Hong Kong-listed Huobi Tech launches cryptocurrency OTC service

Formerly known as Pantronics Holdings, Huobi Technology has shifted its focus from electronic products to crypto.

Hong Kong-listed virtual asset platform Huobi Technology Holdings has launched a cryptocurrency over-the-counter (OTC) service, the firm announced to Cointelegraph on Wednesday.

Listed on the main board of the Hong Kong Stock Exchange (HKEX) since 2016, Huobi Technology was originally known as Pantronics Holdings, an electronic product maker founded back in 1990.

Huobi Technology has been actively moving into the cryptocurrency industry in recent years but operates independently of Huobi Group, the entity that owns the Huobi Global cryptocurrency exchange.

The two companies share some shareholders but they are two separate legal entities, a spokesperson for Huobi told Cointelegraph.

According to the latest announcement, Huobi Technology now allows investors to trade crypto via OTC using crypto block trading services and fiat currencies like the U.S. dollar. The firm plans to expand it to the euro, the British pound and the Hong Kong dollar in the near future.

Huobi Technology has introduced several crypto services in recent years, now supporting virtual asset management, custody, trust and lending. The company holds a wide number of licenses, including the security and asset management licenses from the Securities and Futures Commission of Hong Kong, as well as a trust of company service provider license in Hong Kong. Huobi Tech has also obtained a retail trust company license in the United States state of Nevada via a wholly-owned subsidiary.

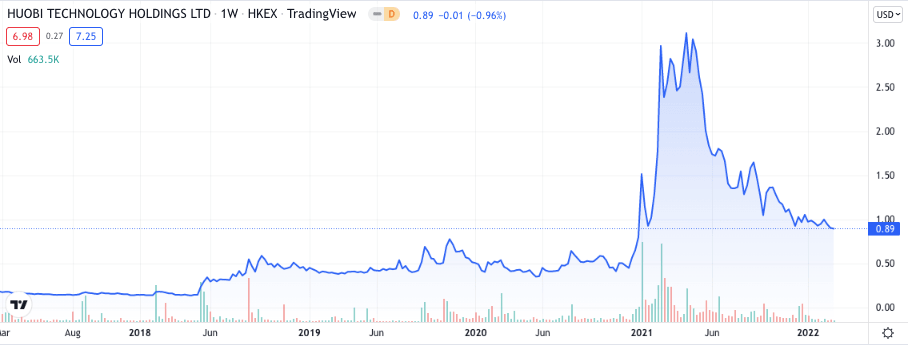

Huobi Technology stock over the past five years. Source: TradingView

Amid Huobi Technology’s entry into the crypto industry, the company’s stocks saw a sharp increase last year, briefly topping above $3 in April 2021, according to data from TradingView. The stock subsequently plummeted afterwards, dropping below $1 in late 2021.

A number of crypto-linked HKEX-listed companies like OKG Technology and BC Technology Group were also falling in late 2021 amid China’s crackdown on the crypto industry enforced in September. At the time of writing, the shares are trading at $0.89.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.