Ethereum price rally isn’t over yet as ETH bulls keep tight support

- Ethereum price has been on a tear with new all-time highs on Monday.

- Although some profit-taking is happening, buyers are defending tight support on the downside.

- The additional media attention on the Ethereum price rally adds a tailwind that should propel price into a break above $5,000.

Ethereum (ETH) has been on a steep rally since the beginning of October, holding 80% of profits already – and it does not look that price action in ETH will stop anytime soon. Fresh buyers are adding to the rally with additional media attention and current tailwinds in cryptocurrencies. ETH price action reveals that although a few indicators point to overbought, bulls are keeping to a tight short window for profit-taking before Ethereum price rockets off to new all-time highs.

Ethereum price has plenty of room to go for new all-time highs

Ethereum price has already given early adopters of the cryptocurrency some solid returns, with a rally of 80% since October. And it does not look that the rally will stop any time soon as fresh volume is added, thanks to the broad media attention supporting its uptrend. Some caution needs to be taken, however, as the Relative Strength Index (RSI) is flirting with the 70 barrier, putting ETH price in the oversold zone.

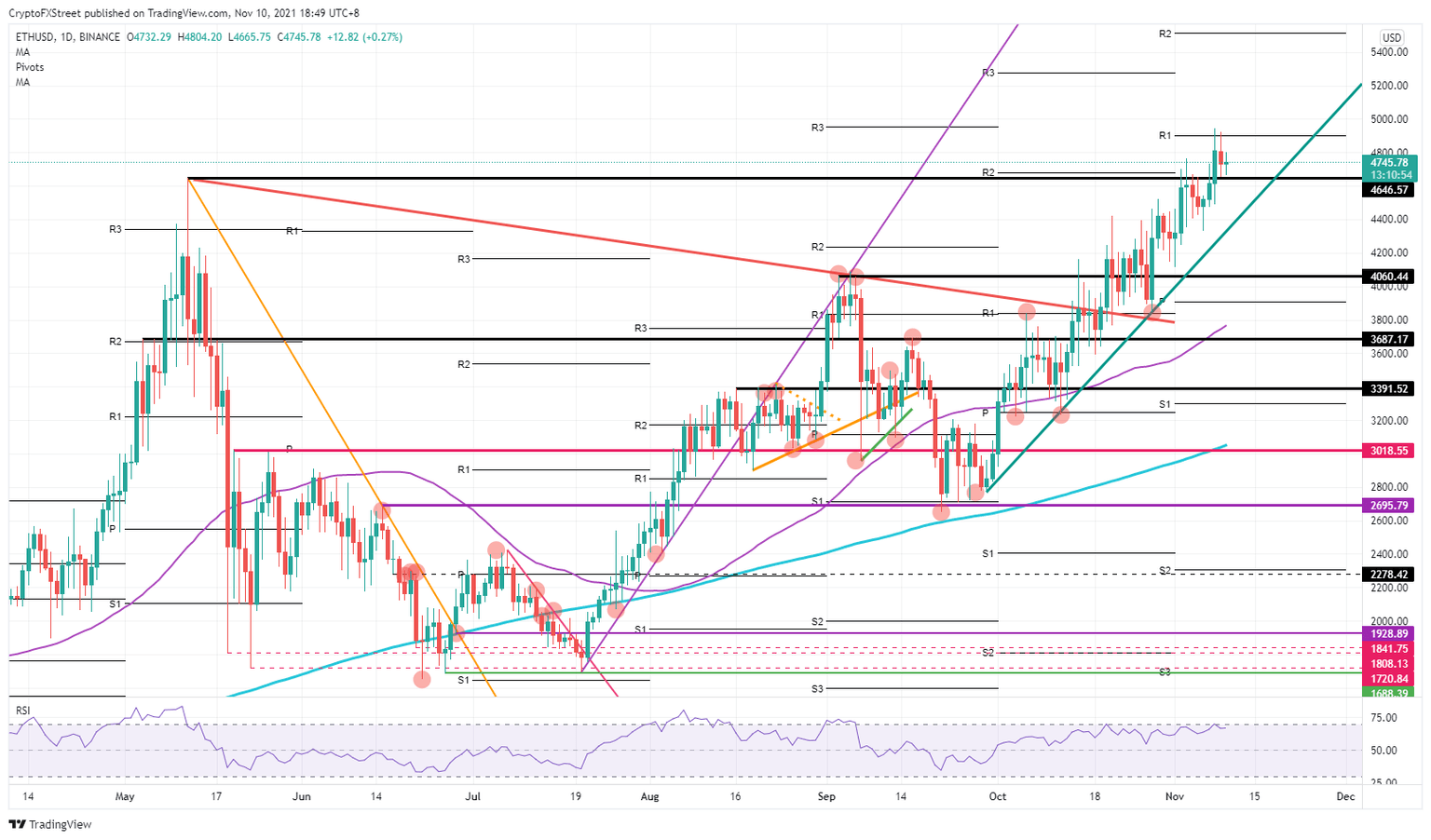

ETH price is still finding very tight support at $4,646.57, which was the high of May 12. On Tuesday, bears tried to break below that level again, but bulls stood their ground. Although Ethereum price looks to be consolidating a bit, as long as bulls keep buying at $4,646.57, expect ETH price to bounce off that level and break above the monthly R1 at $4,901 and try to hit $5,000.

ETH/USD daily chart

Should bulls start to back off and ETH price starts to fade in the wake of $5,000, expect a break below $4,646.57, but the next support level below is not that far away, at around $4,400 from the green ascending trend line that represents the backbone of this rally. That ascending trend line has already held two substantial tests and has seen heavy buying when ETH price was trading in its vicinity. Should there still be a break of that trend line, expect $4,060 to give some support in the near-term and for bulls to reassess the situation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.