Ethereum Price Prediction: ETH targets $3,000 amid renewed bullish momentum

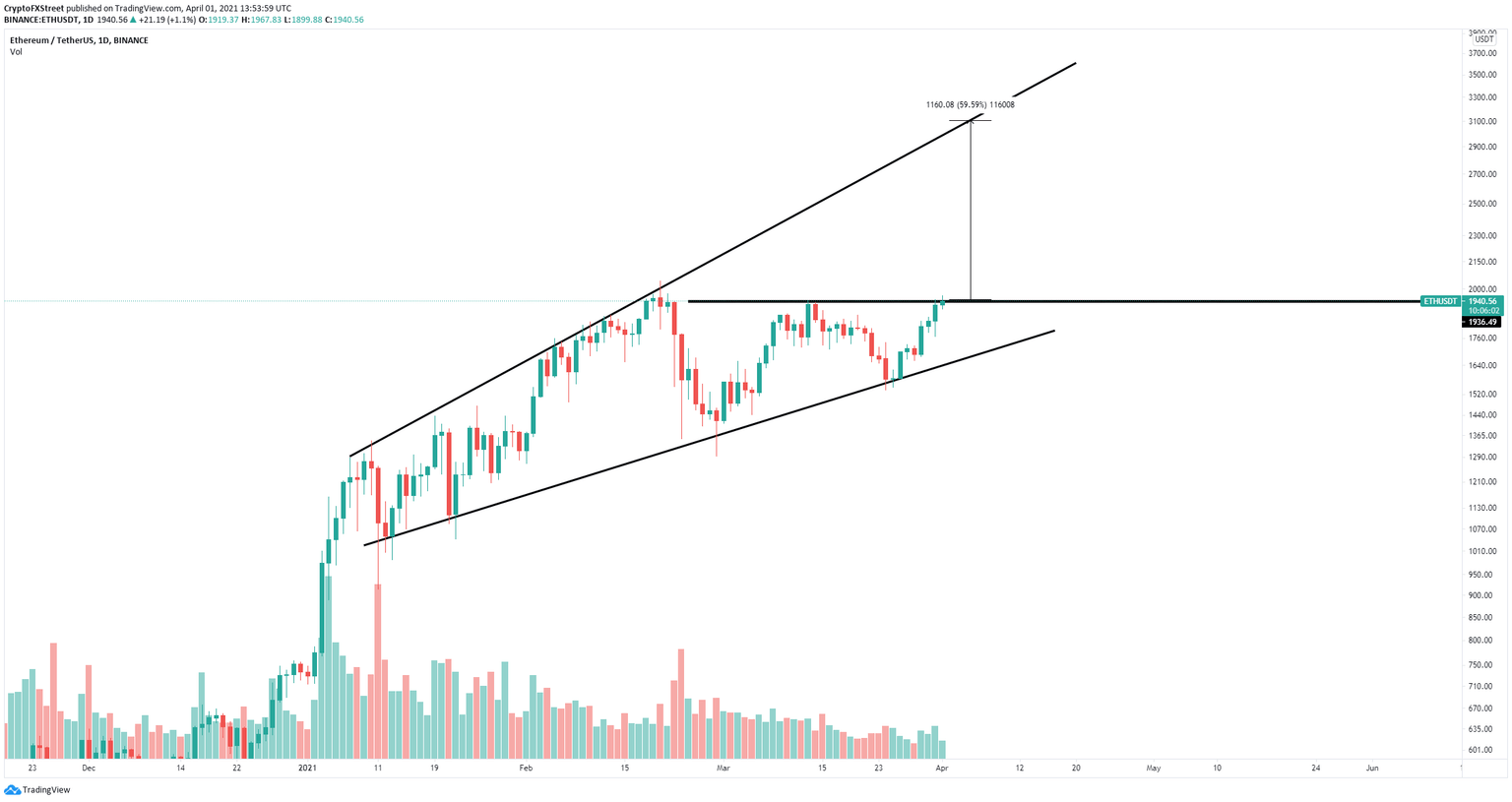

- Ethereum price remains contained inside an ascending broadening wedge pattern.

- The digital asset has experienced a significant shift in momentum in the past week in favor of the bulls.

- The number of ETH coins locked away from exchanges exceeds 13 million.

Ethereum price is only one key resistance level away from a potential jump towards $3,000. On-chain metrics have strengthened significantly in the past month and the trend seems to be changing in favor of the bulls.

Ethereum price on the verge of a massive 60% breakout

On the daily chart, Ethereum has established a broadening wedge pattern. After defending the lower trendline on March 26, ETH is poised for a breakout towards the upper boundary of the pattern at $3,100.

ETH/USD daily chart

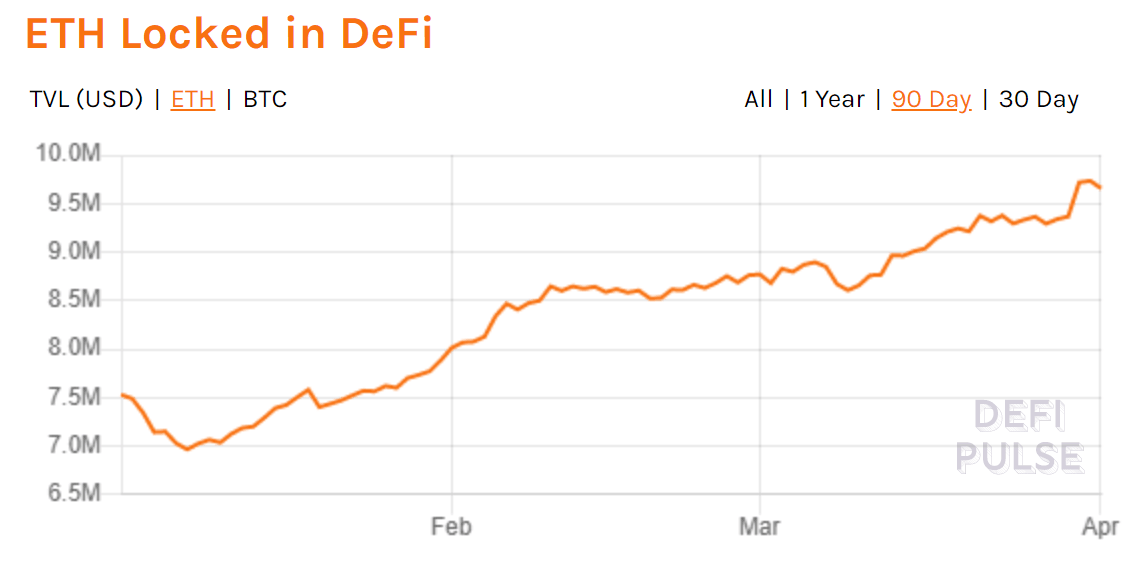

There is a critical resistance level at $1,933 that needs to be cracked first. However, on-chain metrics give the bulls the upper hand. The ETH2 deposit contract holds more than 3.62 million ETH inside, worth about $7 billion at current prices. Additionally, there are 9.65 million ETH locked in DeFi, which means that around 13.27 ETH coins are locked away from exchanges, worth $25 billion.

ETH locked in Defi

However, a rejection from the key resistance level at $1,933 will lead Ethereum price down to the lower boundary of the pattern at $1,700.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.