Ethereum price finds support after a 20% nosedive

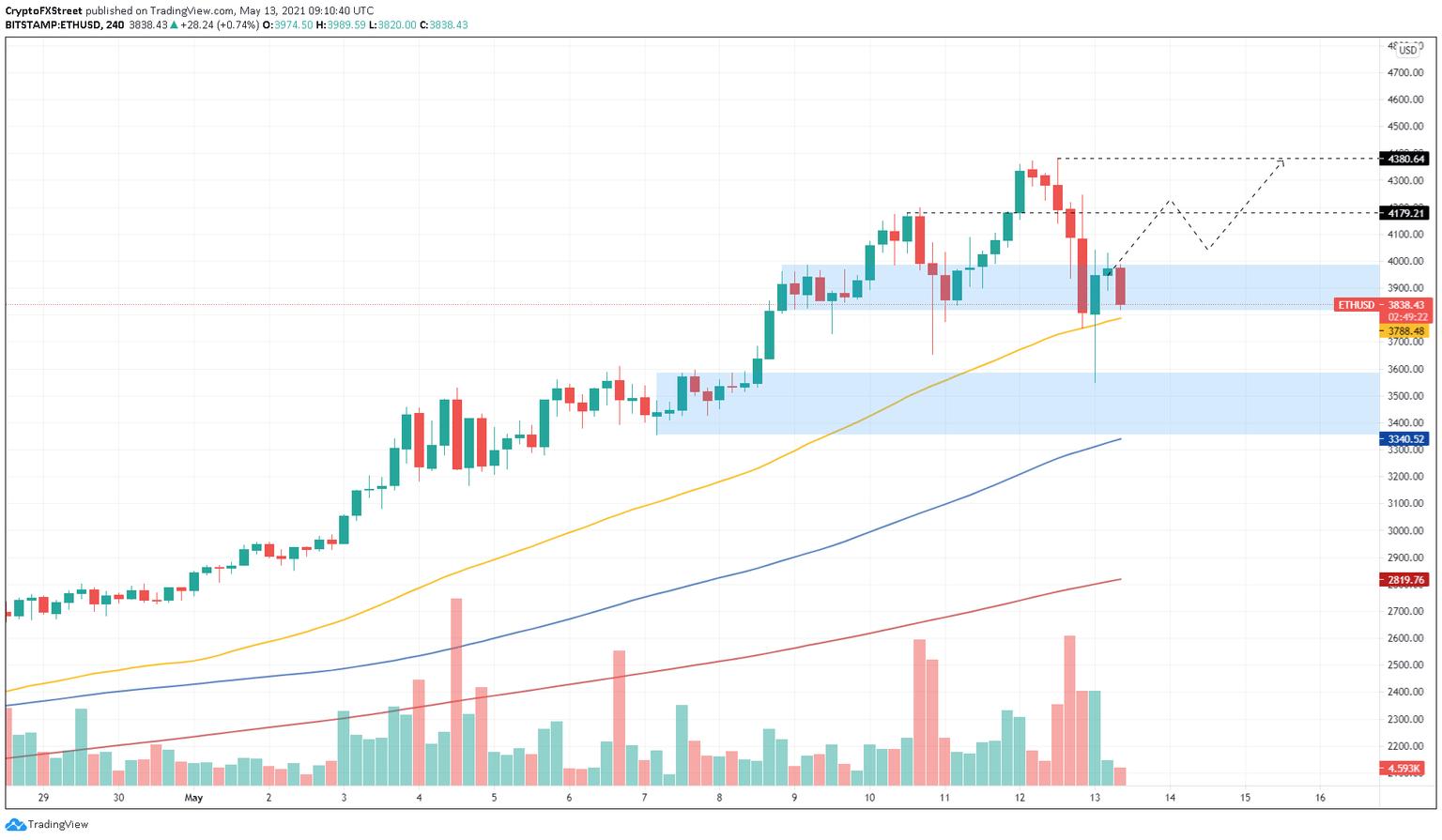

- Ethereum saw a spike in profit-taking after making a new all-time high of nearly $4,400.

- The increasing selling pressure pushed Ether to hit a low of $3,500.

- As long as the 50 four-hour simple moving average holds, ETH can rebound toward higher highs.

Ethereum price sits at a crucial support level that would determine likely determine where it is heading next.

Ethereum price finds a foothold

Ethereum price took a 20% nosedive after rising to a new all-time high of nearly $4,400 on May 12. Investors seem to have rushed to exchanges to buy ETH at a discount as prices quickly, reclaiming the 50 four-hour simple moving average (SMA) at $3,788 as support.

Although the recent price jump looks promising, only a decisive 4-hour candlestick close above $3,788 can lead to an upswing toward the next supply level at $4,179.

If the buyers manage to maintain the bullish momentum, a 5% upswing could develop pushing Ethereum price back to the recent all-time high.

ETH/USD 4-hour chart

A failure to stay above the 50 four-hour SMA will spell trouble for Ethereum price. The downswing could trigger a 6% sell-off to the immediate demand barrier that ranges from $3,355 to $3,584, which coincides with the 100 four-hour SMA.

Author

FXStreet Team

FXStreet