Ethereum Classic Price Prediction: Time to lock in the gains as ETC price retreats

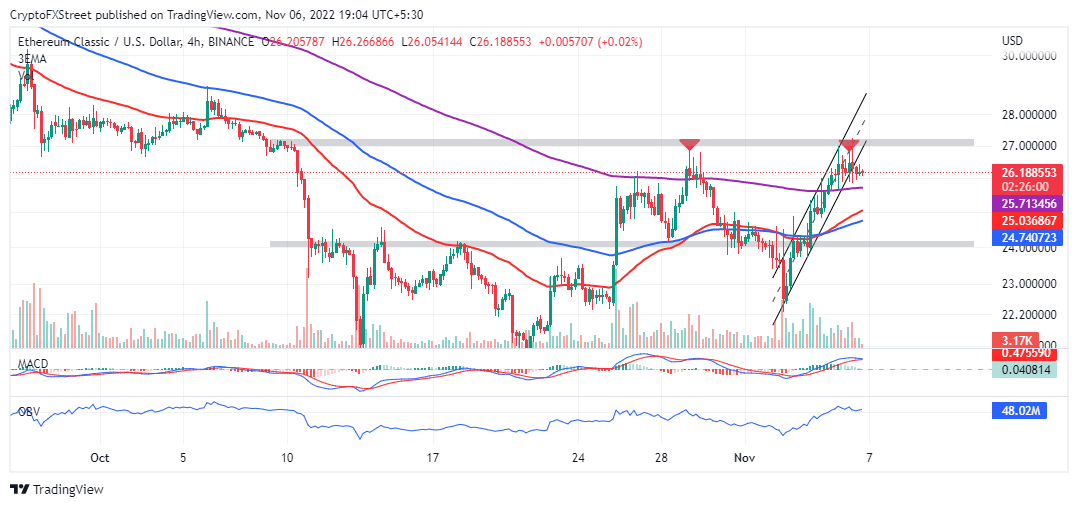

- Ethereum Classic price tops out at $27.00 as declines loom beneath a rising channel.

- The MACD is ready to validate ETC’s pullback with a sell signal.

- Short-term support at the 200-day SMA could pave the way for ETC to resume uptrend.

Ethereum Classic price turned red on Sunday after completing a breakout move to $27.00, as analyzed by FXStreet earlier this week. This rebound respected the confines of a rising parallel channel, but profit booking seems to be curtailing the extension of ETC’s bullish leg above $30.00.

Ethereum Classic price bows to immense resistance

The move to $27.00 largely depended on support at $22.20. Moreover, a four-hour candlestick close above the hurdle turned support area at $24.00 validated the bullish outlook in the Ethereum Classic price.

As mentioned, ETC moved within the boundaries of a rising parallel channel to $27.00. Despite this impressive move, the Ethereum Classic price has now flipped bearish – thanks to investors booking early profits.

ETCUSD four-hour chart

Short-term sell orders will immediately turn profitable if support at $26.00 bows to the building overhead pressure. Besides, the Moving Average Convergence Divergence (MACD) will likely confirm a sell signal before the new week.

Traders must be careful when planning their next move to avoid sudden bullish pullbacks. Sell orders can only be triggered after the 12-day Exponential Moving Average (EMA) (in blue) has crossed below the 26-day EMA.

It is necessary to wait for the Ethereum Classic price to make a clean break under the 200-day EMA (in purple) before flipping strongly bearish. According to the On-Balance-Volume (OBV) indicator, most of the traded volume is negative.

In other words, traders seem determined to sell ETC for short-term profit targets at the 200-day EMA, the 50 EMA (in red) and support mentioned at $24.00. If push comes to shove, Ethereum Classic will stretch the leg to $22.20 before recovery comes into play.

On the other hand, a bullish outcome in Ethereum Classic price cannot be completely ruled out, especially with the token holding above the three moving averages – the 50-day EMA, the 100-day EMA (in blue) and the 200-day EMA.

A four-hour candlestick close above its weekly peak at $27.00 could add credence to Ethereum Classic’s bullish narrative with targets at $30.00 and $34.00, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren