Have bulls seized the initiative in terms of mid-term growth?

Bears could not seize the initiative and all top 10 coins remain in the green zone.

Top coins by CoinMarketCap

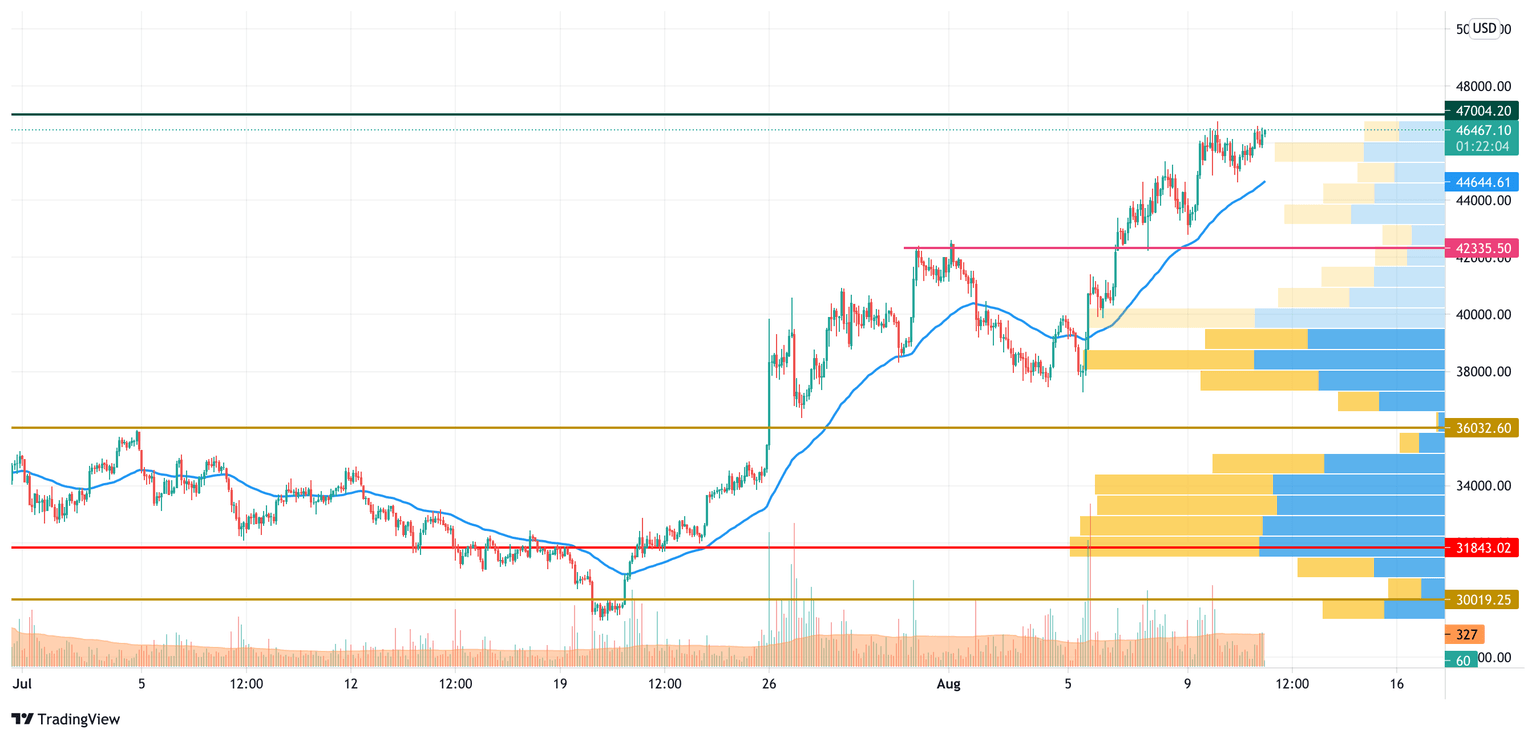

BTC/USD

Yesterday, trading volumes were below average and buyers were unable to gain a foothold above $46,000.

At the end of the day, the bulls lost the initiative and sellers pushed the Bitcoin price below $45,000.

BTC/USD chart by TradingView

Over the past night, the pair recovered to the resistance of $46,000 and, today, the bulls might try to continue their run to the level of $47,745. A new monthly high should be expected around $48,000.

Bitcoin is trading at $46,467 at press time.

ETH/USD

During the day yesterday, buyers continued to try to break through the resistance of $3,200.

