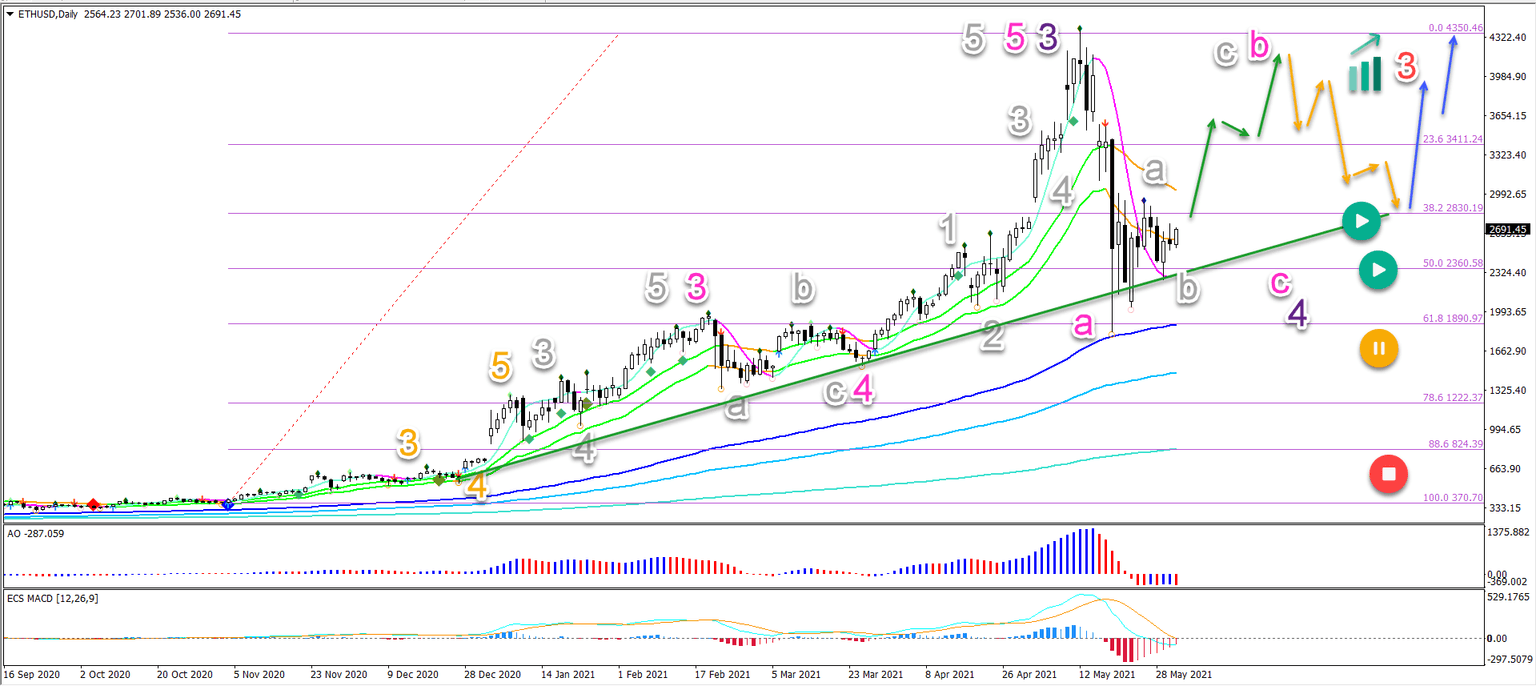

Ethereum testing 23.6% and 38.2% Fibonacci support of wave 4

Ethereum (ETH/USD) is showing strong bullish momentum as mentioned last time. The angle of the uptrend has only accelerated recently (blue arrows).

However, yesterday’s daily candlestick closed as a Doji which indicates indecision. Is this a first sign of a reversal? Let’s review.

Price charts and technical analysis

The ETH/USD uptrend seems too strong for a reversal to take place now:

-

The gaps between the moving averages (MAs), the angle of the MAs, and the gap between price and the 21 EMAs all indicate a strong uptrend.

-

The Doji daily candlestick indicates indecision and it is more likely to create a potential sideways pullback (grey arrow) or retracement (orange arrow) in the uptrend.

-

The support zone (blue box) is likely a bouncing spot (blue box) for more upside (green arrows).

