Ethereum Price Prediction: ETH bulls need to tackle $1,700 before eyeing $2,000

- ETH/USD picks up bids near intraday high, extends Sunday’s bounce off one-month low.

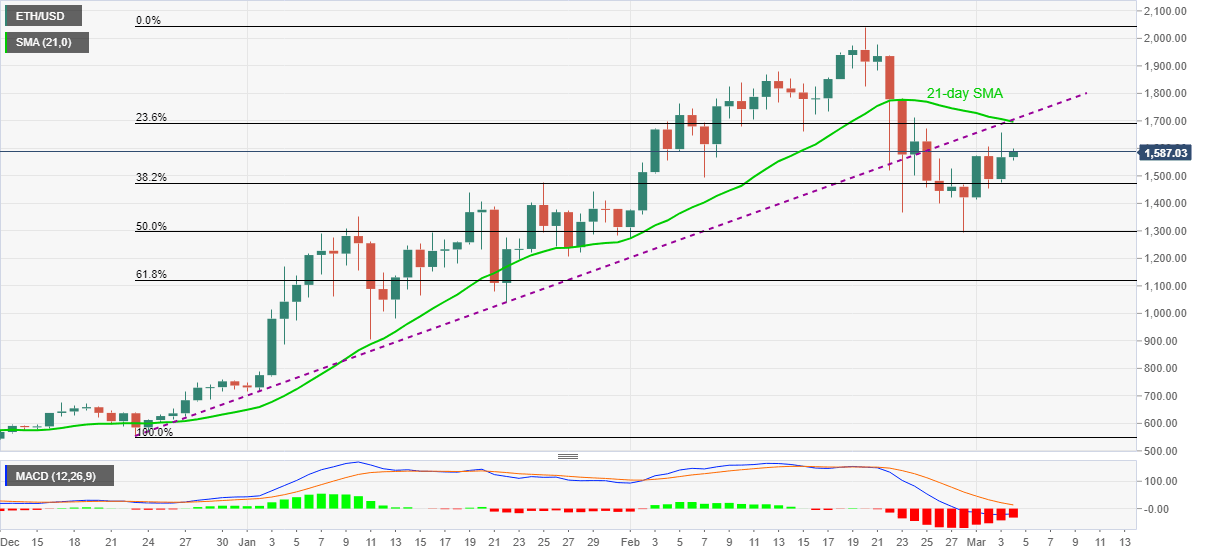

- 21-day SMA, previous support line from late-December and 23.6% Fibonacci retracement guard immediate upside.

- Bears will have a bumpy road on their return.

Ethereum bulls are in full swing while attacking the $1,600 level, currently up 1.77% intraday near $1,595, amid initial Thursday. In doing so, the altcoin extends recovery moves from a one-month low, marked on Sunday.

Also favoring the ETH/USD bulls could be the receding bearish bias shown by the MACD as well as sustained trading beyond key Fibonacci retracement levels of late-December 2020 to February 20, 2021, upside.

However, a convergence of 21-day SMA, a 10-week-old previous support line and 23.6% Fibonacci retracement will test the bulls around $1,700 before giving them a go to the $2,000 threshold.

If at all the ETH/USD fades upside momentum below $1,700, it risks declining back to 50% Fibonacci retracement level of $1,300 and then to the $1,120 level comprising 61.8% of Fibonacci retracement.

Also acting as a downside filter is the mid-January low near $980 and the $1,000 psychological magnet.

Overall, Ethereum bulls are rolling their sleeves for a fresh record high but need to validate their strength.

ETH/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.