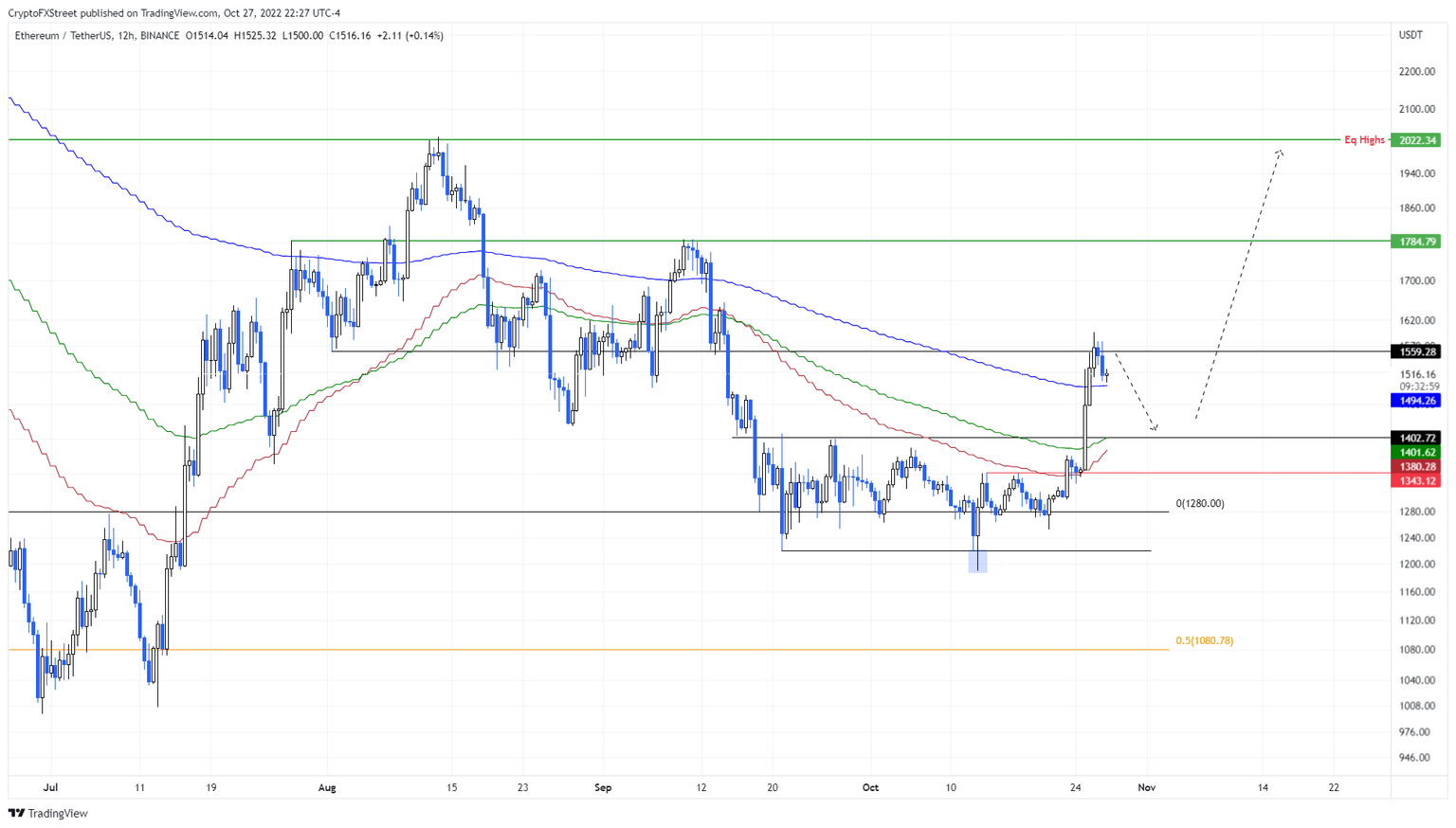

Ethereum Price Prediction: ETH to provide accumulation opportunity before revisiting $2,000

- Ethereum price could experience a swift selloff on the breakdown of the 100-day EMA at $1,494.

- Sidelined buyers can accumulate ETH around $1,400 before the next leg propels the altcoin to $2,000.

- A daily candlestick close below the $1,343 support level will invalidate the bullish thesis for the smart contract token.

Ethereum price action depicts exhausted bulls after an explosive move over the last five days. This upswing is currently facing a significant hurdle and is likely to retrace to stable support levels to refuel. The resulting rally could propel ETH to critical psychological levels.

Ethereum price ready for a new challenge

Ethereum price showed incredible resilience around the $1,280 support level, which led to tight consolidation and sideways movement. The breakout, however, was equally impressive as ETH surged by 25% in under five days and set up a local top at $1,594.

While many investors were blindsided by this sudden explosion, it was an obvious move, as noted in our previous article. As we advance, ETH could pull back to the 100-day Exponential Moving Average (EMA) at $1,494 as investors book profits.

A breakdown of this level will open the path to retesting the $1,400 support level that coincides with the 50-day EMA. Accumulating around this level would be an ideal scenario for the next leg that could propel Ethereum price to $1,784.

Depending on the market conditions and the bullish momentum, Ethereum price could flip this hurdle and aim for the $2,000 psychological level. In total, this move would constitute a 44% gain for investors and is likely where the upside is capped for ETH.

ETHUSDT 1-day chart

While things are looking up for Ethereum price, the $1,400 support level is crucial and has to be defended at all costs. A breakdown of the said barrier could indicate two things - investors are unsure and are booking profits, and/or the sellers are overwhelming the buying pressure.

Either way, a daily candlestick close below the $1,343 support level will invalidate the bullish thesis for ETH. Such a development will likely trigger a further spike in selling pressure and knock Ethereum price to revisit the $1,280 foothold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.