Floki Inu heads towards $0.000175 as technical setup favors FLOKI bears

- Floki Inu price looks south amid bearish technicals on the 4H chart.

- FLOKI bulls unimpressed by Floki Inu's likely listing on four crypto exchanges.

- Defending $0.00022 is critical for FLOKI bulls, stiff resistance awaits $0.000255

Floki Inu price is looking to stabilize at lower levels this Sunday after witnessing volatile trading in the previous week.

The dog-themed crypto coin booked a second weekly loss, eyeing deeper correction from record highs of $0.000405 reached on November 4.

With reducing investors’ interest in the canine-inspired meme coins so far this month, FLOKI price is set to extend its corrective decline in the near term.

FLOKI bulls remain little impressed, despite Floki Inu's team having got the permission to announce the coin potential listing on four cryptocurrency exchanges, viz, Bitmart, FMFW.io, Digifinex and AAX exchange,

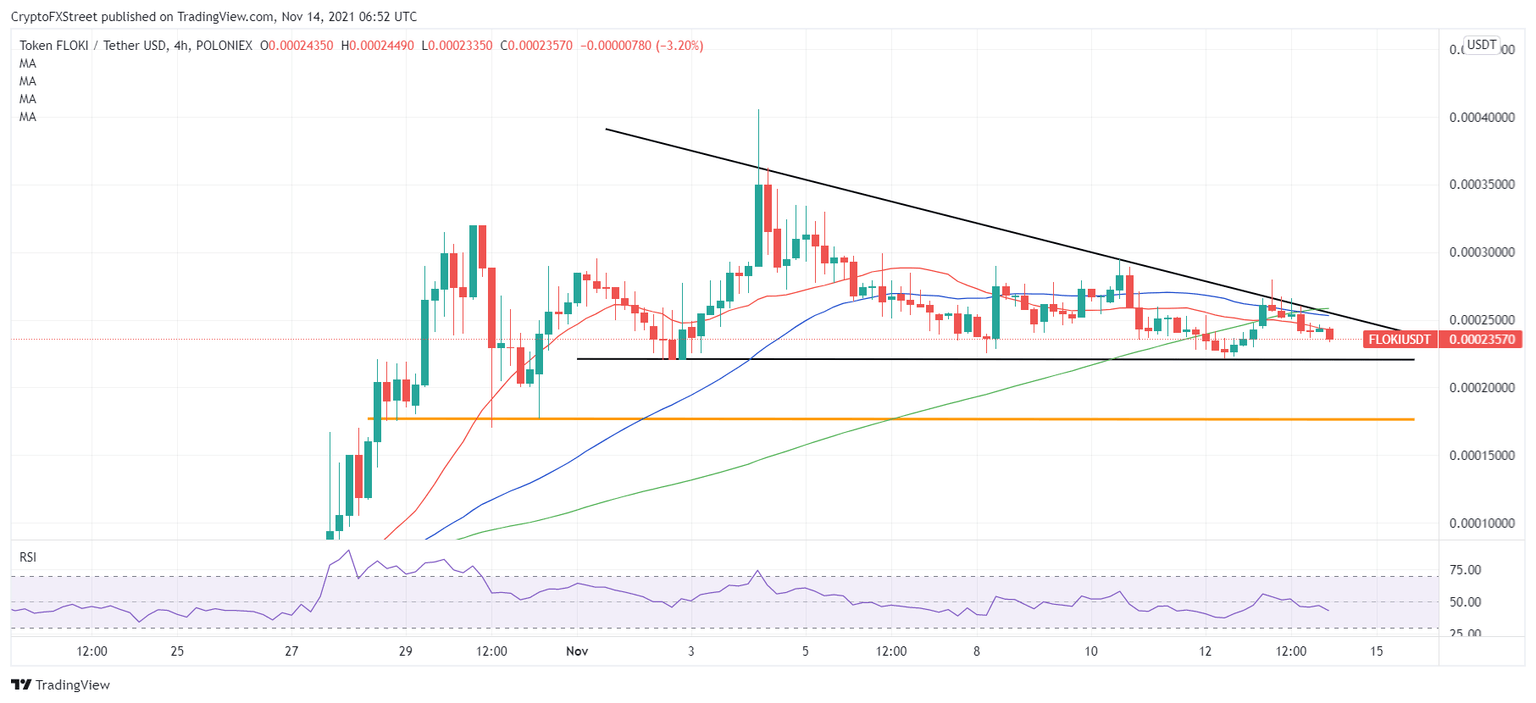

Floki Inu price eyeing a test of the descending triangle support

As observed on Floki Inu’s four-hour chart, FLOKI bears are holding the reins after the coin’s failure to resist at higher levels.

In doing so, FLOKI price has breached the critical short-term bearish 21-Simple Moving Average (SMA) at $0.000243.

The move lower has triggered a fresh selling wave in FLOKI price, exposing horizontal trendline support at $0.00022.

A four-hourly candlestick closing below that level will validate a downside breakout from a fortnight-long descending triangle formation.

A massive sell-off towards the horizontal (orange) trendline support at $0.000175 will then unfold.

The Relative Strength Index (RSI) is pointing sharply lower, allowing room for more declines.

FLOKI/USDT: Four-hour chart

Any upside retracement will need acceptance above the 21-SMA support-turned-resistance.

FLOKI bulls will then face the next significant resistance around $0.000255, which is the intersection of the falling trendline resistance, 50 and 100-SMAs.

Note that the 50 and 100-SMA bearish crossover confirmed on Saturday is playing out, exacerbating the pain in FLOKI price.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.