Floki Inu price at make-or-break point as meme coin forecast confuses investors

- Floki Inu price confuses forecasts as it consolidates within a parallel channel.

- $0.0001167 is a critical level for FLOKI, which could determine its next directional intentions.

- The bulls could aim for an 82% climb if it secures steady support above the crucial line of defense.

Floki Inu price is at a pivotal point as all eyes are on the meme coin, waiting for the token to reveal its directional intentions. Breaking below $0.0001167 could spell trouble for the bulls but securing support above this level could see FLOKI target an 82% release to the upside.

Floki Inu price remains indecisive

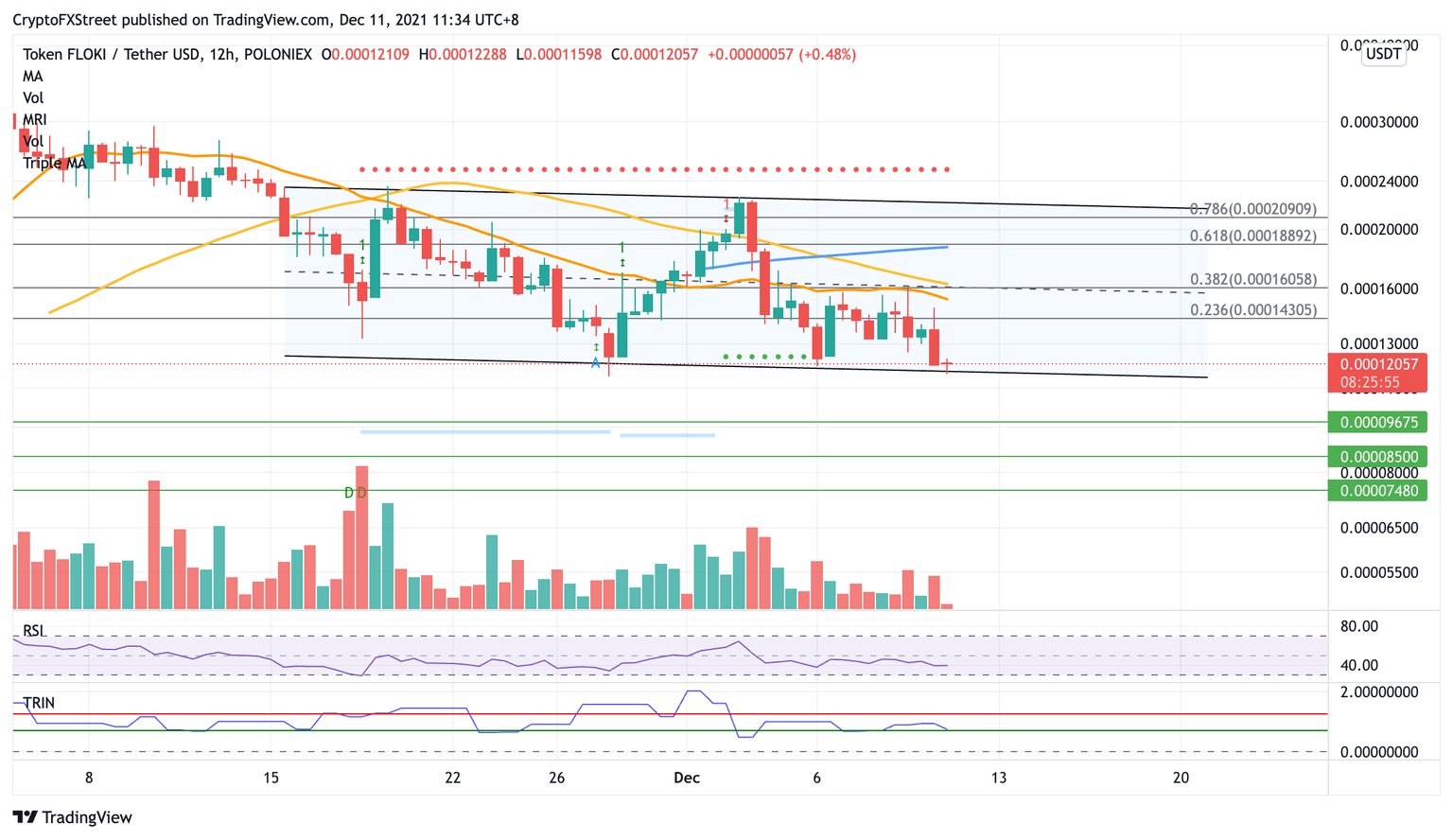

Floki Inu price has formed a parallel channel on the 12-hour chart as the token continues to indicate a lack of directional bias. FLOKI is nearing the lower boundary of the prevailing chart pattern at $0.0001167 which acts as a make-or-break point for the token.

If Floki Inu price manages to sustain above the downside trend line of the parallel channel, this could give hope of a recovery for the bulls to target an 82% rally toward the upper boundary of the governing technical pattern at $0.0002205.

Floki Inu would face immediate resistance at the 23.6% Fibonacci retracement level at $0.0001430. Additional obstacles may appear at the 21 twelve-hour Simple Moving Average (SMA) at $0.0001534, then at $0.0001605, where the 50 twelve-hour SMA, the middle boundary of the prevailing chart pattern and the 38.2% Fibonacci retracement level intersect.

Further resistance may emerge at the 61.8% Fibonacci retracement level at $0.0001889, coinciding with the 100 twelve-hour SMA. Before Floki Inu price reaches the bullish target, the token may face a headwind at the 78.6% Fibonacci retracement level at $0.0002090.

FLOKI/USDT 12-hour chart

However, if Floki Inu price slices below the lower boundary of the parallel channel at $0.0001167, FLOKI could face a bearish target of a 46% drop toward $0.0000625 projected by the prevailing chart pattern.

The first line of defense for Floki Inu price is at the October 28 low at $0.0000967, then at the October 17 high at $0.0000850. FLOKI may also discover a strong foothold at the October 20 high at $0.0000748 if it faces additional downward pressure.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.