Ethereum price risks retesting $4,000 as crypto markets tumble

- Ethereum price managed to slip past the previous highs and set up a new one at $4,875.

- This upswing was met with a minor market crash that pushed ETH as low as $4,457.

- A persistent downswing could knock ETH down to retest the $4,000 level.

Ethereum price has been on a steady uptrend since September 30 but might face the threat of a sharp correction if it fails to hold above crucial barriers.

Ethereum price fumbles

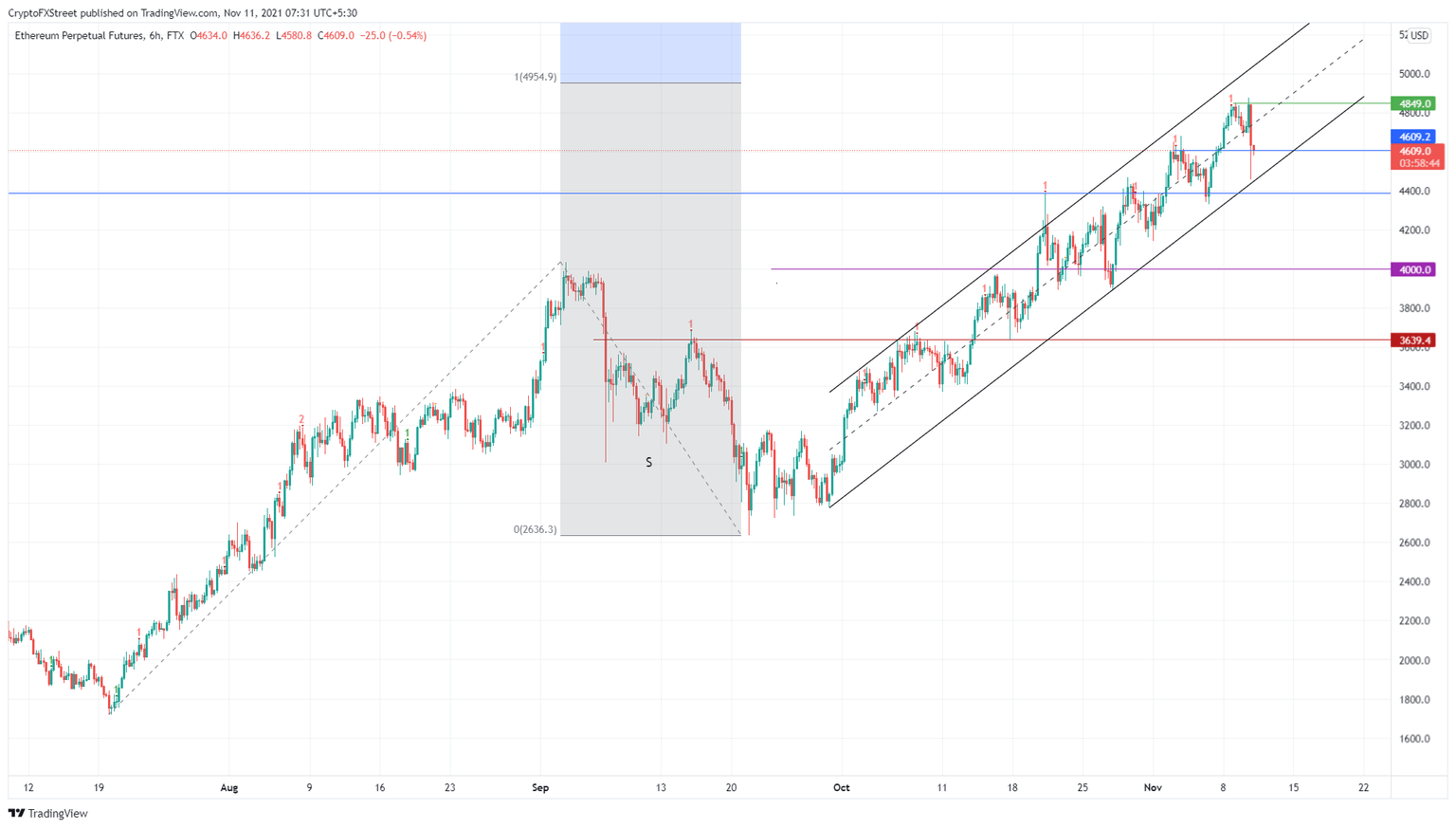

Ethereum price rose 75% from September 30 to set up a new all-time high at $4,849. This move set up seven higher highs and four distinctive higher lows. Connecting these swing points reveals ETH is traversing an ascending parallel channel.

From November 6 to November 9, ETH rose 12% to set up a new high but was immediately followed by another upswing that set a record high at $4,875. This move was followed by an immediate 8.6% flash crash that retested the lower trend line of the channel but has currently stabilized above the $4,609 support floor.

Since this technical formation forecasts a bearish outlook, a daily close below $4,387 will confirm the start of a downtrend. In such a situation, ETH could revisit the $4,000 psychological level after a 13% pullback.

ETH/USDT 6-hour chart

On the other hand, the current pullback will allow the sidelined buyers to step in. Therefore, if the ETH price continues to recover and undoes the losses, it should clear the current all-time high and make a run for the 100% trend-based Fibonacci extension level at $4,954 or the $5,000 psychological level.

This move would invalidate the bearish thesis for Ethereum price and trigger an upswing.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.