Ethereum Price Prediction: ETH bulls lack conviction, but have one more chance at comeback

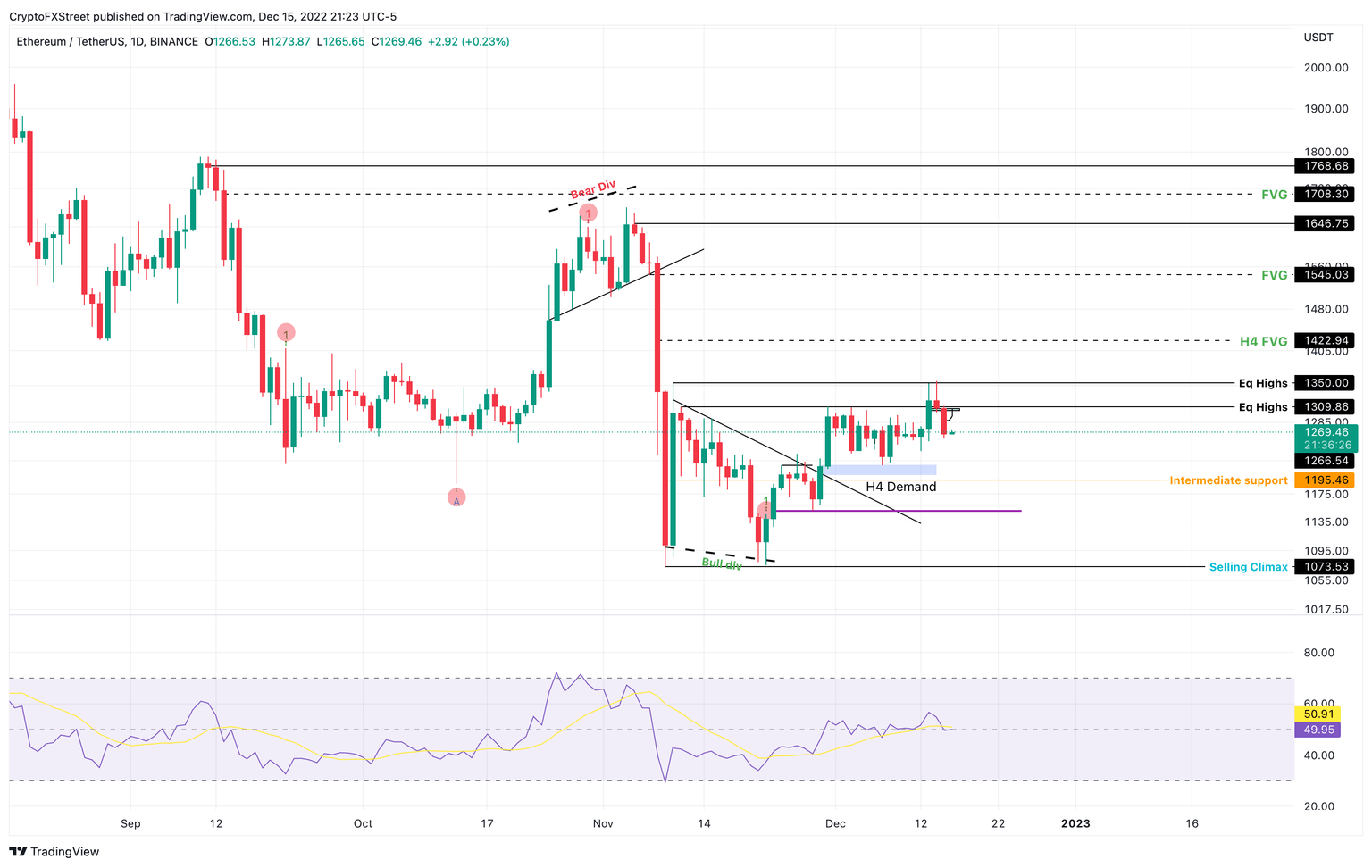

- Ethereum price shows a rejection at the $1,350 hurdle after setting up three equal highs.

- ETH could retrace to the $1,195 support level to replenish momentum before giving the uptrend another go.

- A daily candlestick close below $1,150 will invalidate the bullish thesis.

Ethereum price shows a lack of momentum after the recent volatile events. The run-up pushed ETH to produce another swing high. Rejection at this level has triggered a sell-off that could continue and knock the smart contract token down to critical support levels.

Ethereum price fails to make hay

Ethereum price shot up by 8.8% between 12 and December 14, and set up three equal highs at $1,350. This move showed a lack of momentum from the bulls, resulting in a sudden reversal. As a result, ETH shed 8.4% and is currently hovering around $1,270.

The only solace after undoing recent gains is that the Relative Strength Index (RSI) is bouncing off the midpoint at 50. So, a bounce in RSI here could provide buyers have a chance to make a comeback should they plan to. In such a case, Ethereum price needs to flip the $1,350 hurdle into a support floor to confirm a resurgence of buying pressure.

This development could see Ethereum price retest the $1,422 and $1,545 hurdles.

While the above scenario is a bit of a stretch, the ideal scenario would include a retracement to the $1,195 support level first.

ETH/USDT 1-day chart

On the other hand, if Ethereum price shatters through the $1,195 support level, it will be the first sign of weakness. A continued spike in selling pressure followed by a daily candlestick close below $1,150 will create a lower low and invalidate the bullish thesis.

In such a case, Ethereum price could revisit the $1,073 level and collect the sell-stop liquidity resting below it.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.