Grayscale to launch US’s first spot Chainlink ETF via trust conversion

Crypto asset management firm Grayscale is set to launch the US’s first spot Chainlink exchange-traded fund this week, according to ETF Institute co-founder Nate Geraci.

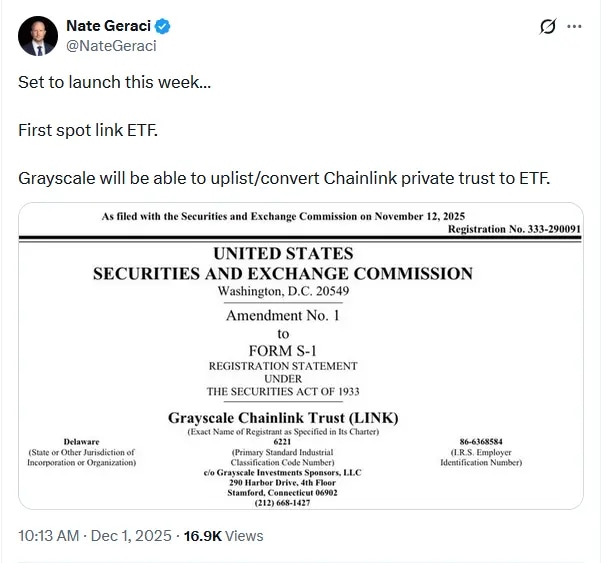

“Set to launch this week… First spot link ETF. Grayscale will be able to uplist/convert Chainlink private trust to ETF,” Geraci noted via X on Sunday.

It comes as another LINK ETF from competing crypto asset manager Bitwise is waiting in the wings.

Source: Nate Geraci

Geraci’s prediction is in line with estimates from Bloomberg Intelligence, which has tipped Grayscale’s product to launch on Dec. 2, according to Bloomberg senior ETF analyst Eric Balchunas.

Last week, Balchunas predicted a “steady supply” of potentially over 100 to launch in the next six months, as he shared a screenshot showing Grayscale’s expected launch date for its LINK ETF.

“There are 5 spot crypto ETFs launching over next 6 days. Beyond that we don’t have exact but we expect a steady supply of them (likely over 100 in next six months),” Balchunas noted via X on Nov. 24.

Like several other of the firm’s ETFs, the Grayscale Chainlink Trust will be a conversion of the firm’s LINK trust into an ETF, five years after it was formed back in late 2020.

The product will generate returns by tracking the spot price of LINK, as well as returns received from staking LINK.

Grayscale has been bullish on the Chainlink ecosystem, dubbing it in a recent research report a “critical connective tissue” linking crypto to traditional finance.

The change in SEC leadership this year has seen the floodgates open for crypto ETFs in the US, with ETFs tied to assets like Solana , XRP and Dogecoin all getting the green light this year.

Last month, Grayscale also launched a spot XRP and DOGE ETF.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.