Here's a guide to make the most profits out of NFTs

- Non-fungible token markets are relatively less liquid when compared to cryptocurrencies and move considerably slower.

- The number of unique users or the size of an NFT community is key to the project's long-term potential and relevance.

- 85% of DeFi users have interacted with NFTs, reflecting a new wave of interest in the digital art and collectibles ecosystem.

As one of the most profitable experiments in blockchain history, NFTs have offered traders an opportunity to flip digital art and invest in collectibles profitably.

NFT hype becomes real as traders earn high profits from collectibles and digital art

As non-fungible tokens (NFTs) increase in popularity, there is an increase of 179.9% in the number of transactions using OpenSea's smart contracts in the past 30 days. The NFT marketplace has clocked 1.35 million transactions in a month.

DappRadar, a decentralized finance data provider, reports,

With new collections coming out daily, and record volumes being invested into the NFT space, there is no doubt that the space entails a huge upside in the midterm.

One of the biggest challenges in flipping NFTs is that markets are generally less liquid than crypto markets and move considerably slower. Estimated market capitalization is considered a useful indicator for calculating the market size of an NFT.

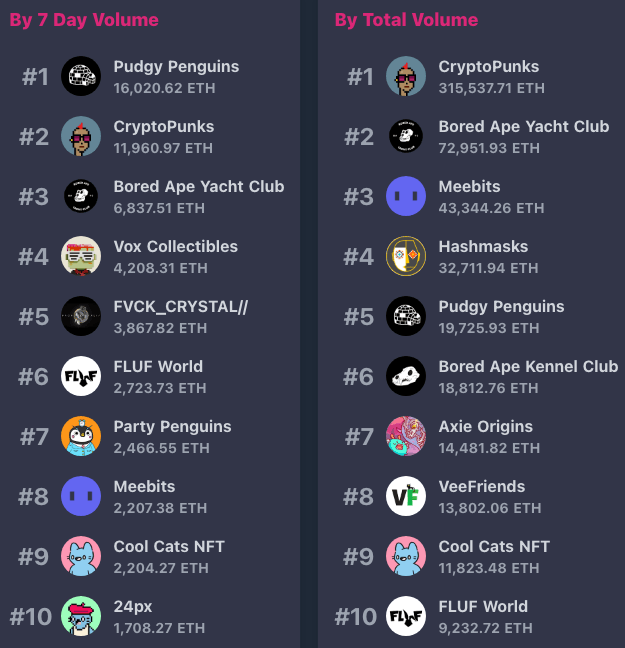

An estimated market cap is obtained by multiplying the seven-day average price with the total supply. It eliminates outdated inputs like sales of NFTs made previously (that do not influence current prices). Websites like rarity.tools ranks NFTs by estimated market cap and nansen.ai provides in-depth access to transactions and wallet addresses trading large amounts of NFTs.

rarity.tools rank NFTs by trade volume

After assessing the market size of an NFT, the next step is to identify unique users and the size of the community. Since it is challenging to make calculated trades in a market where the price is not influenced by trader sentiment or technical factors, support from a community is empowering.

Unique holders is the ideal indicator for identifying investors and collectors holding the NFTs. Unique holders combined with an estimated market cap make the ideal combination for assessing the interest in an NFT project to calculate its relevance and likelihood of staying relevant in the future.

Interest in NFTs has come mainly from the United States and Indonesia based on a recent report from DappRadar. Nearly 85% of DeFi users have interacted with digital art and collectibles, thus driving the adoption of non-fungible tokens.

The data provider analyzed 500,000 users on its platform between July 1 and August 7 and concluded that users in the US appear more interested in NFT collectibles and marketplaces than the rest.

Faze Banks, a founder of a social group for Call of Duty players called "Faze Clan," flipped an NFT for $250,000 profit and announced it on crypto Twitter recently.

Bought a Crypto Punk 48 hours ago and just sold it for a PROFIT of almost +$250,000. There is life changing money in NFT’s if you know what you’re doing. pic.twitter.com/Dk7iwwBi71

— FaZe Banks (@Banks) August 6, 2021

Gary Vaynerchuk, a Belarusian-American entrepreneur, and internet personality, posted an Instagram video sharing his views on early NFT projects,

I'm very hot on a garage sale to early NFT project that takes you a six-month window from $30 to $5000.

Overall, crypto traders and DeFi enthusiasts are exploring NFTs for generating revenue in the short term.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.