Gold fractal boosts Ethereum price potential to hit $6K

Key takeaways

- A gold-like five-point breakout structure is making a strong case for an Ethereum price boom.

- Ethereum is also repeating its 2016–2017 fractal and could rally to $5,000–$6,000 if the pattern holds.

- Fading Solana hype and rising institutional inflows are boosting Ethereum’s fundamental strength.

Gold fractal furthers Ethereum’s bull case

A multi-year gold fractal is making a strong case for an Ether (ETH $2,617) price rally toward $6,000 in the coming months.

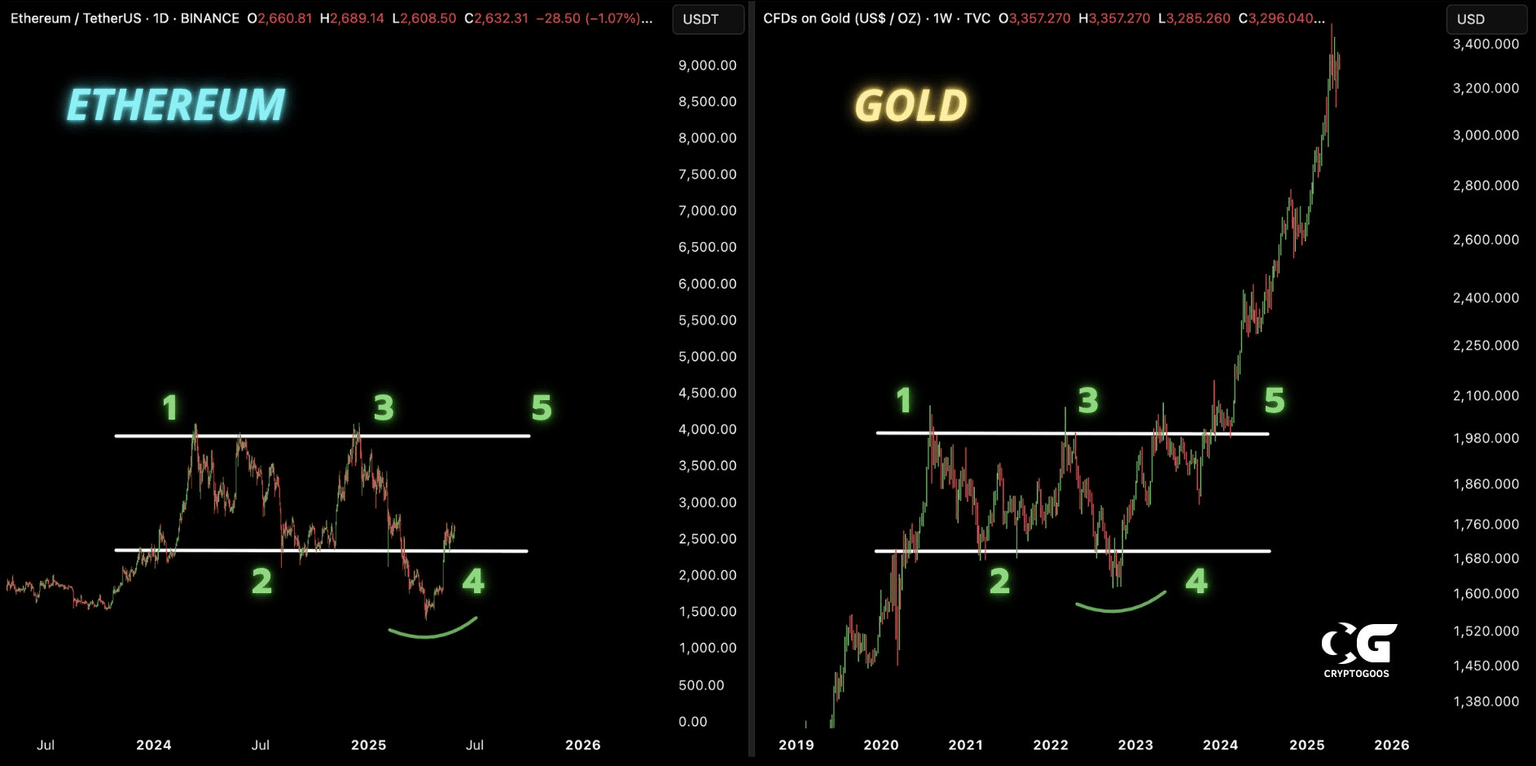

A side-by-side comparison of ETH and gold charts shows Ethereum mirroring gold’s multi-year accumulation structure from 2019 to 2024.

ETH/USD daily and XAU/USD weekly performance comparison. Source: CryptoGoos

Both assets are exhibiting a near-identical five-point formation: two local tops (points 1 and 3), two deep pullbacks (points 2 and 4), and a rounded base (point 5) before an explosive breakout.

Gold completed this pattern with a breakout above $2,100 in early 2024, rallying over 60% to reach new all-time highs above $3,400.

Ethereum now appears to be following the same setup, currently bouncing from its point 4 low near $1,600 and approaching the $3,000–$3,500 resistance zone—analogous to gold’s breakout point.

Ethereum’s rally to $5,000-6,000 is 'easy this cycle'

Another fractal further strengthens the bullish Ethereum outlook, making a case for a $6,000 ETH price in the coming months.

Ethereum appears to be repeating in the current 2024–2025 cycle, potentially setting the stage for a new all-time high, according to technical analyst Crypto Eagles.

