Elliott Wave intraday: Rally in Bitcoin looking impulsive [Video]

![Elliott Wave intraday: Rally in Bitcoin looking impulsive [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Digital Currencies/Bitcoin/bitcoin_5_XtraLarge.jpg)

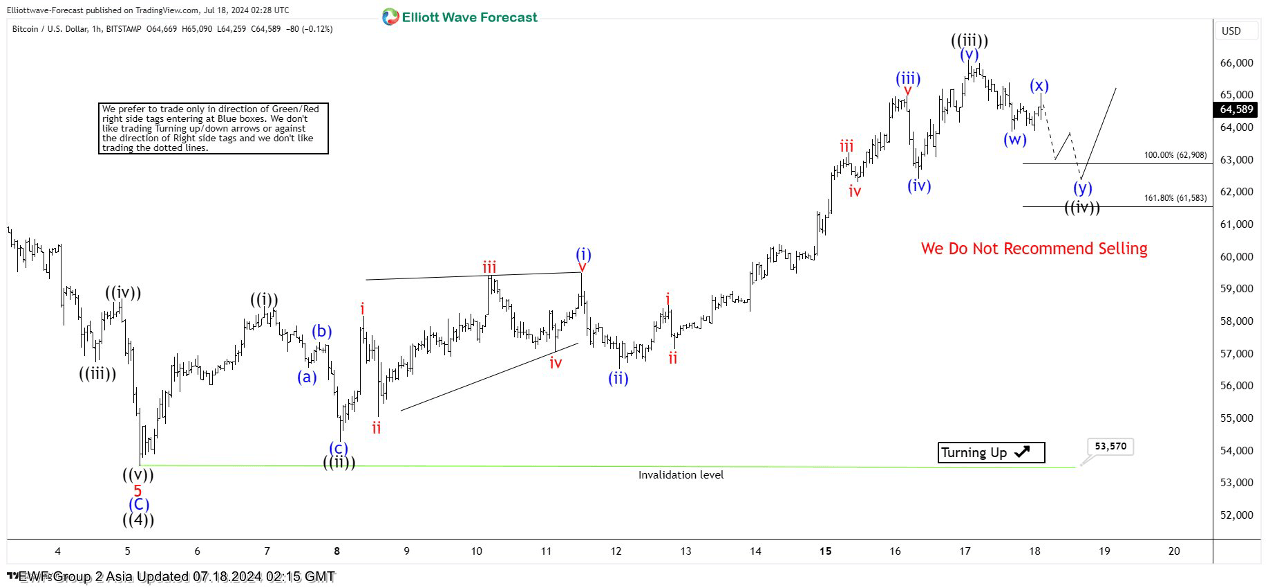

Rally from 7.5.2024 low in Bitcoin (BTC/USD) looks impulsive suggesting further upside. Pullback to 53570 ended wave ((4)) and Bitcoin has turned higher in wave ((5)). The crypto currency still needs to break the previous all-time high on 3.14.2024 high at 73794 to rule out any double correction. Up from wave ((4)), wave ((i)) ended at 58488 and dips in wave ((ii)) ended at 54296 with internal subdivision as a zigzag. Down from wave ((i)), wave (a) ended at 56578 and wave (b) ended at 57376. Wave (c) lower ended at 54296 which completed wave ((ii)).

Bitcoin has turned higher in wave ((iii)). Up from wave ((ii)), wave i ended at 58200 and wave ii ended at 56154. Wave iii higher ended at 59459 and wave iv ended at 57072. Wave v higher ended at 59516 which completed wave (i) in higher degree. Pullback in wave (ii) ended at 56551 and the crypto currency has turned higher again. Up from wave (ii), wave i ended at 58539 and pullback in wave ii ended at 57168. Wave iii higher ended at 63259 and dips in wave iv ended at 62323. Final leg wave v ended at 65012 which completed wave (iii). Pullback in wave (iv) ended at 62446 and wave (v) higher ended at 66129 which completed wave ((iii)). Pullback in wave ((iv)) is in progress to correct cycle from 7.8.2024 low before it resumes higher. Near term, as far as pivot at 53570 low stays intact, expect pullback to find support in 3, 7, 11 swing before it resumes higher.

Bitcoin (BTC/USD) 60 minutes Elliott Wave chart

BTC/USD Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com