Grayscale adds more LTC to its holdings as Litecoin price targets $400

- Grayscale increased its Litecoin trust holdings by 740%.

- LTC likely to see a bullish impulse toward an all-time high mimicking BTC and ETH.

- The short-term technical picture flips bullish as reinforced by the MACD.

Litecoin has performed incredibly well in the ongoing bull run but still seems to have lagged behind its top-ten peers. A multi-year high has been traded at $240, but LTC is seeking support above $220. Despite the minor retreat, Litecoin is getting ready for a massive upswing, especially with Grayscale Investments increasing exposure to the altcoin.

Grayscale Investments buys more Litecoin

Institutional investment has been connected to the 2020/2021 crypto bull cycle. Large money management firms like Grayscale Investments Holdings have been known to buy a large volume of cryptocurrency, adding to the buying pressure and setting the price to higher highs.

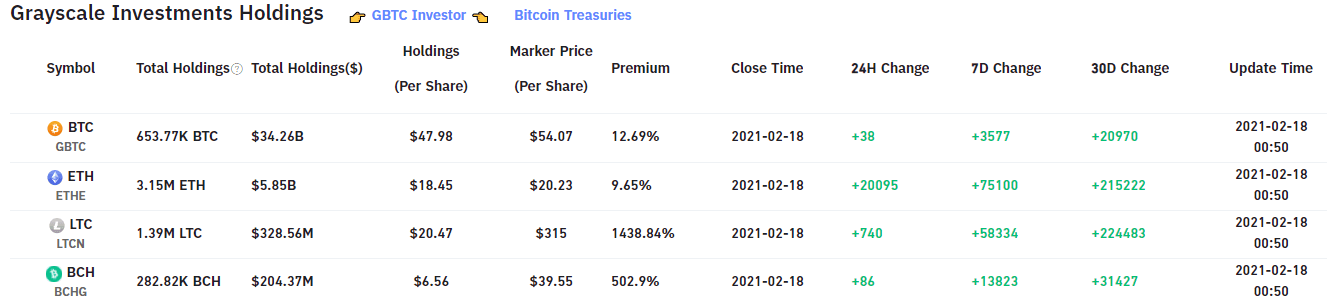

The recent addition to the Litecoin trust by Grayscale is one massive bullish signal that could see Litecoin continue with the rally to all-time highs. According to Grayscale Investments' data, the Litecoin trust increased by roughly 1.4 million LTC, representing a 740% rise. Note that Grayscale operates other trusts, including Bitcoin and Ethereum. The two largest cryptocurrencies have benefited from increased demand by the fund management firm.

Grayscale Investments trusts

How Bitcoin and Ethereum reacted to Grayscale's input?