One of these tests pierced this level and marked the maximum at $3,235, but sellers immediately pushed the Ethereum (ETH) price below the support of $3,100.

ETH/USD chart by TradingView

Weak bearish momentum faded rather quickly at around $3,050 and the pair was able to recover to the resistance line by the end of the day. If the bulls manage to increase volumes today, then the price of ETH can test the level of $3,340.

Ethereum is trading at $3,260 at press time.

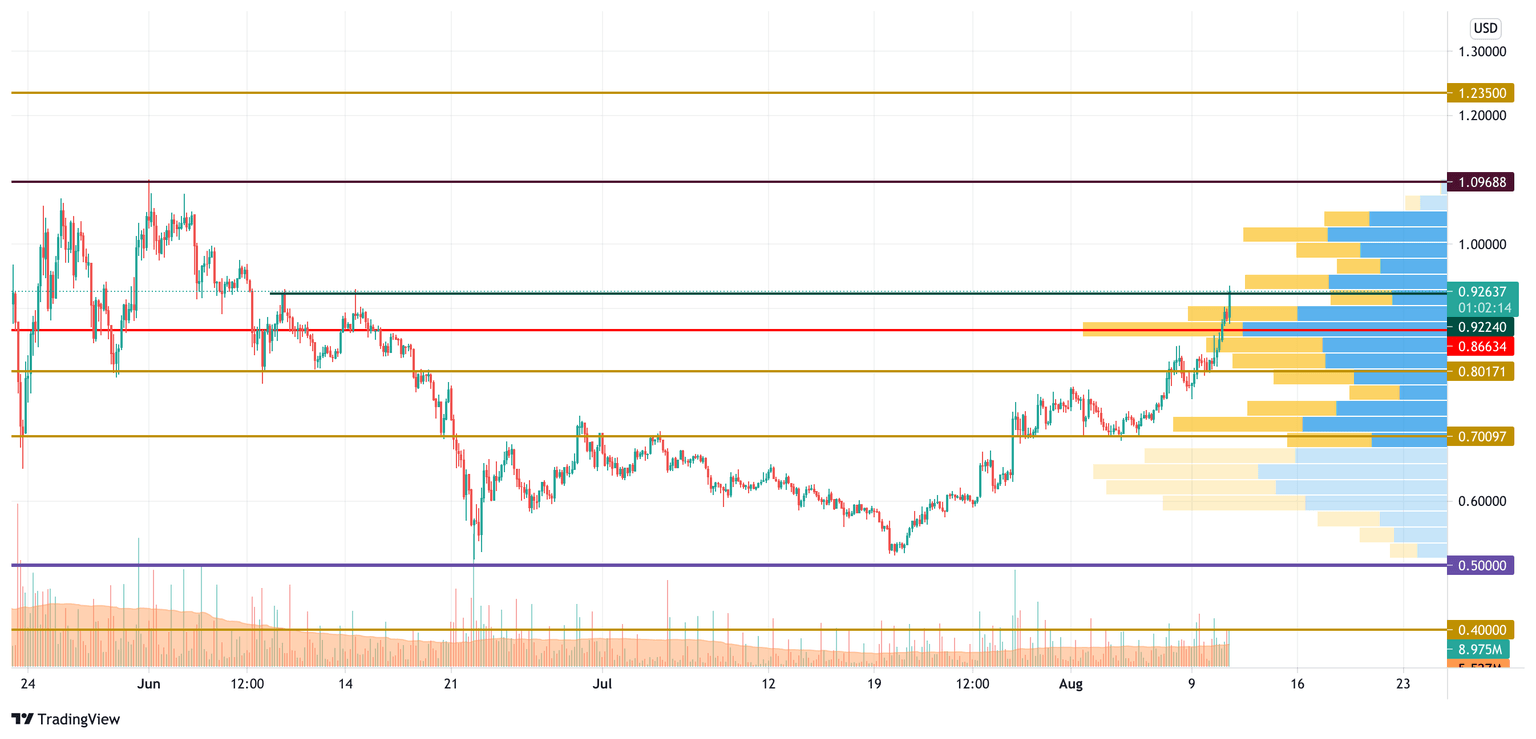

XRP/USD

Yesterday morning, the XRP price held above the key level of $0.80 and, during the day, buyers managed to continue the rise. At night, the bulls broke through the target level in the form of the POC line ($0.869).

XRP/USD chart by TradingView

Today, the growth may continue and the monthly maximum will be renewed to the level of $1.09.

XRP is trading at $0.9263 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.