Ethereum's 2.0 upgrade might be the catalyst for a new bull run

- Possible bullish signals pop up as core ETH devs lock funds in Eth 2.0 smart contract

- Eth 2.0 deposit contract dropped over the past few days

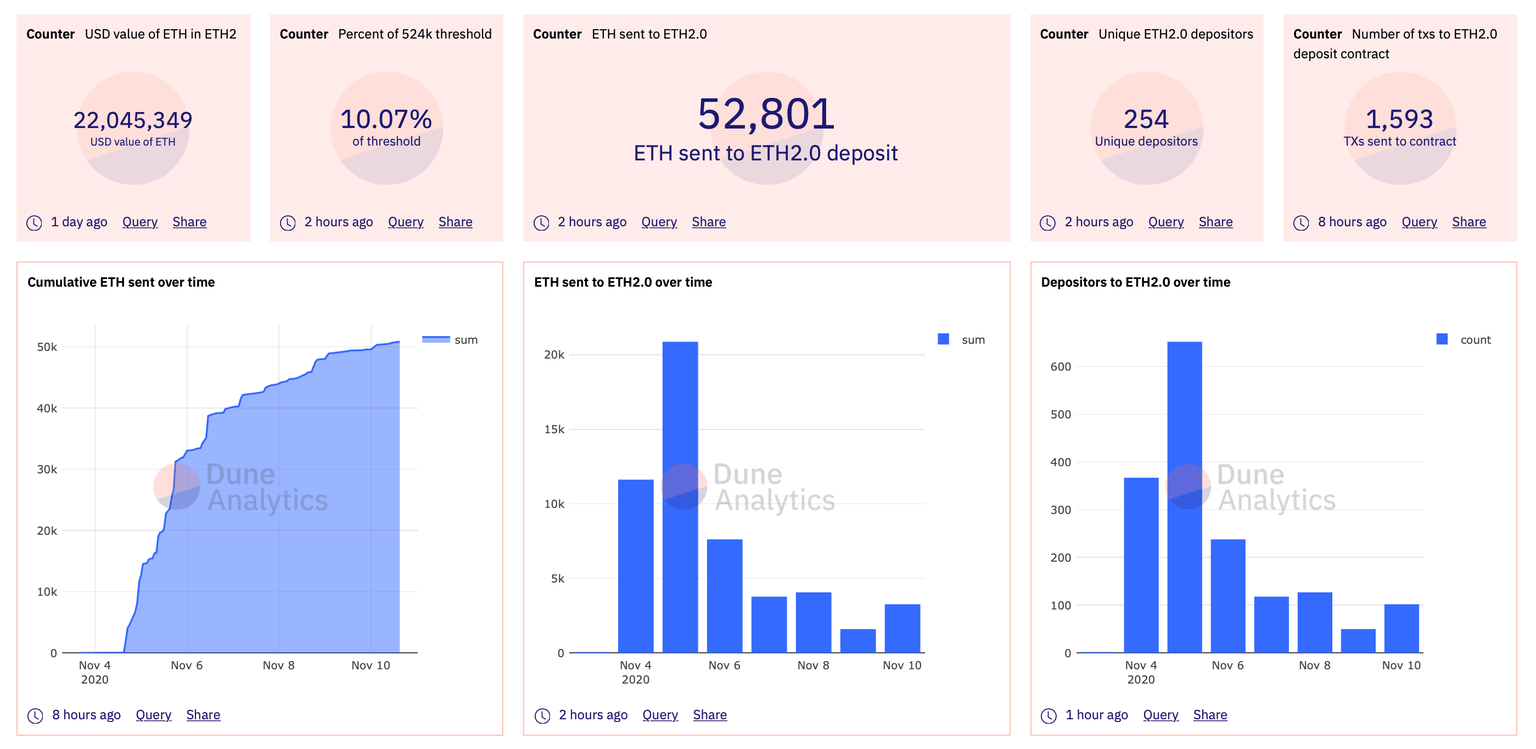

Data from Dune Analytics reveals that 52,801E TH have been sent to the Ethereum 2.0 deposit contract over the past few days. This amounts to 10% of the 524,000 tokens threshold needed to launch the upgrade into mainnet. As core developers continue to lock up their coins in the contract they are incentivized for a quick launch, which could positively affect prices.

Ethereum 2.0 Network Statistics

Ethereum turns bullish as speculation around ETH 2.0 mounts

To push for scalability on the Ethereum network, the need for ETH 2.0 has gained a lot of attention from the crypto community. Market participants seem to believe that the upgrade may have a bullish effect on the smart contract token as it further pushes its buying pressure to meet up with the 500,000 ETH threshold.

This milestone is important to ETH 2.0 as the launch had been divided into four phases, with the first being phase 0. This part of the network upgrade is meant to facilitate the transition of the Ethereum protocol into Proof-of-Stake.

Taking a look at the ETH/USD chart on a weekly timeframe, we can see the formation of a double bottom pattern which has been confirmed by the breakout from the $364 support zone, with possible resistance at the $800 mark towards the end of the year. This bullish reversal pattern and the build-up of trading volume indicates that a major bullish trend could be close.

ETH/USD Daily chart

On the one hand, it might appear that there has been a decline in the number of ETH 2.0 deposits as shown by CryptoQuant. A Twitter poll reveals that one of the main reasons behind the sudden decline is that market participants are "just not interested" in having their tokens held until phase 1 launches.

ETH 2.0 Deposits

Despite the lack of interest from the Ethereum community to contribute to the development of ETH 2.0, core developers seem committed. Vitalik Buterin, the cryptocurrency’s co-founder, sent 3,200 ETH to the deposit contract address, worth over $1.4 million. Such interest to make sure that the upgrade is delivered in a timely manner will likely play a key role in Ether’s price action over time while speculation continues rising.

Author

FXStreet Team

FXStreet

-637406500720285290.png&w=1536&q=95)

-637406502507549337.png&w=1536&q=95)