Ethereum Price Prediction: Why ETH/USD advance $200 seems imminent

- Ethereum price steps above $180 following a breakout on Friday.

- ETH/USD technical levels signal that price action to $200 is still in the picture during the weekend session.

The weekend session is bullish across the cryptoccurrency market. Ethereum is at the helm of this bullish action following the breakout on Friday. The price action extended the bullish leg above two critical levels; $170 and $180. At the time of writing, Ether is doddering at $182 following a 7% rise on the day.

ETH/USD 4-hour chart

Looking back, Ethereum has been able to contain gains from the crash that occurred on March 12 within an ascending channel. The channel support has been very instrumental to price growth in the last four weeks. However, the frequent up and down movements cannot be ignored. On the upside, the channel resistance continues to hinder growth.

Meanwhile, Ethereum has bounced off the channel support and is on its way towards $200. Buyers are trying to defend a higher support at $180 so that the focus can stay on $200. Technical levels from the RSI and the MACD shows that bulls are strongly in control. However, the oversold RSI suggests that traders should be on the lookout for a possible retreat below $180.

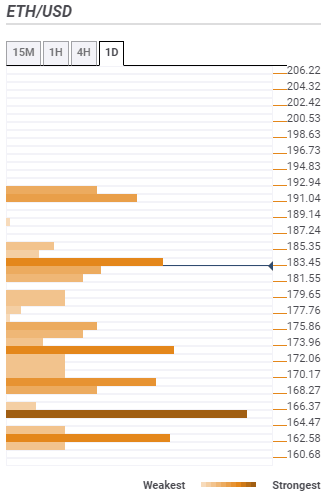

Ethereum resistance and support

Resistance one: $185.35 – Highlighted by the previous high 1-hour and the previous high 4-hour.

Resistance two: $191.04 – Highlighted by the 61.8% one-month.

Support one: $175 – Home to the previous high one-day and SMA five 4-hour.

Support two: $173 – Hosts the previous low 4-hour, the Bollinger Band 15-mins lower curve, SMA 200 one-day, and the SMA 1-hour.

Support three: $166.37 – This is the strongest support area as highlighted by the Fibo 38.2% one-week curve and the pivot one-day support two.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren