Elrond Price Prediction: EGLD to jump by 20% as key indicator screams buy

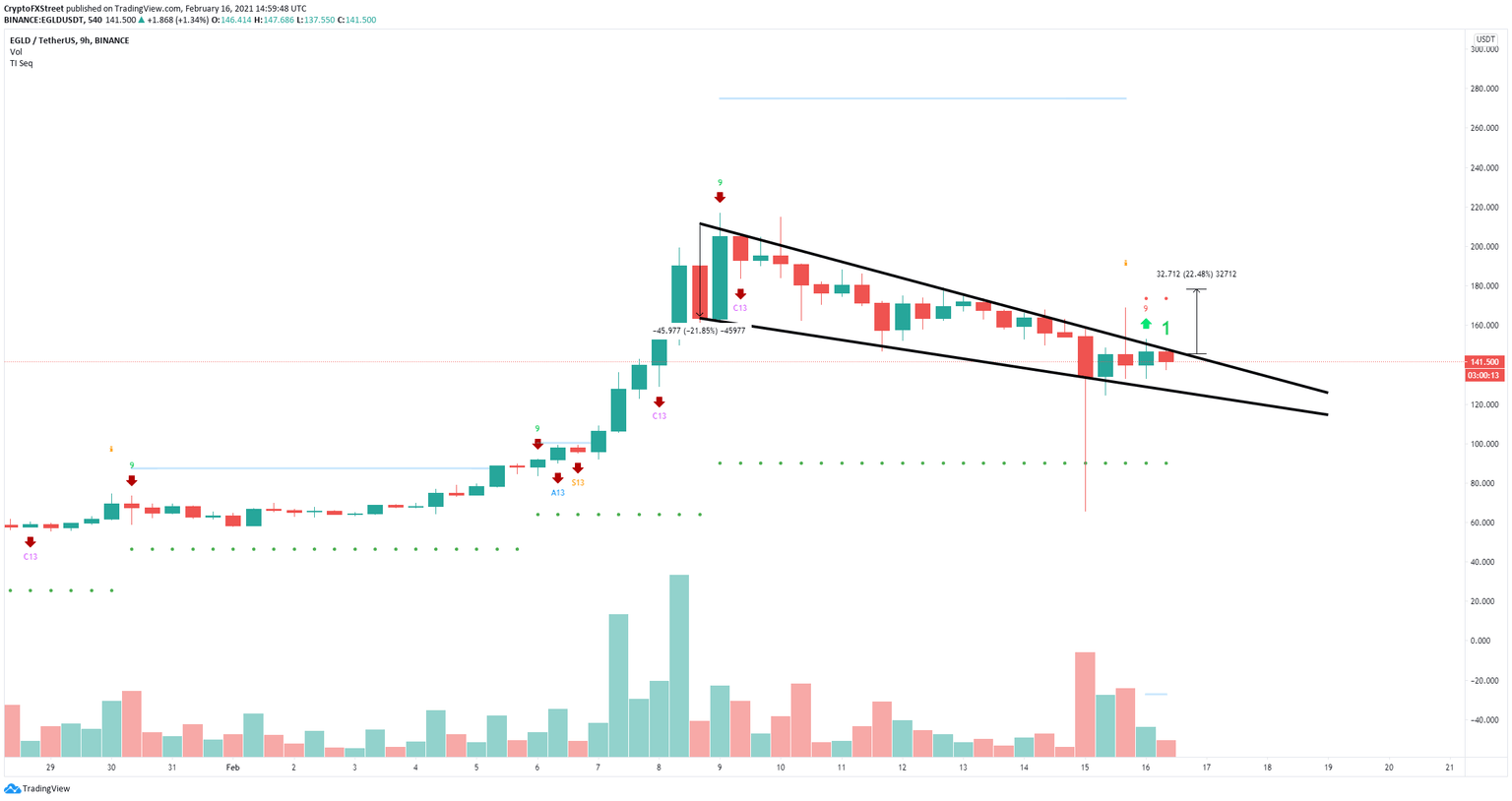

- Elrond price is contained inside a descending wedge pattern on the 9-hour chart.

- The digital asset is on the verge of a breakout towards $180.

- A key indicator has presented a buy signal that gives the upper hand to the bulls.

