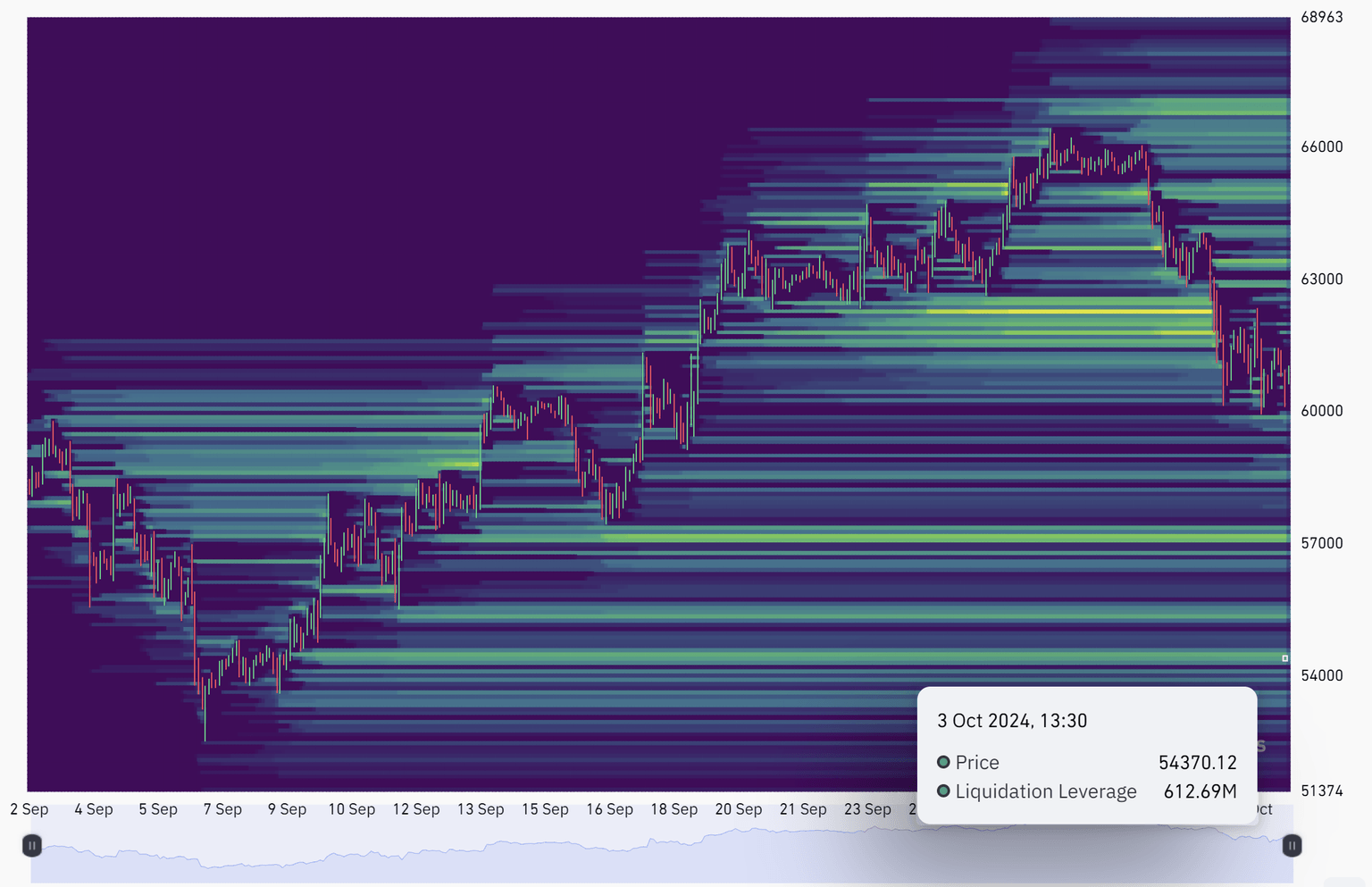

Bitcoin liquidation heatmap. Source: CoinGlass

When looking at Bitcoin liquidation levels, $612 million in liquidation leverage in positional value is also around $54,370, coinciding with the CME gap range.

But if BTC drops further, it will increase its chances of dropping below $52,510 to invalidate the medium and possibly the long-term bullish structure.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.