The pattern in focus follows four distinct stages: a multimonth consolidation range, a sharp shakeout that traps late bulls, a breakout above resistance, and finally a parabolic rally.

In 2017, this structure led to a price surge of over 1,000% from sub-$10 levels to above $1,400.

ETH/USD weekly price chart. Source: TradingView/CryptoEagles

The current setup shows Ethereum moving in a similar trajectory, with its range between $1,600 and $4,000, followed by a steep pullback, now rebounding toward a potential breakout zone around $3,500–$4,000.

Crypto Eagles suggests that Ethereum could rally toward the $5,000–$6,000 range in the coming months if the “candle for candle” fractal continues to play out.

“Only difference now [is that] the base is 100x larger,” the analyst explained, adding:

The fundamentals are 10x stronger. $5k - $6k EASY THIS CYCLE.

Cooling memecoin frenzy could send ETH higher

Fundamentally, Ethereum’s bullish case is further supported by improving market positioning.

Ether has outperformed the broader crypto market in recent weeks, especially Solana (SOL $160.60), which had previously drawn capital away during its memecoin-fueled rally.

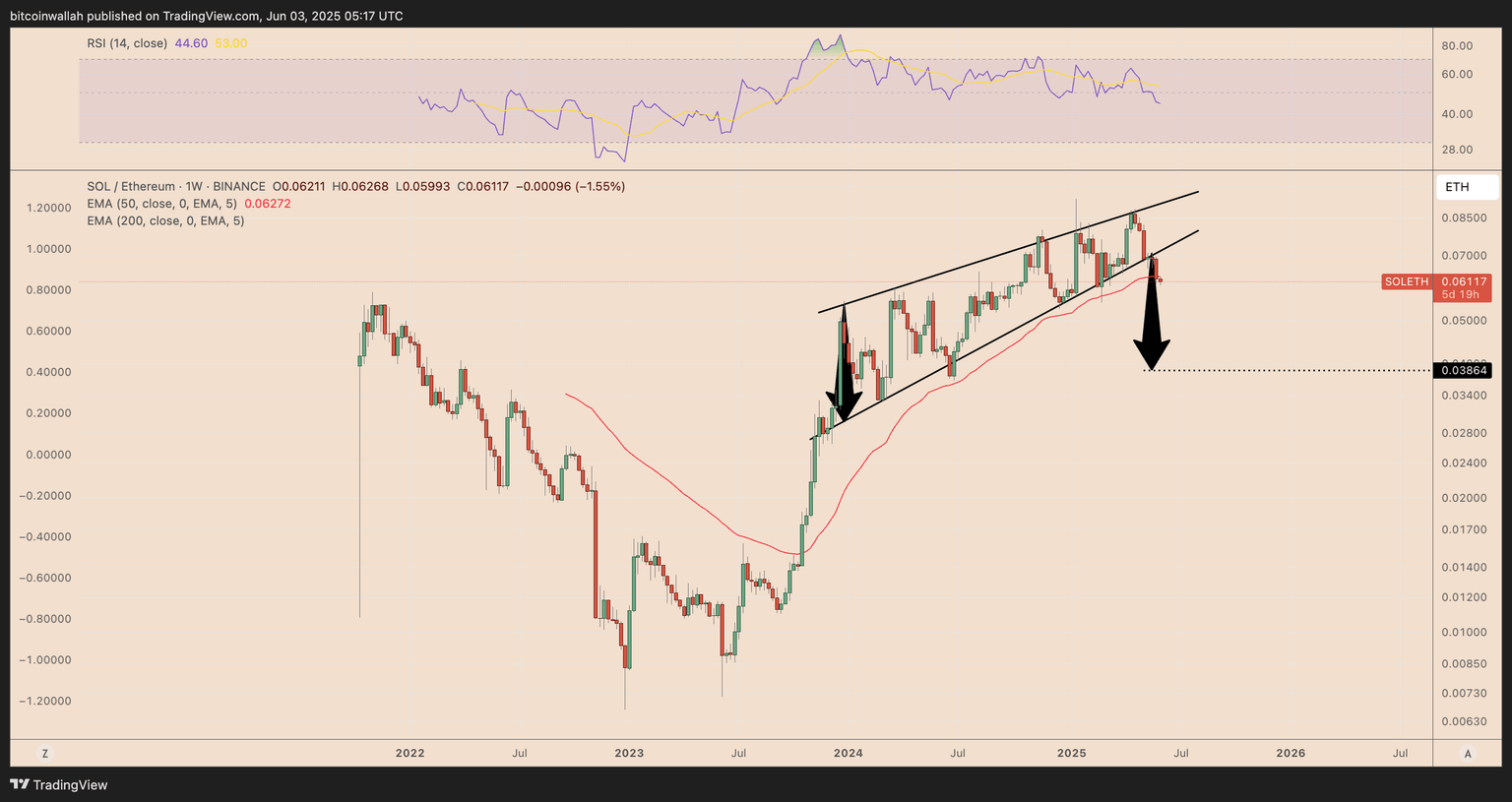

SOL/ETH weekly price chart. Source: TradingView

As the memecoin frenzy cools and bearish patterns emerge on the SOL/ETH chart, analysts at Standard Chartered and chartist Alex Clay expect ETH to extend its dominance.

Institutional demand is also accelerating. Ether-focused investment funds attracted $321.4 million in the week ending May 30—the largest inflow among all crypto assets—according to CoinShares.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.