Is another Bitcoin price selloff beckoning as Grayscale ponders selling $2 billion GBTC?

- Grayscale deliberates tendering up to 20% of the firm’s outstanding shares if plans for a BTC ETF flop.

- Grayscale Bitcoin Trust continues to trade at a huge discount amid a seemingly unending crypto winter.

- Bitcoin price holds below $17,000 after facing rejection at $18,400 last week.

According to reports, Grayscale Investment, the world’s largest digital investment company, has informed its investors that it is exploring options regarding the Grayscale Bitcoin Trust (GBTC) if plans to convert it to a Bitcoin exchange-traded fund (ETF) fail to materialize.

Grayscale could liquidate 20% worth of GBTC

According to a report published by The Wall Street Journal (WSJ), Grayscale’s CEO Michael Sonnenshein, the options being considered include tendering up to 20% of the fund’s outstanding shares, approximately $2.08 billion of the GBTC trust.

Shareholders could receive a tender offer requesting them to sell or tender their shares at a predetermined price when the time comes. The Grayscale Bitcoin Trust (GBTC) is the world’s largest BTC investment vehicle, popularly known by its ticker symbol GBTC.

GBTC is designed to trade at a premium or discount relative to the price of Bitcoin in the market. Due to the 2022 crypto winter, GBTC has been trading at a huge discount rate.

The trust traded at a 49% discount on Friday compared to Bitcoin price. At the moment, Grayscale allows only the creation of GBTC shares, with the redemption of the shares disallowed.

What is the fate of Grayscale’s Bitcoin ETF plans?

Sonnenshein fears that the recent FTX debacle could be a reason for the Securities and Exchange Commission (SEC) to put brakes on a Bitcoin exchange-traded fund (ETF). The FTX collapse has, since early November, spread contagion across the industry, leaving companies like BlockFi with no other viable options but to file for bankruptcy.

The SEC has, on several occasions, rejected proposals to have a spot ETF. The regulator only allows ETFs that monitor price movements of Bitcoin futures. Although Grayscale has yet to set a timeline for converting its GBTC into an ETF, the CEO believes that all options must be considered well in time.

The CEO indicated in the offer letter that its GBTC would continue operating. Still, the company will keep exploring ways to make the conversion to an ETF or carry on with the tender offer.

“We are as committed as ever to converting GBTC to an ETF. It is what we are putting the full resources of the firm behind,” Grayscale’s CEO Sonnenshein said in the interview with WSJ.

Bitcoin price forecast as Grayscale considers options for its GBTC

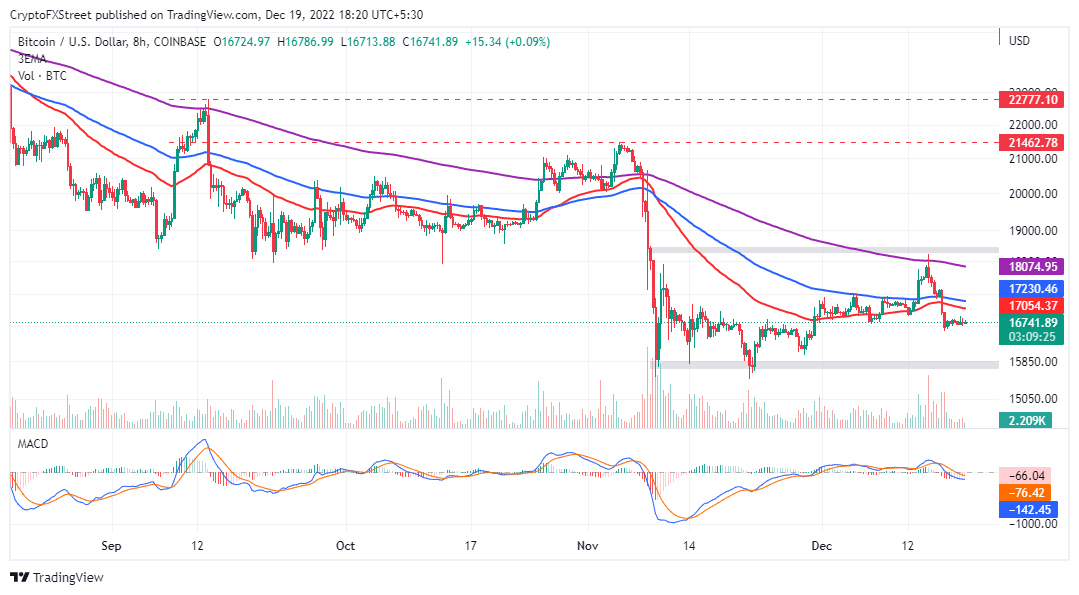

Bitcoin price has yet to regain the ground it lost since mid-last week when it climbed to $18,400. Support at $16,000 was important in ensuring that declines did not stretch further. BTC dodders at $16,718 amid a directionless battle between the bulls and bears.

BTC/USD eight-hour chart

The Moving Average Convergence Divergence (MACD) reinforced last week’s sell signal by sliding below the mean line (0.00). As long as the MACD (line in blue) stays below the signal line (in red), the path with the least resistance will be to the downside.

A daily close below support at $16,000 might leave Bitcoin price in danger of plummeting to $15,800. If push comes to shove, Bitcoin price could drop to $12,000, which some analysts believe is the ultimate bottom.

On the upside, a recovery above the major moving averages like the 50-day Exponential Moving Average (in red), the 100-day EMA (in blue) and the 200-day EMA (in purple) may invalidate the bearish outlook and support the resumption of Bitcoin’s uptrend above $20,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren