Ethereum Price Forecast: ETF and staking inflows drive ETH above $3,300

Ethereum price today: $3,340

- Ethereum ETFs recorded net inflows of $130 million on Tuesday as BlackRock's ETHA flipped positive after four negative days.

- Ethereum's validator entry queue has soared to 2.34 million ETH, its highest level since 2023.

- ETH could tackle the $3,670 hurdle if it flips the 200-day EMA and $3,470 resistance.

US-listed spot Ethereum (ETH) exchange-traded funds (ETFs) recorded about $130 million in net inflows on Tuesday, their largest in nearly a week, per SoSoValue data. BlackRock's ETHA recorded the largest inflow, attracting $53.3 million after four consecutive days of outflows.

The return of institutional interest follows softer-than-expected December Consumer Price Index (CPI) data, which triggered a spike in crypto prices.

The price growth follows a surge in the Ethereum validator entry queue to 2.34 million ETH — its highest level since August 2023 — and a collapse in the exit queue from 2.5 million ETH to 288 ETH. As a result, the number of staked ETH has reached a record high of 35.89 million ETH, according to ValidatorQueue.com.

The validator queue is a safeguard waiting line that controls the rate at which new validators can join or leave the Ethereum network, preventing sudden changes to the validator set. The rising entry queue shows that more investors are flocking to use their assets to support Ethereum's security, thereby reducing market supply.

A large share of the new staked supply is from Ethereum treasury firm Bitmine, which staked 186,560 ETH on Wednesday. The firm has staked 1,530,784 ETH over the past month, per Lookonchain data.

Key whale enters profit as buyers regain dominance

Following the recent price growth, a key Bitcoin whale who has been holding a 203,340 ETH long position on Hyperliquid over the past month is now sitting on over $37 million in profits. Last month, the whale was holding a floating loss of $74 million when ETH dropped below $2,800.

The switch to profit follows buyers gaining dominance in Binance's Ethereum derivatives market after over six months of seller-dominated volumes, as network activity soared to record highs.

Ethereum Price Forecast: ETH could tackle the $3,670 hurdle

Ethereum experienced $228 million in liquidations over the past 24 hours, driven by $197 million in short liquidations, according to Coinglass data.

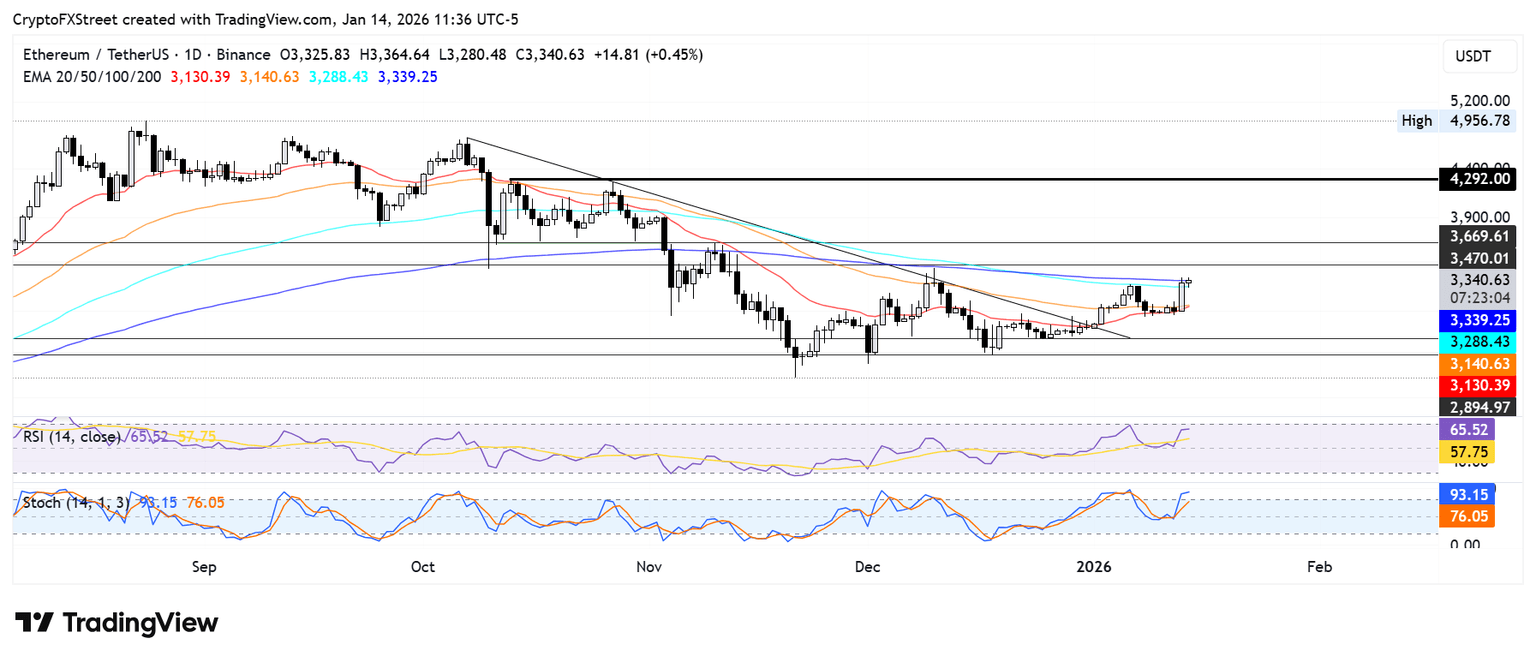

Following a 7% rise on Tuesday, ETH is tackling the 200-day Exponential Moving Average (EMA), as it eyes a move toward the $3,470 resistance. ETH could tackle the $3,670 hurdle if it flips the 200-day EMA and $3,470 resistance.

On the downside, ETH could hold the 20-day EMA if it sees a rejection around the 200-day EMA. Further down, the $2,890 support could provide a base if ETH loses the 20-day EMA.

The Relative Strength Index (RSI) is trending upward and above its neutral level while the Stochastic Oscillator (Stoch) is in overbought territory. The move indicates a dominant bullish momentum, but overbought conditions in the Stoch could lead to a short-term correction.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi