Ethereum price surges to record high ahead of Berlin upgrade and Coinbase direct listing

- Ethereum recorded yet another record high, reaching $2,340.

- An analyst suggested that Ether price could surge by another 500%, given Ethereum’s fundamentals.

- Berlin upgrade and Coinbase direct listing could also positively impact Ethereum price.

Ahead of Ethereum’s Berlin upgrade and the Coinbase direct listing, Ether is up by over 8% in the past week and has made a new all-time high at $2,340.

Ethereum price to surge by another 500%

With the rise of non-fungible tokens (NFTs) and decentralized finance (DeFi) over the past year, Ethereum has benefitted from being one of the most used blockchain networks in the crypto industry.

Although the Ethereum network does have some drawbacks, including high transaction fees, Ether’s price has more than doubled since the start of the year.

Former hedge fund manager and crypto analyst Teeka Tiwari recently claimed that Ethereum is currently extremely undervalued. ETH price could surge by another 500%, taking its price to the five-digit territory.

Tiwari further believes that Ethereum could surpass the value of Microsoft, Apple, Google and Facebook combined over the next decade. According to Tiwari, DeFi and decentralized apps (Dapps) will make Ethereum the most valuable software platform in history.

The analyst added that he is not the only believer in the future in Ethereum, as SkyBridge Capital CEO Anthony Scaramucci highlighted Ethereum’s fundamentals, saying that it is going to make it a “sticky cryptocurrency and a store of value, and something people will transact with.”

Tiwari suggested that Ethereum is currently “wildly undervalued” and that the cryptocurrency will go “much, much higher.”

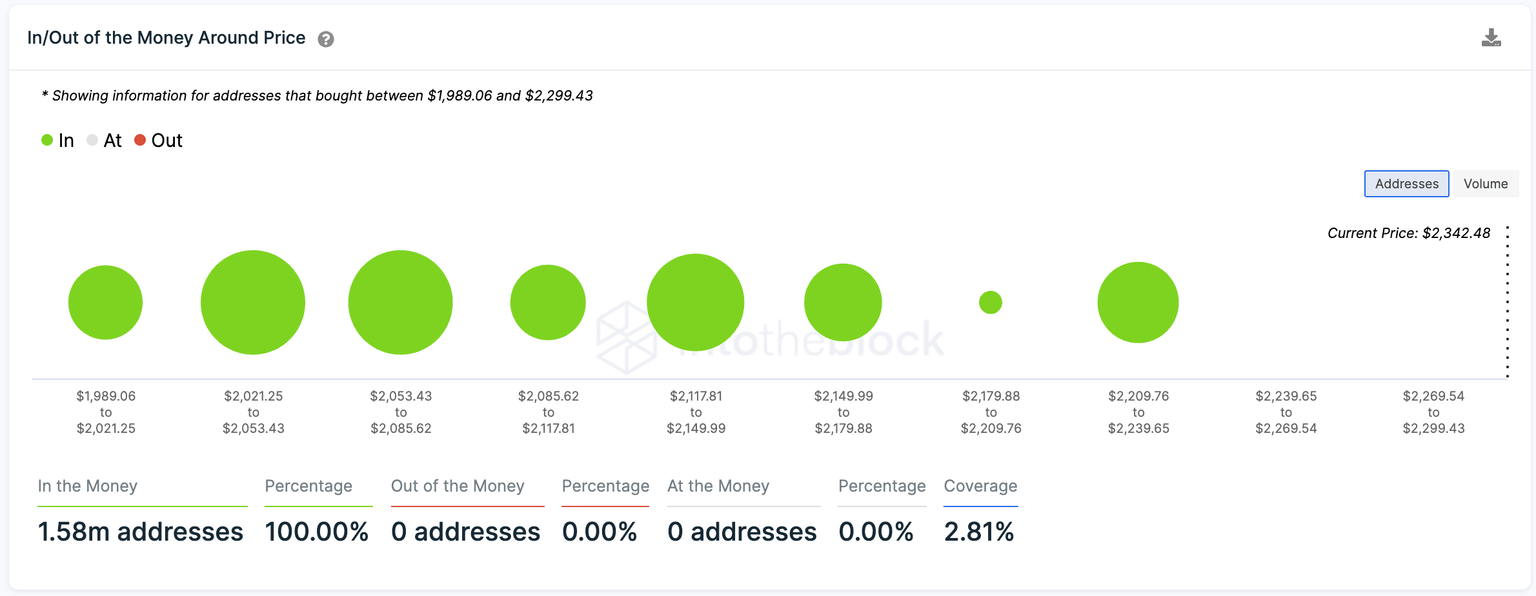

The IntoTheBlock In/Out of the Money Around Price (IOMAP) data shows that Ethereum has virtually no resistance ahead, having made a record high. An interesting level to watch is between $2,209 to $2,239, which could hold massive support for the cryptocurrency. If a correction occurs and this level is lost, the next support could be found at $2,149 to $2,179.

Ethereum IOMAP data

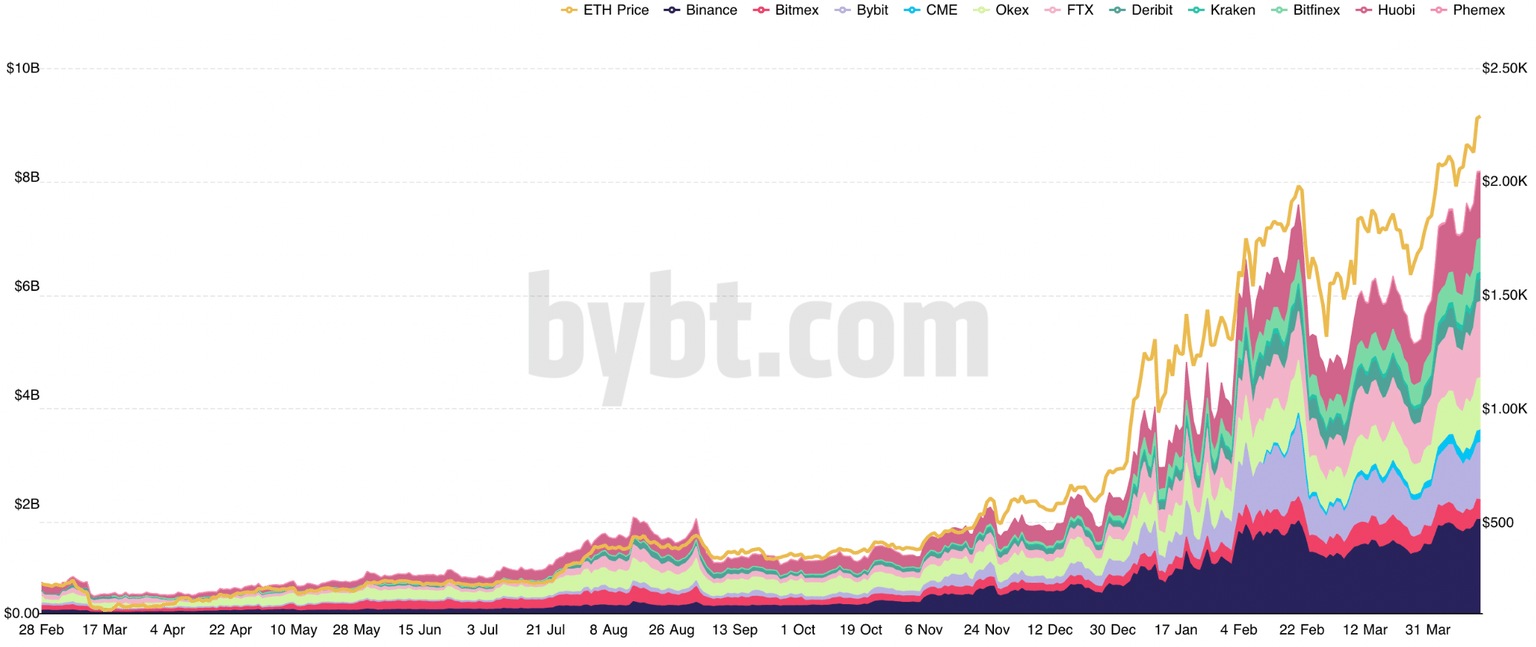

Ethereum’s price surge has caused Ether’s open interest to reach a new record high of $8 billion, which is roughly 50% of Bitcoin’s figure in February this year.

Ether futures open interest

The current futures open interest surge reflects that markets allow even more prominent players to participate in derivatives trading. This also reflects CME Ethereum futures contracts, which was a significant milestone for Ether.

With an increase of institutions entering the crypto market, Ethereum price could still have massive room for growth.

Ether to be more scarce than Bitcoin

While the DeFi and NFT industries continue to grow, Ethereum faces high transaction fees and lagging transaction times. The Berlin hard fork, expected on April 14, is expected to pave the way for other upgrades in the future, including London. The upgrade is a step closer to Ethereum 2.0, where the network will be using the proof-of-stake consensus mechanism.

Gas prices were at all-time highs as the network faced increased demand, while ETH price also steadily increased.

The Berlin upgrade will provide some solutions to Ethereum’s high transaction costs, although congestion on the network would still likely remain until scalability is improved.

The crypto market is expected to benefit from another huge bullish driver in the market – Coinbase’s direct listing – which will occur on April 14 as well.

Coinbase’s direct listing is expected to be a “watershed” moment for the cryptocurrency industry, as other entities in the sector could follow the footsteps of the major exchange in the future. CEO of Token Metrics, Ian Balina, commented:

Ether is surging because it is relatively undervalued compared to Bitcoin. Factoring in Coinbase’s $100 billion [valuation] that will bring users to the crypto space, and Ethereum being the only other crypto asset with CME futures contracts for institutions, one can see why Ethereum is surging.

Following the Berlin upgrade, the London upgrade expected in July could make Ether deflationary and more scarce than Bitcoin, especially after introducing the crypto’s ability to be burned after transactions, said Balina.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.