First Mover Asia: Alameda research, FTX are bound to each other; Bitcoin trades sidways

A recent Alameda document showed that the biggest asset on the organization's balance sheet was FTX’s FTT token.

Good morning. Here’s what’s happening:

Prices: Macroeconomic uncertainty reigns but bitcoin continued to hold tight comfortably above $20K. DOGE plunged late on Thursday after news that Twitter was halting work on its crypto wallet project.

Insights: Alamedia Research and crypto exchange FTX are bound together, a recent Alameda document underlines.

Prices

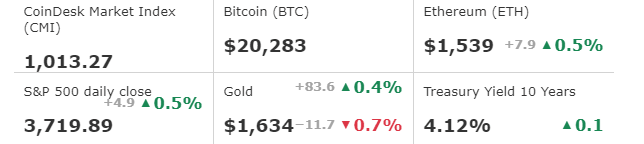

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Bitcoin Sails Along; DOGE Plummets Late

By James Rubin

The global economy saw more stormy weather on Thursday as the U.S. Labor Department announced a small dip in weekly jobless claims just a few hours after the Bank of England boosted its interest rate by a jumbo-sized 75 basis points, matching recent U.S. hikes.

The two unrelated events underscored the difficulties central banks are facing in cooling the still hot job market and stemming inflation, and they sent equities downward.

However, bitcoin and ether, the two largest cryptocurrencies by market capitalization, continued to sail along at roughly the same levels they’ve maintained for much of the past two weeks. BTC was holding steady at about $20,200, while ETH continued to hover over $1,500 – both up a few smidgens during the past 24 hours. Crypto investors have recently been undeterred by a raft of evidence that conditions are still not ready to settle down.

“Hawkish monetary policy and macroeconomic uncertainty rage on,” CoinDesk crypto markets analyst Glenn Williams wrote. “But crypto investors ultimately have little else on their mind than cost basis.”

A number major tokens spent much of the day trading solidly in the green, with MATIC and LRC recently up nearly 11% and 7%, respectively. But popular meme coin DOGE plunged more than 9% following a report that Twitter's mercurial new owner, Elon Musk, was halting work on the social media platform's crypto wallet. The token spiked 16% last week as Musk, an avid DOGE supporter, neared completion of his $44 billion deal. Musk's activities and utterances have consistently influenced DOGE's price.

The job market may soon offer more concrete evidence that central bank measures to tame rising prices are working. Job cuts by online retail giant Amazon and ride-share service Uber sent equity markets falling. The tech-focused Nasdaq dropped 1.7%, while the S&P 500 was off 1%. Amazon warned that business would be declining. Safe haven gold continued a recent series of declines, and was down 0.4%.

In an interview on CoinDesk TV's First Mover program, Bilal Little, president of asset management platform DFD Partners, said that the Federal Reserve's latest interest rate boost provided markets with clarity and that investors would pivot to next week's Consumer Price Index for the latest read on inflation.

Little struck an upbeat note about bitcoin, saying that investors would be "looking to assets for better returns, in this case bitcoin."

"The market is looking for a nice surprise to the upside," he said.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Polygon | MATIC | +10.8% | Smart Contract Platform |

| Loopring | LRC | +7.0% | Smart Contract Platform |

| Chainlink | LINK | +3.7% | Computing |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | −15.1% | Entertainment |

| Dogecoin | DOGE | −9.1% | Currency |

| Shiba Inu | SHIB | −1.8% | Currency |

Insights

By Sam Reynolds

Alameda Research and FTX, which once both had Sam Bankman-Fried at the top, have tried to create a firewall between the two firms more recently.

In October 2021, SBF handed over control of Alameda Research to Caroline Ellison and Sam Trabucco. Concerns about conflicts of interest were rising, as Alameda had the tripartite role as a market maker, investor and trader.

Many FTX users didn’t like that SBF, and by virtue FTX, led the firms as theymight find themselves lining the pockets of Alameda as they traded a new token it was market making, or perhaps worse, being on the other side of a trade against Alameda.

A firewall was put in place, and the SBF-led empire tried to make Alameda a separate institution from FTX.

The biggest asset

But recently, CoinDesk came into possession of an internal Alameda document that outlined its balance sheet.

And the biggest assets on the books? FTX’s FTT token.

This makes the two firms bound to each other.

FTT’s token officially gives exchange users discounts on trading fees if they stake it. But practically, it operates as something akin to stock. In good times, FTT’s token rises, and in bad times, it declines. Apropos, whenever bad news about Binance hits the news wires, its eponymous token, BNB, declines.

So now, approximately $5.2 billion of Alameda’s net worth of $14.6 billion is tied up in “unlocked FTT” and “FTT collateral.”

If, for some reason, FTX faces a crisis, or a fierce competitor, Alameda risks becoming less liquid. If there’s a massive market drawdown, the contagion between a crippled FTX and Alameda would create a catastrophe that would make Three Arrows’ “Lehman Moment” look like a monthly cyclical correction.

But likewise, there’s still a problematic relationship between FTX and Alameda. Market manipulation is on everyone’s mind, which is why in TradFi such an arrangement would not be allowed.

The dynamic would be similar in theory to the New York Stock Exchange and market-maker goliath Citadel Securities having the same parent, with NYSE and its executives emphasizing stocks being market made by Citadel. Suchingredients would be ripe for a Congressional Inquiry. But these types of relationships don’t happen because TradFi market makers are bound by registration requirements and some form of transparency.

There’s $41 million of SOL also on Alameda’s books, as Solana was an investment by FTX and a made market by Alameda. Solana has fallen out of favor with traders given its frequent ‘breakdowns’ and the questionable size of its development community. When Alameda and FTX were pushing this token throughout the summer of 2021, did they know something that retail did not?

Occasionally, OTC deals Alameda is involved in, such as with Reef Finance, sometimes go wrong and retail traders are left to punt around in the shadows of the elites.

Like many crypto companies, Alameda exists as a collection of corporate entities spanning multiple countries from the Far East to Delaware. Has anyone seen a list of shareholders?

Important events

8:30 p.m. HKT/SGT(12:30 UTC) United States Nonfarm Payrolls (Oct)

8:30 p.m. HKT/SGT(12:30 UTC) Canada's Unemployment Rate (Oct)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.