-

Only a deeper retracement places the bullish outlook on hold (orange) or invalidates it (red circle).

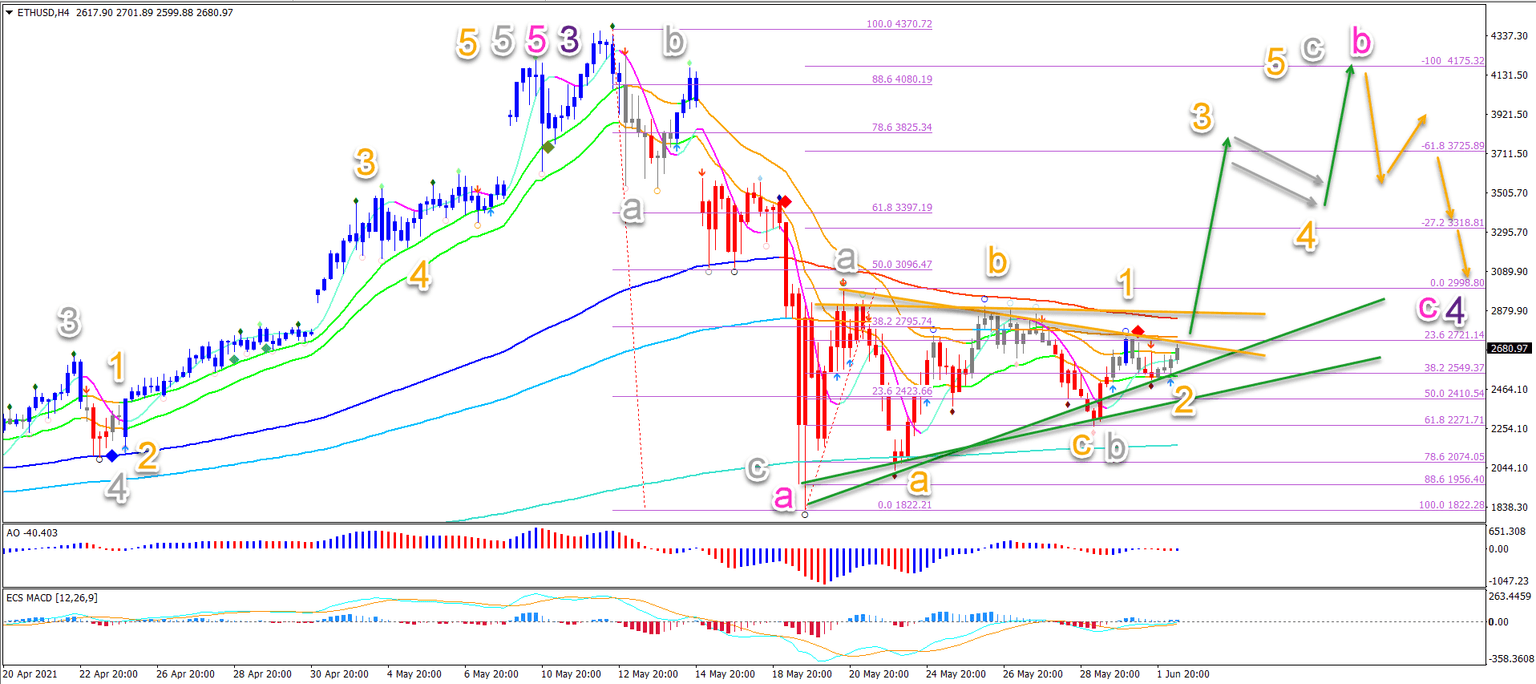

On the 4 hour chart, price action made a bearish pullback to and bounce at the 23.6% Fibonacci retracement level:

-

After completing a 5 wave pattern (blue) in wave 3 (orange), price action is probably building a wave 4 pullback (orange).

-

The 23.6% and 38.2% Fibonacci retracement levels remain key for the potential wave 4 (orange) pattern.

-

A bull flag pattern (grey arrows) could indicate a shallow pullback and uptrend continuation (blue arrow).

-

A deeper pullback (orange arrows) will probably test the Fibonacci support levels.

-

The targets of the uptrend are located at $4750, $5000, $5500.

-

A break below the 50% Fib places the uptrend on hold (yellow button) whereas a deeper retracement invalidates it (red button).

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.