Elrond price restarts 35% rally as EGLD recovers from minor setback

- Elrond price restarts its 38% upswing after the recent crash.

- A higher high above $341 will signal a confirmation of the upswing.

- A breakdown of the $269 support level will invalidate the bullish thesis.

Elrond price breached a crucial bullish pattern on November 4 but began consolidating in a swift manner. This coiling up was met with selling pressure during the big crypto collapse. As things calm down, EGLD is giving its uptrend another try.

Elrond price looks for a comeback

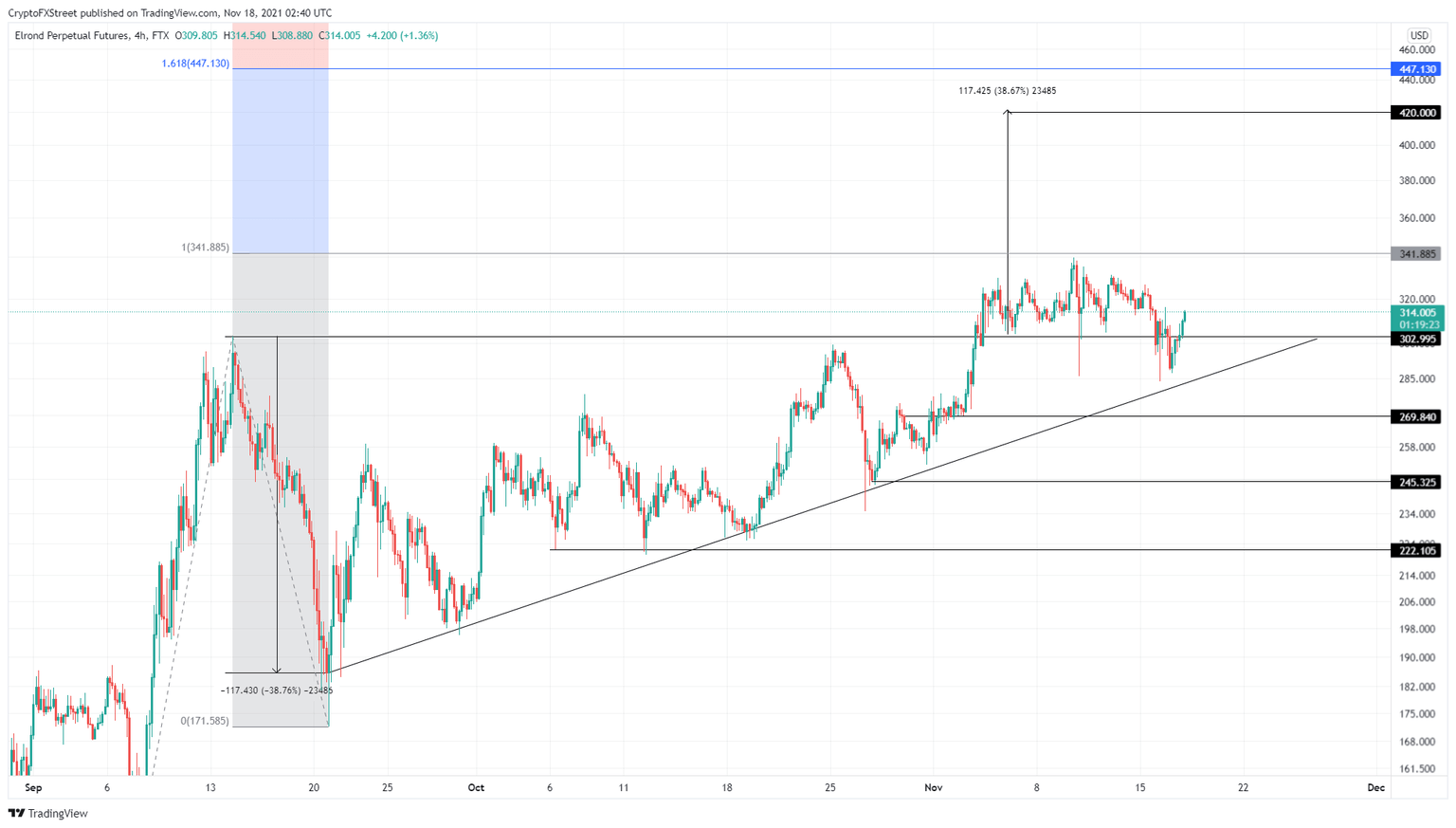

Elrond price set up two equal highs at $302 and roughly four higher highs between September 14 and November 4. Connecting these swing points reveal the formation of an ascending triangle pattern.

This technical setup forecasts a 38% upswing to $420, obtained by measuring the distance between the first swing high and swing low to the breakout point of $302. This impending move puts EGLD’s upside potential at $420.

The last time Elrond price breached the horizontal trend line, it tagged the 100% trend-based Fibonacci extension at $341. The subsequent market crash pushed EGLD back under the said resistance barrier.

However, Elrond price seems to be quick in making a comeback as it has rallied 10% to where it currently stands at $313. Going forward, EGLD will face the $341 supply barrier, breaching which will propel it to the intended target at $420.

EGLD/USDT 4-hour chart

While things are looking a bit messy for Elrond price, a failure to set a higher high above $341 will indicate a lack of buying pressure. However, if the selling pressure increases, pushing EGLD below $269, it will create a lower low and invalidate the bullish thesis.

In such a situation, Elrond price could crash 9% to the $245 support floor or $222 in a dire case.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.