Ethereum Price Forecast: Whales go into buying frenzy in preparation for ETH 2.0 – Confluence Detector

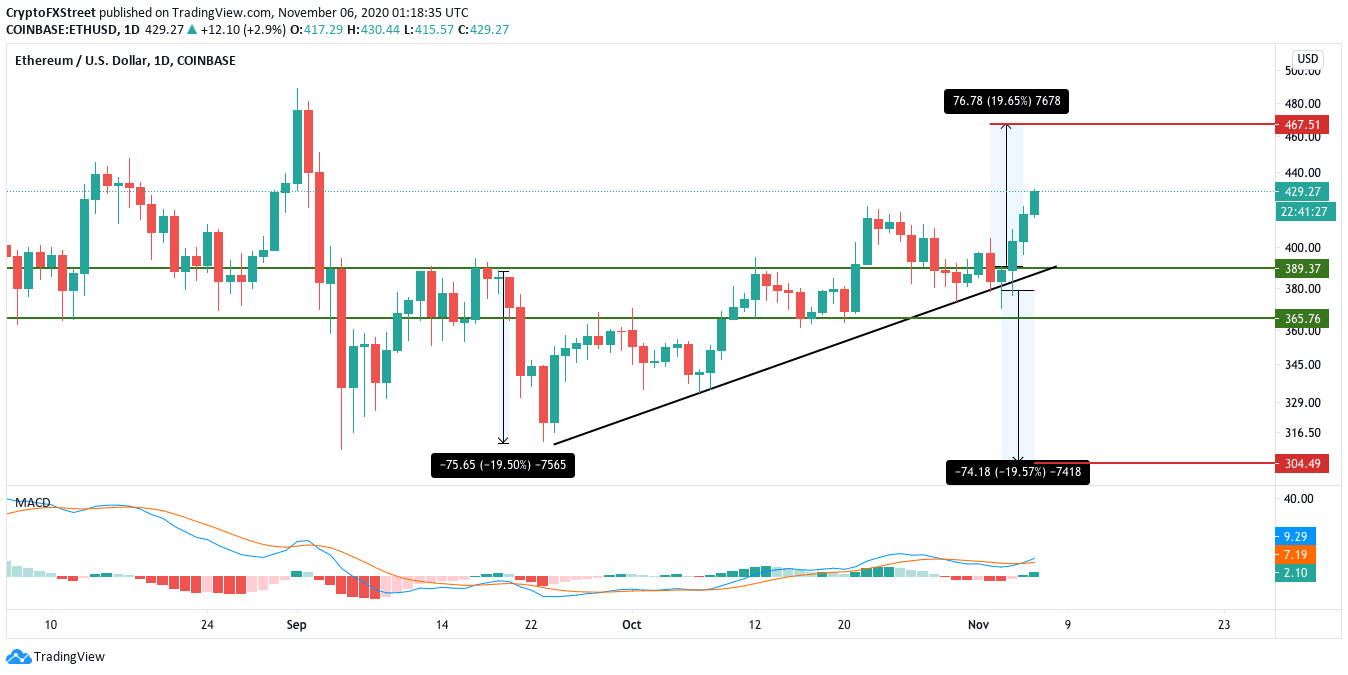

- Ethereum has broken above from the ascending triangle formation in the 1-day chart.

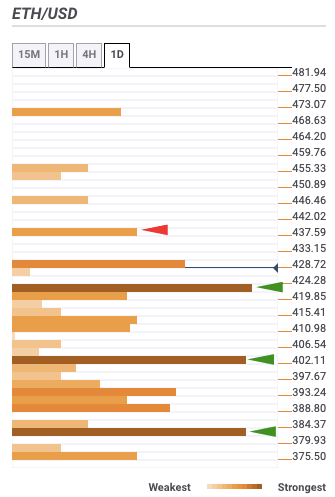

- The daily confluence detector shows a lack of strong resistance barriers on the upside.

After dropping sharply from $475 to $320.25 between September 2 and September 23, Ethereum has been climbing steadily upward in an ascending triangle formation. Several technicals show that the buyers will remain in control and help the smart contract platform reach the $475-level as determined by the ascending triangle.

Ethereum goes up, up and away

This Wednesday, November 4, the price managed to break above the triangle and is currently heavily bullish. Over the last three days, the price has flown up from $387 to $441. As per technical analysis, the price target for Ethereum, based on the triangle formation, is $475.

ETH/USD daily chart

The daily confluence detector is a handy tool that helps us visualize strong resistance and support levels. ETH is currently sitting just below the $442 resistance barrier. Upon conquering this level, the price should easily reach $475. If the buyers remain in control, there will be no stopping Ethereum from reaching the $500 zone.

Ethereum daily confluence detector

Adding further credence to this optimistic outlook is the way the whales have been behaving. Since October 12, the number of addresses with 1,000 to 10,000 ETH rose by 3.3%. Roughly 208 whales have joined the network since then. The spike in buying pressure has directly contributed to the rise in price.

Ethereum holders distribution

This bullish outlook holds if the price remains on its current trajectory. If the sellers somehow manage to take control, they will face a robust support wall at $422. Along with this, there are two more strong support walls at $405 and $380, which should absorb any residual selling pressure.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

%20%5B07.06.33%2C%2006%20Nov%2C%202020%5D-637402266735859826.png&w=1536&q=95)