Fetch.ai price risks a 10% drop as the 25-day EMA support lets loose

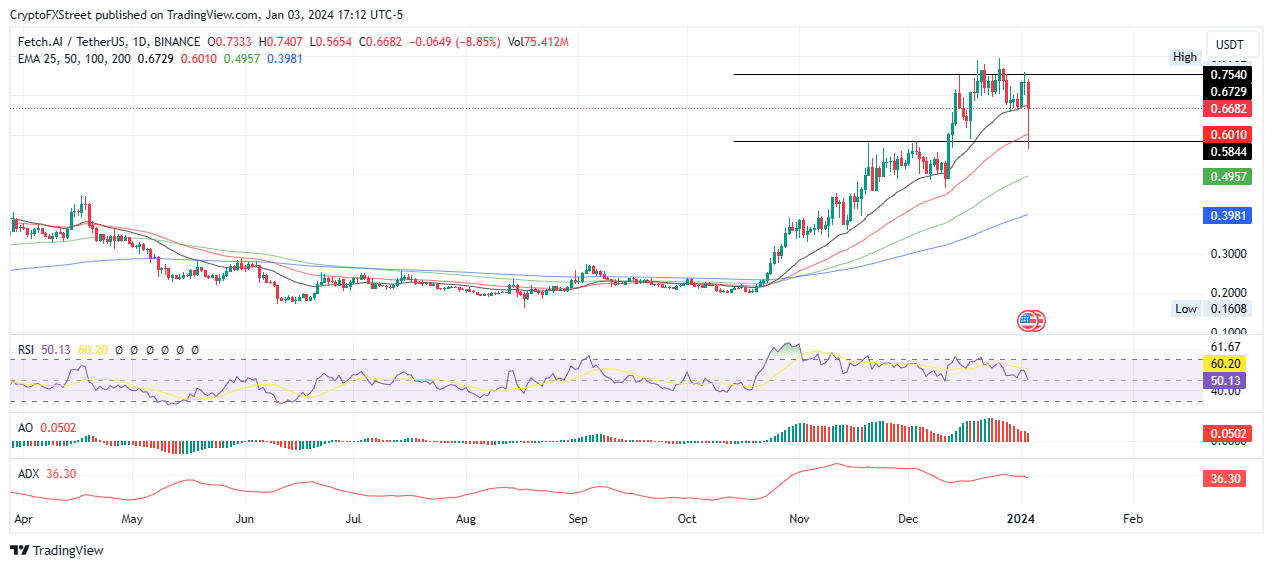

- After a 284% climb, Fetch.ai price has met formidable opposition at $0.7540, capping its upside potential.

- FET could drop 10% if it loses the support due to the 25-day EMA amid falling momentum.

- The deeper correction scenario will be invalidated upon a decisive candlestick close above $0.7540.

Fetch.ai (FET) price has been on a pronounced uptrend since around October 18, when the crypto market turned bullish. Its price action since then has been characterized by higher highs and higher lows. This was the case until the AI crypto coin met opposition, and now its upside potential appears limited.

Also Read: Fetch.AI price rally likely with retail investor accumulation of FET tokens

Fetch.ai price eyes 10% drop

Fetch.ai price appears poised for an extended fall, potentially going 10% deep as the support offered by the 25-day Exponential Moving Average (EMA) at $0.6729 breaks. It comes after a strong dip that saw FET record an intra-day low of $0.5654. Although the market buying the dip facilitated a strong bullish rejection, buyer momentum remains low, and the AI crypto coin now appears unable to flip the 25-day EMA back to a support.

Enhanced seller momentum could see Fetch.ai price extend lower, going as low as the 50-day EMA at $0.6010, or lower, to tag $0.5844, 10% below current levels. A break and close below this level on the daily timeframe would violate the prevailing bullish outlook.

In the dire case, the slump could extend for Fetch.ai price to test the 100-day EMA or worse, the 200-day EMA, with such a move constituting a 40% drop below current levels.

The Relative Strength Index (RSI) is nose-diving and could soon cross below the 50 level, not only showing that momentum is falling but also suggesting that the bears are gaining ground as the bulls loosen their grip.

The Average Directional Index (ADX) indicator is also showing signs of being subdued, deviating to the south with a 36 reading. This, coupled with the histogram bars of the Awesome Oscillator (AO) that continue reducing in volume towards the midline, accentuates the bearish thesis.

FET/USDT 1-day chart

On-chain metrics supporting Fetch.ai price bearish outlook

Data from Santiment shows a spike in active deposits, which points to more tokens flowing into centralized exchanges. This often precedes a rise in short-term sell pressure. Since mid-December, there has been an effective drop in withdrawal transactions, moving from 230 to the current 46, showing a reduced accumulation trend.

FET Santiment: Price, Active Deposits, Withdrawal Transactions

The development activity and network growth metrics also show signs of being subdued, adding credence to the bearish thesis. These metrics show that the project has not been making any significant traction in both user adoption and project upgrades.

FET Santiment: Price, Development activity, Network growth

On the other hand, if the bulls find strength, potentially as sidelined or late investors buy the dip, Fetch.ai price could recover north. While a restoration above the 25-day EMA would be ideal, the correction thesis will only be invalidated once FET price records a candle stick close above $0.7540 on the daily timeframe.

In a highly bullish case, the gains could extend higher for the Fetch.ai price to clear the range high at $0.7952, with the potential to tag the $0.8000 psychological level. Such a move would denote a 23% climb above current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B02.26.29%2C%252004%2520Jan%2C%25202024%5D-638399231398671045.png&w=1536&q=95)

%2520%5B02.28.15%2C%252004%2520Jan%2C%25202024%5D-638399231821094933.png&w=1536&q=95)