Ethereum turns five but ETH price Vs. Bitcoin never recovered since 2018

The Ethereum network is turning five years old, but ETH price performance versus Bitcoin leaves something to be desired.

Ethereum is five years old and Ether (ETH) has surprised investors with a trip above $300 — but compared to Bitcoin (BTC), the biggest altcoin is underperforming.

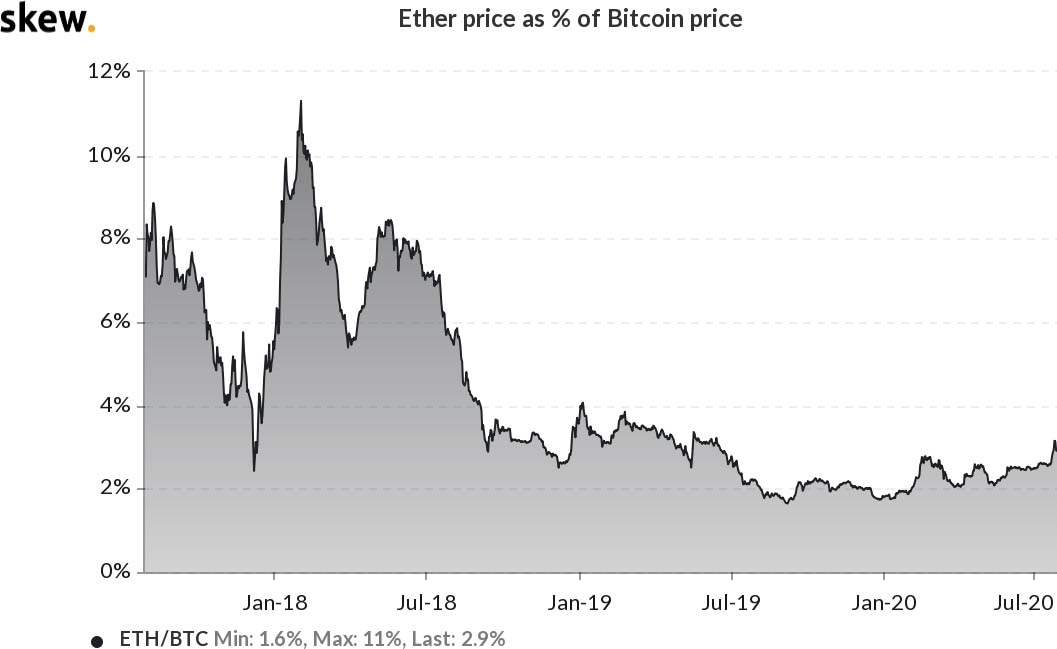

As data from on-chain monitoring resource Skew confirms, ETH/USD as a percentage of BTC/USD remains far below its all-time highs.

Ether stays far from Bitcoin price share highs

As of Ethereum’s birthday, Ether’s share stood at 3.1% of the BTC price. At its peak in January 2018, the figure was 11%.

Since the altcoin boom over two years ago, Ether has failed to reclaim much of its lost ground as Bitcoin took over the broader cryptocurrency market cap.

As developers pushed ahead with Ethereum’s transformation to Ethereum 2.0, only recently has ETH/USD begun rewarding patient bagholders.

The past week alone has seen price gains of 45%, beating Bitcoin’s performance as previous resistance at $285 fell away. At press time, ETH/USD traded at $325, fuelled by the DeFi token phenomenon and associated trading boom.

“Just tested former resistance as support to the sat,” popular analyst Scott Melker confirmed on Tuesday.

Ether price as a percentage of Bitcoin price 3-year chart. Source: Skew

Lukewarm birthday wishes

Nonetheless, not everyone was convinced.

“ETH/BTC stops dumping for a change and ETH maxis go full blown manic,” Blockstream developer Grubles wrote on Twitter on Sunday.

“Just recently ETH/BTC was at Coinbase-listing levels from nearly 5 years ago.”

Meanwhile, the past weeks have seen significant changes in realized correlation between the two cryptocurrencies, with the 1-month measure showing particular divergence from the norm.

ETH/BTC realized correlation comparison. Source: Skew

Cointelegraph has published a dedicated retrospective to celebrate Ethereum’s fifth anniversary, taking a look at the project’s ups and downs since 2015.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.