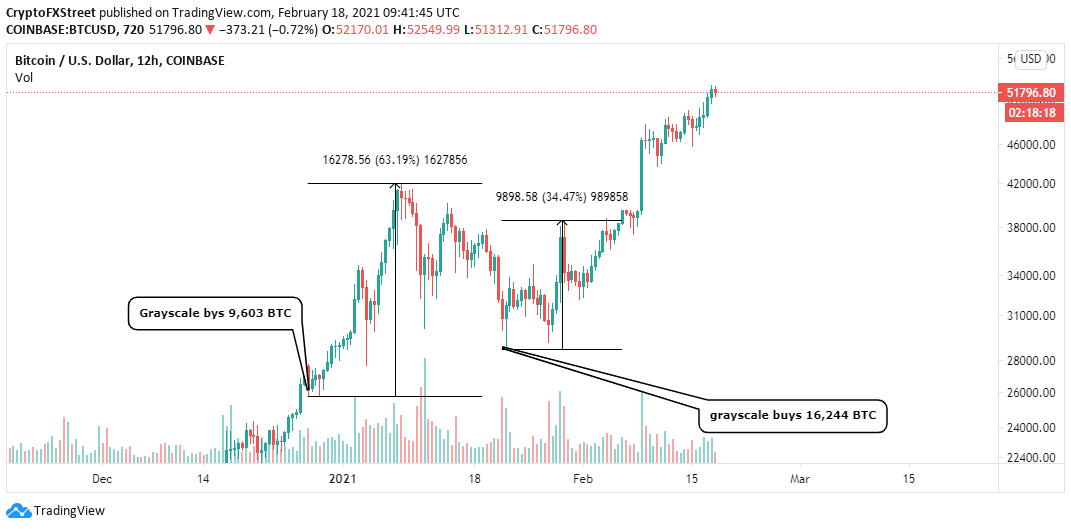

Grayscale's Bitcoin trust is the most extensive cryptocurrency holdings by any company in the world. Amid the bull run, Grayscale has continued to enhance its exposure to the pioneer cryptocurrency. For instance, around January 20, the money manager bought an additional 16,244 BTC. This purchase was more than 18 times what the Bitcoin miners averagely add to their daily supply.

Consequently, there was a market reaction with Bitcoin rallying by nearly 35% toward the end of January. The bullish impulses can be seen on the BTC chart every time Grayscale buys more of the asset.

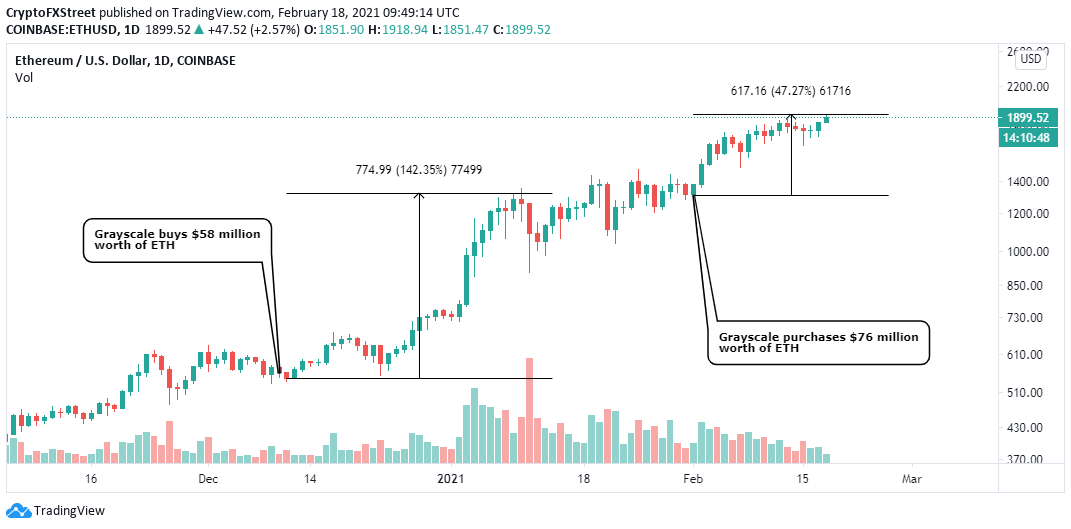

Ethereum has also broken out to higher highs due to an increase in Grayscale holdings. For instance, the chart below shows that Ether spike by more than 142% after the fund manager purchased $58 million worth of the altcoin in December. Similarly, on February 2, it added $76 million worth of ETH to the trust. Since then, Ethereum has grown by 42% to trade new all-time highs and appears to have the potential to hit higher levels.

ETH/USD daily chart

Litecoin eyes highs above $400 as demand jumps

A macro bull run comes as a result of exchange platforms' reserve dwindling coupled with heightened demand. In the same way, Bitcoin and Ethereum have shot upwards due to the 'Grayscale effect,' Litecoin is likely to catch momentum for gains eyeing all-time highs above $400.

LTC/USD 4-hour chart

Litecoin is looking forward to breaking above the crucial resistance, which is likely to catapult it to $300 before making advances toward $400. The technical picture shows that buyers have the control, especially with the Moving Average Convergence Divergence (MACD) moving higher above the midline.

It is worth noting that the bullish outlook will be invalidated if Litecoin fails to hold break above $250 crucial hurdle. At the same time, Support above $220 is critical to the uptrend, because if lost overhead pressure will increase toward the buyer congestion at $200.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520(26)-637492409150021378.png&w=1536&q=95)