Here's why Avalanche price is rocketing

- Avalanche price surged by approximately 33% in August, upholding an uptrend ignited in June.

- The growing NFT volume has much to do with AVAX's bullish price action.

- Short position liquidations on the Ethereum competitor hit $2.01 million across all derivatives exchanges as Avalanche price tagged $30.00.

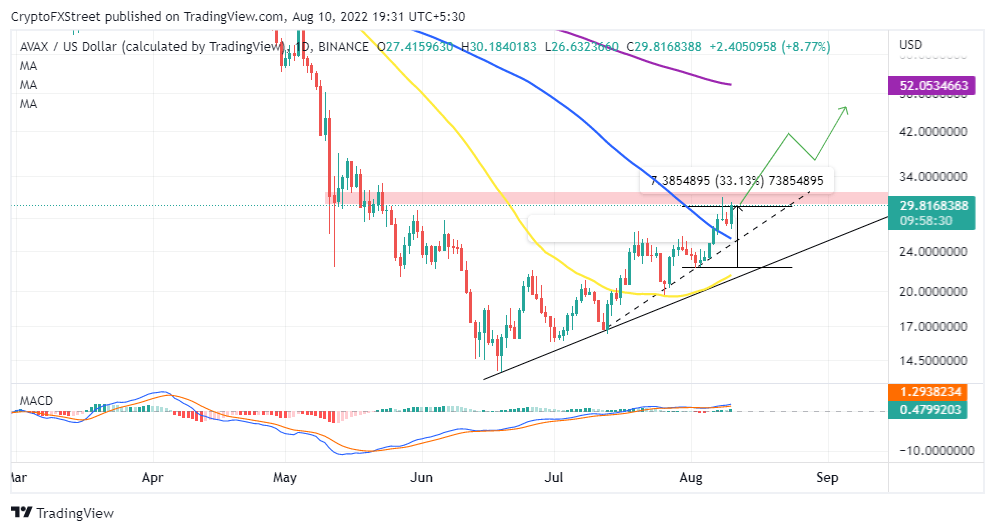

Avalanche price continued with its consistent winning streak in August's first and second weeks. After a 33.13% move, AVAX dodders within a whisker of $30.00. From both a technical and fundamental perspective, Avalanche price is unlikely to end its uptrend at the highlighted resistance.

Avalanche price recovery driven by rising NFT volumes

The substantial growth in Avalanche-based non-fungible tokens (NFTs) is one of the main fundamental factors pushing Avalanche price higher. Data from CryptoSlam shows that related volumes grew by 30.90% over the last 24 hours. The sum of all the sales made rose by 12% from 125 to 140 in the same period.

Navy Seal, the largest Avalanche-based NFT collection, saw its trading volume jump 62.7%. NFT collections such as Pizza Fame Chefs and Avepepes have also performed well.

The Futures data from Coinglass revealed that investors in short positions suffered massive liquidations as Avalanche price climbed to $30.00. Approximately $2.01 million in short positions have been liquidated over the last 24 hours. On the other hand, long trades worth $734,760 were liquidated within the same period.

Avalanche price liquidations

Avalanche price needs to break above the seller concentration at $30.00 to affirm the bullish grip. A buy signal from the Moving Average Convergence Divergence (MACD) on the daily chart reveals that buyers have the upper hand. The next targets on the upside lie at $42.00 and $50.00, respectively.

AVA/USD Daily Chart

If the much-awaited break above $30.00 does not materialize, Avalanche price might suffer a blow as it corrects south. The ascending accelerated trend line (broken line) is in place to prevent the down leg from stretching to the primary trend line (continues line). Fortifying the second support area is the 50-day SMA. Avalanche price is not expected to pull back beyond $20.00 before a significant trend reversal occurs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637957436087264171.png&w=1536&q=95)