Ethereum Price Prediction: ETH bulls eye key hurdles above $1,700 during the latest recovery

- ETH/USD rises for the second consecutive day, extends bounce off two-month-old support line.

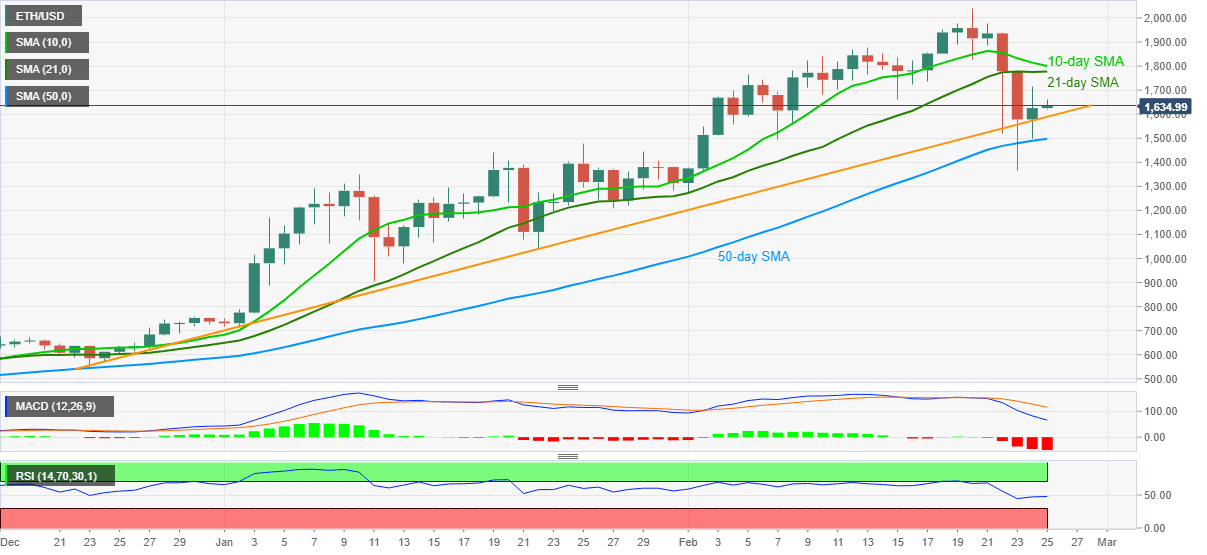

- 10-day, 21-day SMAs to probe the bulls before directing them to the record highs.

- Bears need validation from 50-day SMA even if they conquer the key support line.

Ethereum bulls catch a breather around the intraday high of $1,660, currently up 1.25% around $1,645, during the early Thursday. In doing so, the altcoin manages to extend bounce off an ascending trend line from late-2020.

Although normal RSI conditions suggest further corrective pullback, 21-day and 10-day SMA levels, respectively near $1,780 and $1,800, will test the short-term bulls.

It should also be noted that the ETH/USD run-up past-$1,800 needs to cross the $2,000 threshold before targeting to refresh the recently flashed all-time high of $2,041.

Meanwhile, a daily closing below the stated support line, at $1,590 now, needs to break the 50-day SMA level of $1,497 to recall the ETH/USD sellers.

Following that, the latest swing low of $1,367 and the monthly low around $1,270 will lure the pessimists.

Overall, ETH/USD is up for corrective pullback but the bulls shouldn’t be careless.

ETH/USD daily chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.