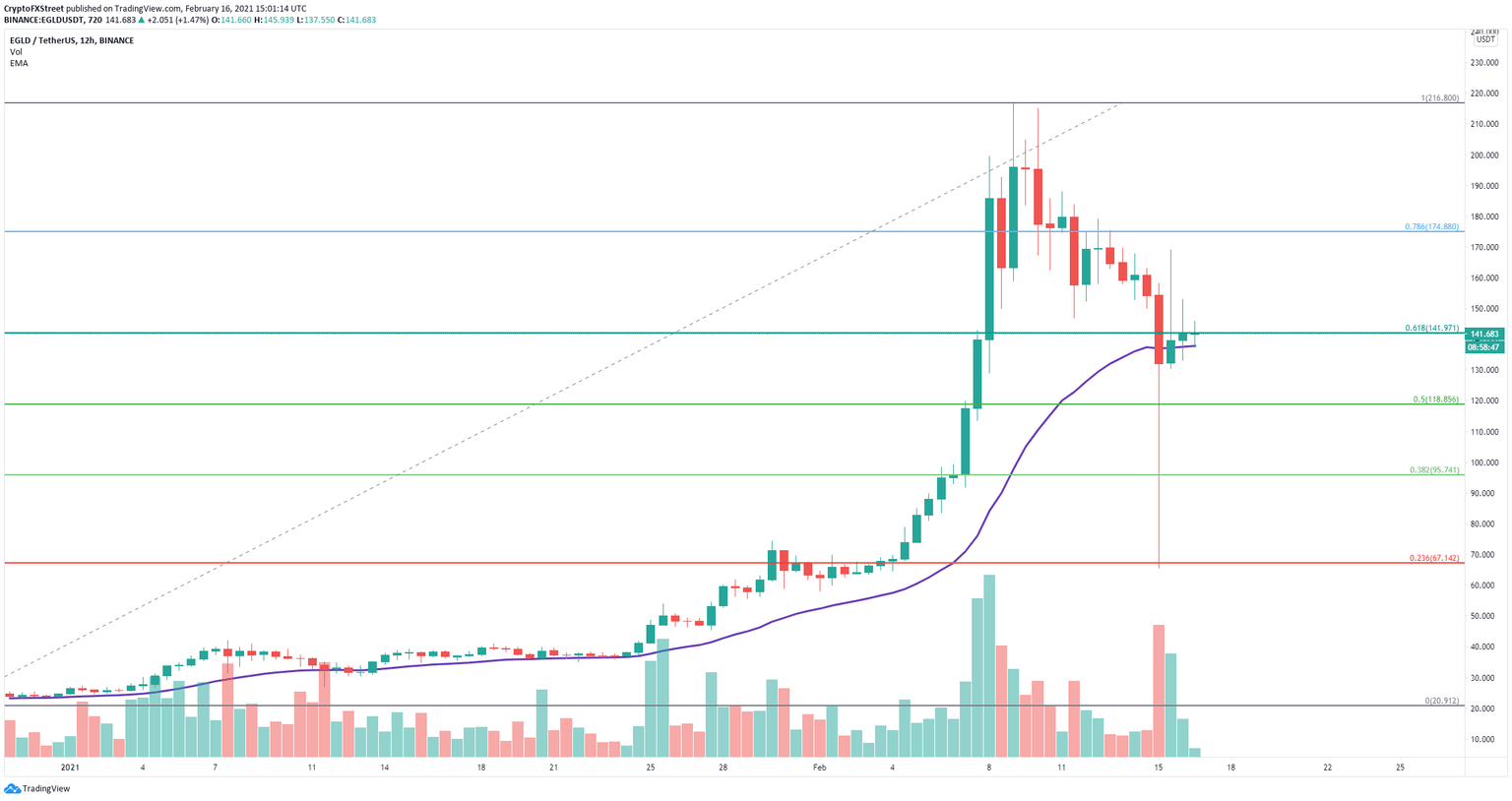

After hitting an all-time high of $217 on February 9, Elrond price has suffered a significant pullback down to $65.6 on February 15, but bulls managed to buy most of it pushing the digital asset up to $140.

Elrond price on the brink of a breakout to $180

On the 9-hour chart, Elrond has established a descending wedge pattern which is really close to a breakout or breakdown. The key resistance level is established at $148 and support at $127.

EGLD/USD 9-hour chart

The TD Sequential indicator has just presented a buy signal on the 9-hour chart giving the upper hand to the bulls. A breakout above $148 can quickly push Elrond price towards $180, a 22% move calculated by using the maximum height of the wedge pattern.

EGLD/USD 12-hour chart

On the 12-hour chart, to invalidate the bullish outlook, bears have to crack the 26-EMA support level at $138, which has been an accurate guide since December 2020. Losing this key level can drive Elrond price down to $118, the 50% Fibonacci Retracement level and as low as $95, at the 38.2% level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.