Ethereum Classic Price Prediction: ETC eyes 40% upswing after brutal market crash

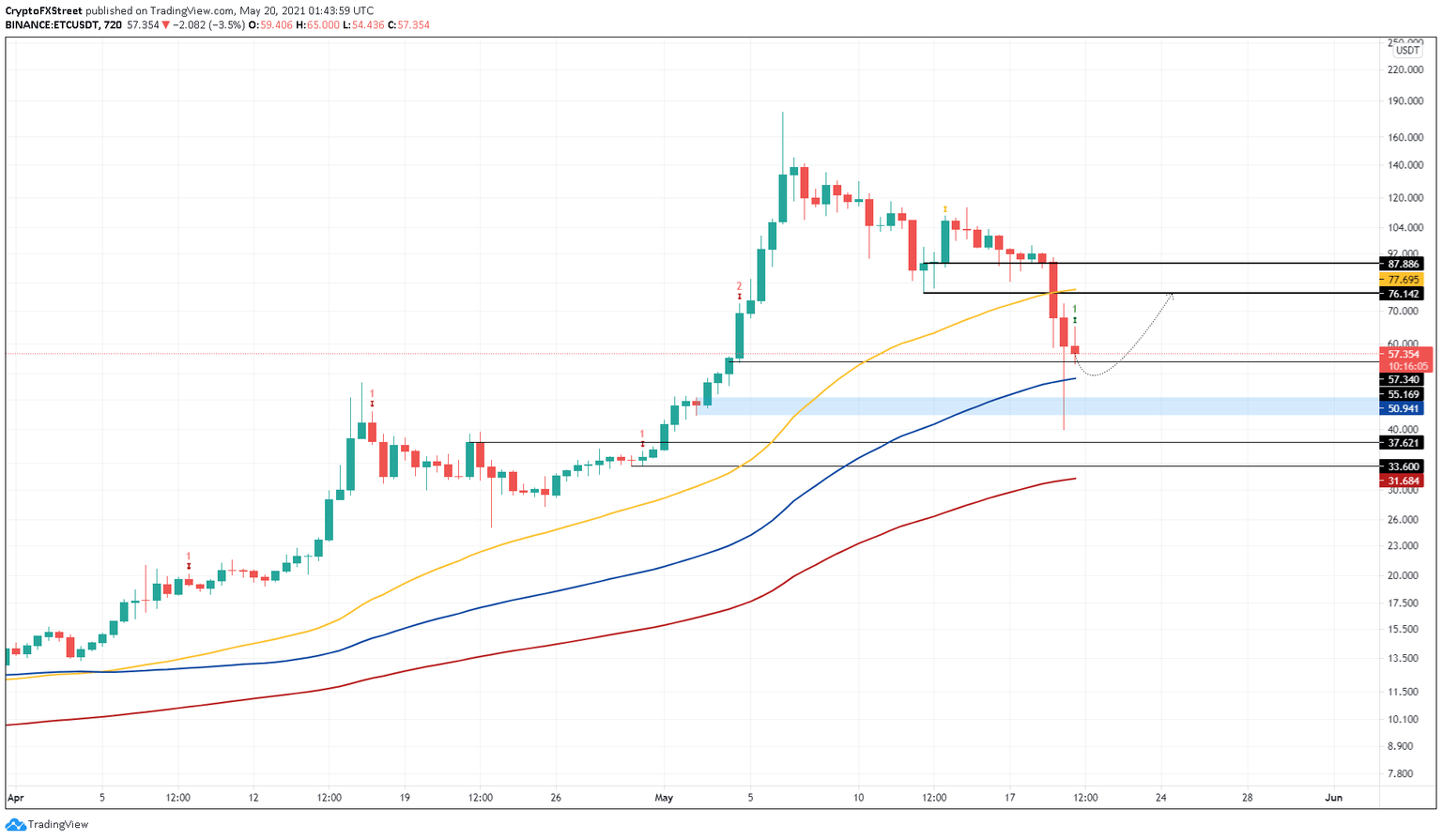

- Ethereum Classic price is currently hovering above a support level at $55.17.

- ETC could surge 40% to $76.14 after tagging the 100 twelve-hour SMA at $50.94.

- The MRI has flashed a buy signal, adding credence to the bullish thesis.

Ethereum Classic price undid its gains between May 2 and May 6 as it crashed during Wednesday’s trading session. Now ETC is finding its foothold as it trades above a critical demand barrier.

Ethereum Classic prepares for a u-turn

Ethereum Classic price nosedived approximately 55% during Wednesday’s trading session. Currently, ETC is signifying bullishness, primarily due to the Momentum Reversal Indicator’s (MRI) buy signal flashed in the form of a green ‘one’ candlestick on the 12-hour chart.

This technical formation forecasts a one-to-four candlestick upswing. However, investors could see ETC retest the 100 twelve-hour Simple Moving Average (SMA) at $50.94 before climbing higher.

The first area of interest would be the 50 twelve-hour SMA at $77.69, roughly a 40% ascent from $50.94.

Beyond this, Ethereum Classic price could rally another 11% to test the subsequent resistance line at $87.89.

While the scenario explained above is optimistic, there is a chance that ETC price could shatter the support level at $55.17 and the 100 twelve-hour SMA at $50.94 and slide nearly 9% toward the demand zone that stretches from $42.72 to $46.44.

A reversal from this area of support is also likely. In such a case, investors could expect Ethereum Classic price to rise 65% to tag the 50 twelve-hour SMA at $77.69.

ETC/USDT 12-hour chart

On the off chance the buyers are overwhelmed at either of the two critical levels mentioned above, investors should expect the Ethereum Classic price to slide 12% to tag the $37.62 support floor.

However, a decisive close below $33.60 will invalidate the bullish thesis detailed above. In that case, ETC will retest the 200 twelve-hour SMA at $31.68.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.