EOS price recoups strength, eyes 25% upswing

- EOS price has lipped the $1.11 hurdle into a support level, hinting at a bullish outlook.

- The altcoin could retest a critical hurdle at $1.46 if the market outlook remains neutral to bullish.

- A daily candlestick close below $0.992 will invalidate the bullish thesis.

EOS price has shown considerable strength over the last three weeks, which has led to a recovery above a significant hurdle. As a result of this development, investors can expect the altcoin to kick-start a mean reversion play.

EOS price takes control

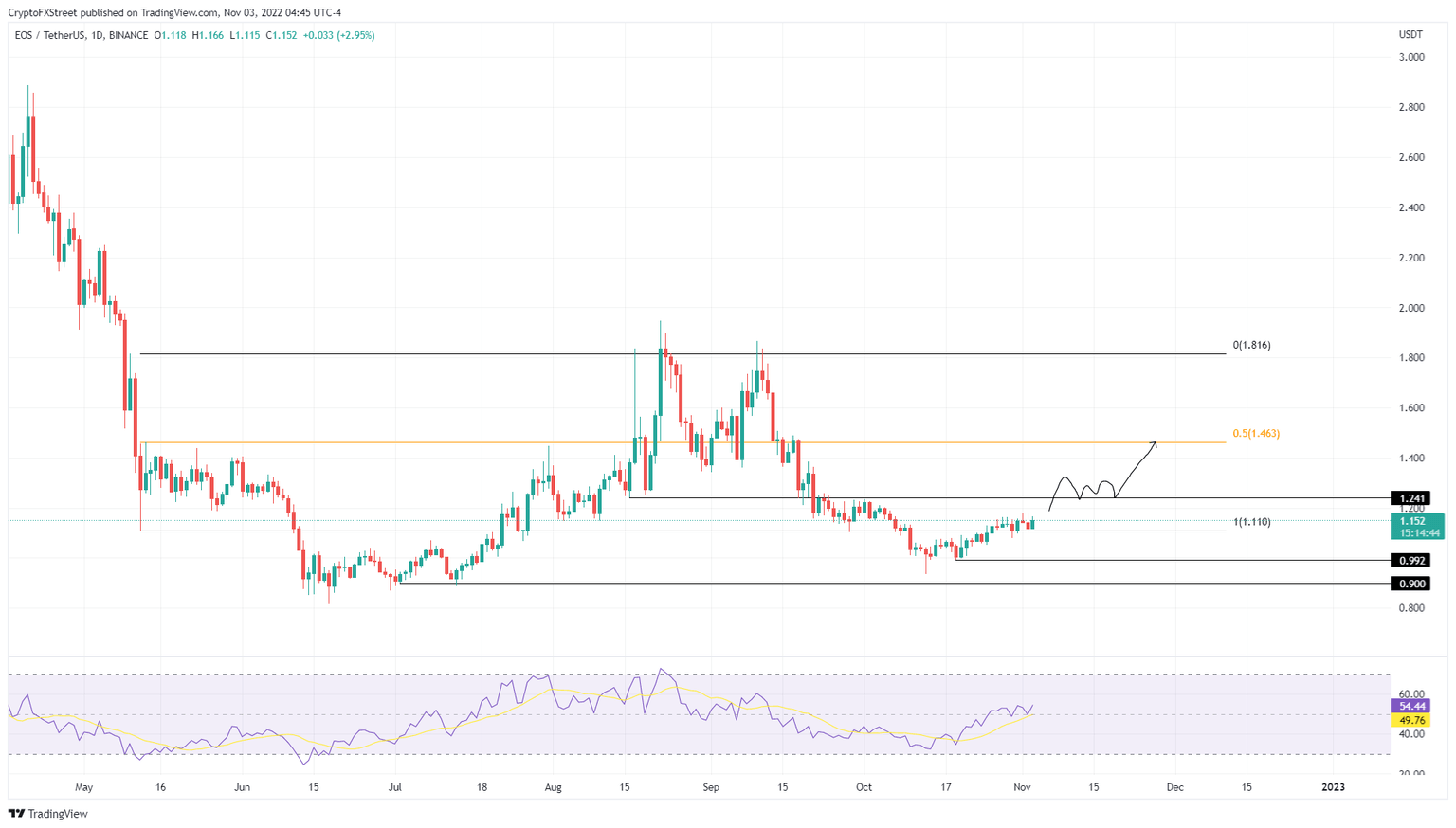

EOS price created a range, extending from $1.11 to $1.81 between May 10 and 12. Since then, the altcoin has deviated below the range low and range high and is currently sitting above $1.11, hinting at a quick run-up,

The $1.24 resistance level needs to be overcome for bulls to extend higher. A successful flip could be a buy signal for investors, planning to capitalize on the 18% move to $1.46. While this outlook is a short-term play, a highly bullish scenario would include EOS price retesting the range high at $1.81.

Further adding weight to this upswing in EOS price is the Relative Strength Index (RSI) momentum indicator hovering above 50. This outlook suggests that there is more room for the altcoin to head north before investors begin to sell and slow down the uptrend.

EOS/USDT 1-day chart

On the other hand, if EOS price fails to stay above $1.10, it will be a clear signal that there is a lack of buying pressure. A move that produces a lower low below $0.992 will, however, invalidate the bullish thesis.

This development could see EOS price revisit the $0.90 support level, where buyers can recoup their strength and give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.