Ethereum Price Prediction: ETH sets sights on $3,800

- Ethereum price is primed for a 15% climb after ETH consolidates within the price range.

- A slice above the upper boundary of the governing technical pattern could put $3,800 on the radar.

- Should Ethereum price witness its uptrend retreat, there appears to be ample support for ETH above $3,000.

Ethereum price is ready for a 15% bounce as ETH continues to set higher highs and higher lows. The bulls are aiming for a rally toward $3,800 next should it be able to conquer a critical level of resistance.

Ethereum price prepares for 15% upswing

Ethereum price has formed an ascending parallel channel on the 4-hour chart as ETH continues to trend closer to the upper boundary of the chart pattern.

A break above the topside trend line of the governing technical pattern could work in favor of the bulls, opening up the possibility of a rally of 15%.

The first resistance is at $3,352, the 61.8% Fibonacci extension level, then the $3,404, the upper boundary of the parallel channel. Should ETH manage to be able to slice above this level, the measured target of the potential ascent is 11%, reaching $3,800, reaching the 78.6% Fibonacci extension level.

ETH/USDT 4-hour chart

Adding credence to this bullish thesis is the Relative Strength Index (RSI), which suggests that Ethereum price is still not overbought, even as ETH has recorded its August high and could be primed for a higher target.

The first line of defense for Ethereum price is at the middle boundary of the parallel channel, coinciding with the 20 four-hour Simple Moving Average (SMA) at $3,180, then the 50 four-hour SMA at $3,091.

A spike in selling pressure could see Ethereum price drop to retest the lower boundary of the governing technical pattern at $3,037, corresponding to the 50% Fibonacci extension level.

Should Ethereum price witness a trend reversal and invalidate the bullish outlook, ETH could tag the upper boundary of the demand barrier, which starts at $2,850 and extends to $2,722, the 38.2% Fibonacci extension level.

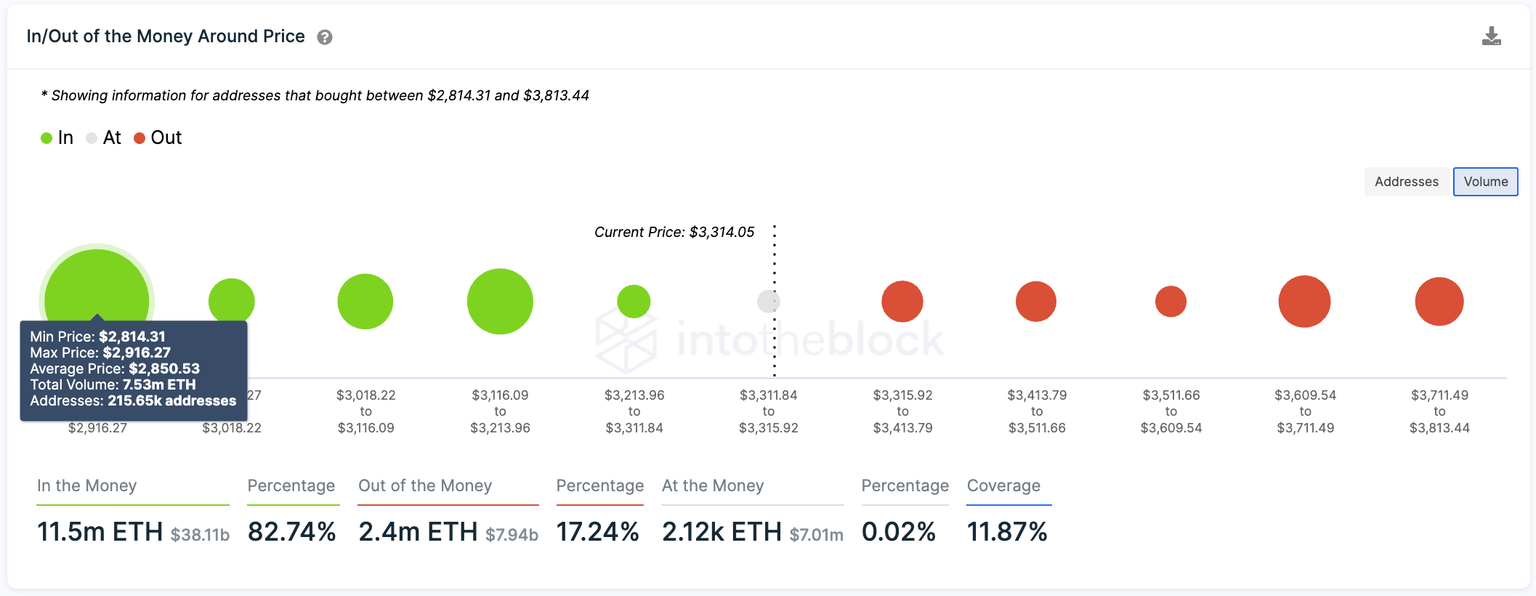

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric reveals that the largest cluster In the Money, 215,650 addresses purchased 7.53 million ETH, acts as meaningful support for Ethereum price.

ETH IOMAP

However, the IOMAP suggests that Ethereum price will find sufficient support at $3,177, where 562,140 addresses bought 2.1 million ETH.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.