Ethereum (ETH) market update: a trip to $200.00 delayed for now

- Ethereum price recovery stumbled on approach to key technical levels.

- A move towards $200.00 is still a possibility.

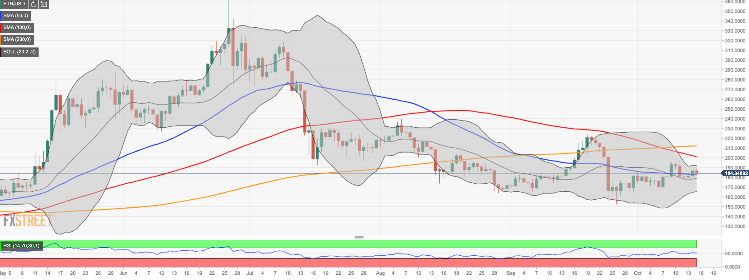

ETH bottomed at $152.50 on September 26 and managed to claw back some ground. However, the upside momentum has faded away on approach to the next critical resistance area of $190.00-$200.00. At the time of writing, ETH/USD is changing hands at $183.90, down 1.5% since the beginning of the day and mostly unchanged on a day-on-day basis. The second-largest con with the current market value of $19.8 billion has been range-bound recently, moving in sync with the market.

Ethereum’s technical picture

On the intraday charts, the initial resistance is created at $186.00 by a combination of SMA200 (Simple Moving Average) and the upper line of a Bollinger Band on a four-hour timeframe. A sustainable move above this barrier will open up the way to the next short-term target $190.00, followed by the upper line of a daily Bollinger Band at $192.50. An ultimate resistance awaits ETH bulls at $200.00 as a host of speculative sell-orders located on the approach to this area is likely to slow down the recovery.

On the downside, the initial support comes $183.50. This barrier is strengthened by SMA50 on a daily chart. If it is broken, the sell-off will continue towards $180.00 and $179.20 (SMA100 four-hour and the lower line of four-hour Bollinger Band). This area is likely to slow down the sell-off, however, a sustainable move lower will attract new sellers to the market and push the price towards $165.70 ( the lower line of a daily Bollinger Band).

ETH/USD, one-hour chart

Author

Tanya Abrosimova

Independent Analyst